When investors ask about the oldest stock in the U.S., they are searching for companies that have done more than simply survive. These are businesses that have remained continuously accessible through public markets for centuries, enduring wars, financial crises, regulatory upheaval, and sweeping technological change. Many of them were founded before modern stock exchanges existed and long before today’s economic system took shape.

Only a small number of American companies meet this standard. While hundreds of firms were established in the 18th and 19th centuries, very few successfully transitioned into publicly traded corporations and remained listed across multiple generations of economic transformation. Longevity in public markets has required repeated reinvention, scale, and deep integration into the U.S. economy.

This article explores five oldest publicly traded companies in the United States, examines how they have endured for more than two centuries, and explains what their survival reveals about long-term corporate resilience.

Key Takeaways on the Oldest Stock in the U.S.

- The oldest stock in the U.S. dates back to the 18th century, predating the formal establishment of the New York Stock Exchange.

- Long-term survival reflects adaptation, scale, and institutional relevance rather than uninterrupted financial success.

- Most enduring companies operate in sectors such as financial services, utilities, and consumer staples, where demand persists across economic cycles.

- Age alone does not guarantee superior returns, but it does signal corporate durability and resilience.

What Does “Oldest Stock in the U.S.” Mean?

The term oldest stock in the U.S. refers to a company that meets three key criteria:

- Early founding: The company was established during the early history of the United States, often in the late 18th or early 19th century.

- Public ownership: It transitioned into a publicly traded corporation, making its shares available to investors.

- Continuous market access: It has remained listed or otherwise continuously accessible through public markets despite mergers, restructurings, and regulatory changes.

This distinction is important because being an old company is not the same as being an old stock. Many early American businesses were privately owned, family-run, or dissolved long before modern stock markets developed. Only a small number successfully evolved into publicly traded companies and maintained that status over centuries.

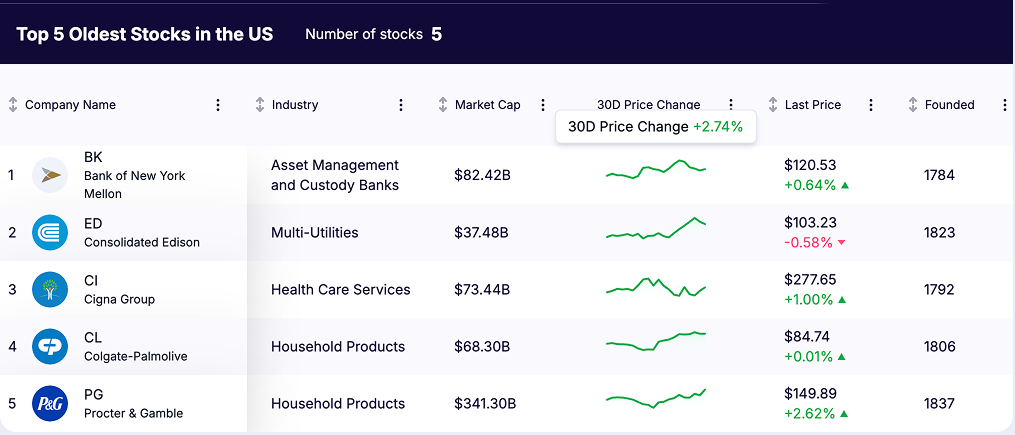

Five Oldest Stocks Still Trading in the United States

