As a beginner investor in the U.S. stock market, one of the most important questions you will face is this:

Should you reinvest dividends or take the cash?

It may seem like a small detail. But it can shape your long-term returns and determine how effectively you build wealth over time.

What Is Dividend Reinvestment?

Dividend reinvestment is exactly what it sounds like – instead of receiving your dividends as cash, you use them to buy additional shares of the stock (or fund) that paid the dividend.

Instead of taking the dividend in cash, a Dividend Reinvestment Plan (DRIP) puts that money right back into the investment. Most brokers do this for free, even allowing fractional share purchases.

In other words, you are taking your dividends and putting them right back to work by buying more ownership of the company.

Many brokerages make this process easy and automatic. When you open an account or buy a dividend-paying stock, you can usually elect to have dividends automatically reinvested.

In fact, dividend reinvestment is often:

- Automatic and easy: You can “set it and forget it,” and the reinvestment happens without any effort on your part.

- Low or no-cost: Most brokers reinvest dividends for free, charging no commissions. (For example, Vanguard’s brokerage offers a no-fee, no-commission dividend reinvestment program)

- Fractional investing: Even if your dividend isn’t enough to buy a full share, brokers will buy partial shares so that every dollar of your dividend gets invested.

- Consistent: Reinvesting every dividend imposes discipline. You are continuously buying more shares over time, which is a form of dollar-cost averaging – smoothing out your purchase price over the long run.

In short, dividend reinvestment lets you continually grow your holdings without needing new cash from your bank account. It’s an efficient way to compound your investment.

Why Reinvest Dividends? The Power of Compounding

What makes reinvesting dividends so powerful? It’s not magic. It’s called compounding.

When you reinvest your dividends, you’re not just earning money. You’re earning money on the money you already earned. Over time, this creates a snowball effect where your investment keeps growing faster and faster without you lifting a finger.

As legendary investor Charlie Munger once said:

“The first rule of compounding: Never interrupt it unnecessarily.”

That quote might sound simple, but it’s loaded with wisdom. Here’s what it means in plain language:

Reinvesting dividends unlocks the full power of compounding. Instead of taking payouts as cash, they buy more shares. Those extra shares then earn their own dividends, which are also reinvested. The result is a self-reinforcing cycle of steady, accelerating portfolio growth.

Reinvesting Dividends vs. Taking the Cash: A Real-World 30-Year Comparison

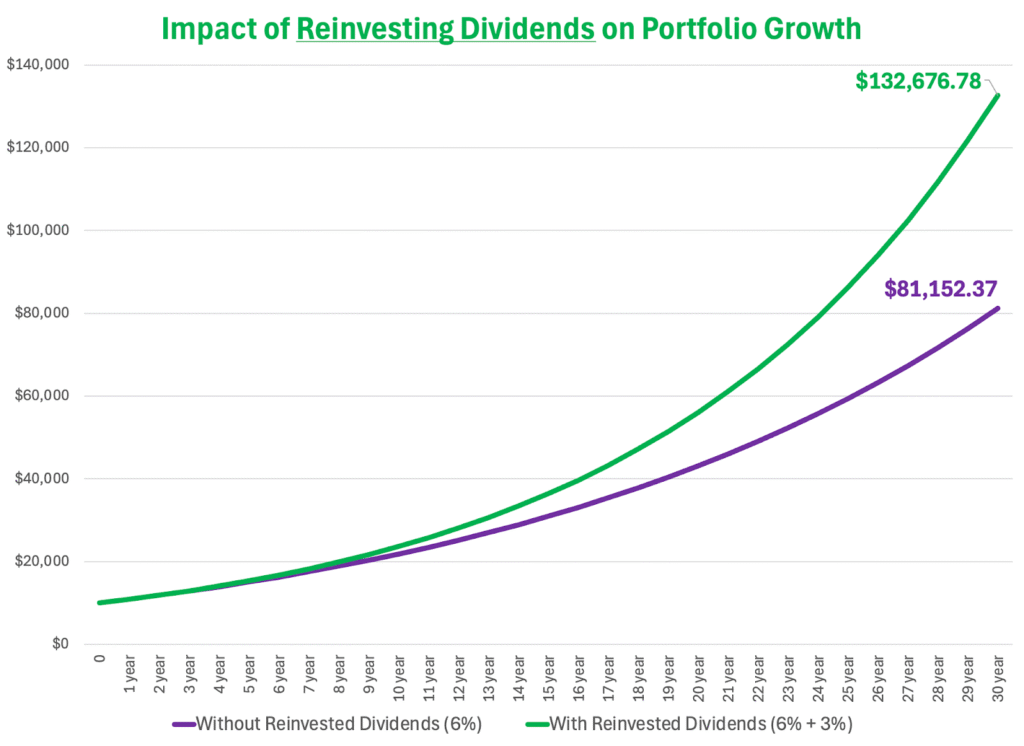

So let’s bring this concept to life.

What actually happens to your portfolio if you reinvest dividends vs. if you just take the cash? We modeled a simple, real-world scenario with basic assumptions to show the difference clearly.

📌 Key Assumptions:

- Initial Investment: $10,000

- Annual Initial Investment Price Appreciation: 6%

- Annual Dividend Yield: 3%

- Investment Duration: 30 years

Two Scenarios Compared:

Scenario A: Dividends Collected, Not Reinvested

In this scenario, the investor receives a 3% dividend payout each year, which is not reinvested. The principal investment compounds at 6% annually through price appreciation, while the dividend income is set aside and does not grow.

Scenario B: Dividends Reinvested and Compounded

In this approach, the investor reinvests the 3% dividend income annually, using it to purchase additional shares at the prevailing market share price. The full investment, including newly acquired shares, compounds at a combined annual return of 9% (6% capital growth plus 3% reinvested dividends).

After 30 years:

- With reinvestment, your portfolio grows to $132,676.78

- Without reinvestment, it reaches just $81,152.37

Both strategies benefit from compounding, but at very different levels of efficiency. When dividends are reinvested, the compounding effect is amplified, as each payout contributes to a growing base that continues to generate additional returns.

Over a long time horizon, this difference becomes substantial. Reinvesting dividends consistently can lead to significantly greater portfolio value compared to simply collecting them in cash. For long-term investors seeking to maximize total return, dividend reinvestment is not just a helpful tactic. It is a key pillar of effective wealth building.

How to Set Up Dividend Reinvestment (DRIP)

Setting up automatic dividend reinvestment, commonly known as a Dividend Reinvestment Plan (DRIP), is simple and supported by most major U.S. brokerages. With just a few clicks, you can ensure that every dividend you receive is automatically reinvested into additional shares of the same stock or fund.

Here is how to get started:

1. Enable DRIP Through Your Brokerage Account

Most leading brokerages in the United States, including Fidelity, Schwab, Vanguard, E*TRADE, and Robinhood, offer commission-free dividend reinvestment. You can typically activate this feature when placing a trade, adjusting your account settings, or managing an existing investment.

Look for an option labeled “Reinvest dividends” or “Enroll in DRIP.” You may have the ability to apply this setting to your entire account or to specific holdings.

2. Customize Preferences by Security (Optional)

If you hold multiple dividend-paying stocks or funds, you can usually choose whether to reinvest dividends for each one. For example, you may want to reinvest dividends from long-term growth stocks while taking cash from income-generating positions.

These preferences can be changed at any time within your account settings.

3. Monitor Execution and Account Activity

On each dividend payment date, your account will automatically use the dividend proceeds to purchase more shares of the same security. Most brokerages support fractional share purchases, so even small dividend amounts are fully reinvested. For instance, a $12 dividend on a $60 stock would purchase 0.2 shares.

You can verify each transaction by reviewing your brokerage account activity or dividend history.

4. Reinvest Dividends Without Fees

Dividend reinvestment through DRIPs is typically free of commissions or fees. This means the full amount of each dividend, after any applicable taxes, is invested back into your portfolio. It is one of the most efficient and cost-effective ways to build long-term value.

5. Adjust or Cancel Anytime

You can opt in or out of dividend reinvestment at any time. If your investment strategy changes and you prefer to receive dividends in cash, simply update your preferences. Most brokers allow you to modify these settings instantly online.

Summary

Setting up a DRIP is a quick and effective way to automate the compounding process. Once enabled, dividend reinvestment happens automatically with no extra steps required. It is a simple tool that can play a powerful role in long-term portfolio growth.

As Charles Schwab notes:

“Once you set it up, generally by simply checking a box, there’s nothing more to do but let compounding do the work.”

Tax Implications of Reinvesting Dividends (Taxable vs. Retirement Accounts)

Reinvesting dividends is a powerful way to grow your portfolio, but it does not eliminate your tax obligations. Understanding how dividends are taxed in taxable accounts versus retirement accounts is essential to making informed decisions.

Dividends in a Taxable Brokerage Account

If you hold dividend-paying investments in a taxable account, you will owe taxes on the dividends in the year they are paid, regardless of whether you reinvest them or take the cash. The IRS treats reinvested dividends as taxable income, just as if you had received the cash in hand.

Most dividends from U.S. companies are considered qualified dividends, which are taxed at the favorable long-term capital gains rates: 0%, 15%, or 20%, depending on your income level. Some dividends, however, may be non-qualified and taxed at your ordinary income tax rate.

Whether you choose to reinvest or not, you must report dividend income each year on your tax return. Reinvesting simply means you used the dividend to purchase more shares instead of receiving the cash, but it does not defer or eliminate the tax.

Dividends in Tax-Advantaged Retirement Accounts

If your investments are held in a 401(k), Traditional IRA, or another tax-deferred retirement account, you do not pay taxes on dividends when they are received. Dividends can be reinvested without triggering a tax event, and all growth, including reinvested dividends, remains tax-deferred until you begin making withdrawals in retirement. At that point, withdrawals are taxed as ordinary income, not at dividend or capital gains rates.

In a Roth IRA, the tax treatment is different.

Contributions are made with after-tax dollars, and as long as certain requirements are met, such as holding the account for at least five years and being age 59½ or older, qualified withdrawals are completely tax-free.

This includes any dividends received and reinvested within the account. In other words, dividends in a Roth IRA grow and compound entirely tax-free, and there is no tax owed at any point if withdrawals meet the qualifying conditions.

Why This Matters

Dividend reinvestment is especially effective in retirement accounts. Because there is no annual tax drag, every dollar of dividend income can be reinvested in full, allowing your investments to compound more efficiently.

In contrast, taxable accounts reduce the effective reinvestment amount slightly each year due to tax obligations. This does not eliminate the benefits of reinvestment, but it is an important consideration in long-term planning.

When Might You Not Reinvest Dividends?

Dividend reinvestment is a powerful default strategy for growth, but it may not be the right choice for every investor in every situation. Here are some scenarios when taking dividends in cash could be preferable:

- You Need Income: If you are depending on your investments to provide current income. For example, if you’re retired or need the cash flow, you might choose to take dividends as cash rather than reinvesting. The dividends can be used to pay for living expenses or other needs. In this case, the goal of the investment is to generate income now, not maximize future growth. Many retirees stop reinvesting dividends and instead use them to fund their retirement spending.

- Diversification or Rebalancing: When you reinvest dividends, you’re buying more of the same stock. If one stock (or sector) is already a large portion of your portfolio, automatically reinvesting will make that position even bigger over time. Some investors prefer to take the cash and reallocate it elsewhere to maintain a balanced portfolio. For example, suppose you own a company that has grown to be, say, 10% of your portfolio and it pays dividends. You might take those dividends in cash and invest them in other individual stocks or funds, rather than increasing your exposure to that same company. This can help with diversification and managing risk.

- Valuation Concerns or Strategy Reasons: If you believe a stock is overvalued or you have other ideas for the money, you might not reinvest into that same stock. Taking the dividend in cash gives you the flexibility to deploy it in a different investment that you find more attractive.

In general, if you don’t need the dividend cash and you’re happy with the investment, reinvesting is the optimal choice for growth.

But if you do need the cash or have a better use for it, there’s nothing wrong with taking the dividends. Just remember that if you’re not reinvesting, ideally you should put that cash to work elsewhere (unless you truly need to spend it).

Letting dividends accumulate as idle cash defeats their purpose.

Conclusion: Reinvesting Dividends to Build Long-Term Wealth

For most long-term retail investors, reinvesting dividends is a simple but powerful strategy to grow wealth over time. This approach amplifies returns by taking full advantage of compounding growth.

Over the decades, the impact of reinvested dividends can be substantial. Historical research has consistently shown that portfolios which reinvest dividends tend to significantly outperform those that do not. By reinvesting, you place your portfolio on a self-reinforcing growth path, allowing each dividend to generate its own stream of future dividends.

Of course, your dividend strategy should align with your personal financial goals. If you rely on your portfolio for current income, or if you have more attractive uses for the capital, taking dividends in cash can serve those needs.

The trade-off is simple: reinvested dividends lead to greater long-term compounding, while cash dividends offer immediate liquidity but reduce future growth potential.

Some investors use a blended approach, such as reinvesting dividends in retirement accounts to maximize tax-advantaged growth, while taking cash in a taxable account to support living expenses or rebalance their portfolio. The key is to be intentional and consistent with your strategy.

Reinvesting dividends is also easy and cost-effective. Most U.S. brokerages offer free dividend reinvestment plans, and the process can often be enabled with a single setting. Once active, every dividend is automatically used to purchase additional shares, including fractional shares, so your money keeps working without any extra effort.

If you do not need the dividend income today, allowing those payments to roll into more shares is one of the most efficient ways to accelerate wealth accumulation. The earlier you start, the greater the compounding advantage.

Disclaimer: This content is for informational and educational purposes only and does not constitute financial, investment, or tax advice. Individual circumstances vary, and you should consult a qualified financial advisor before making any investment decisions or implementing a dividend reinvestment strategy.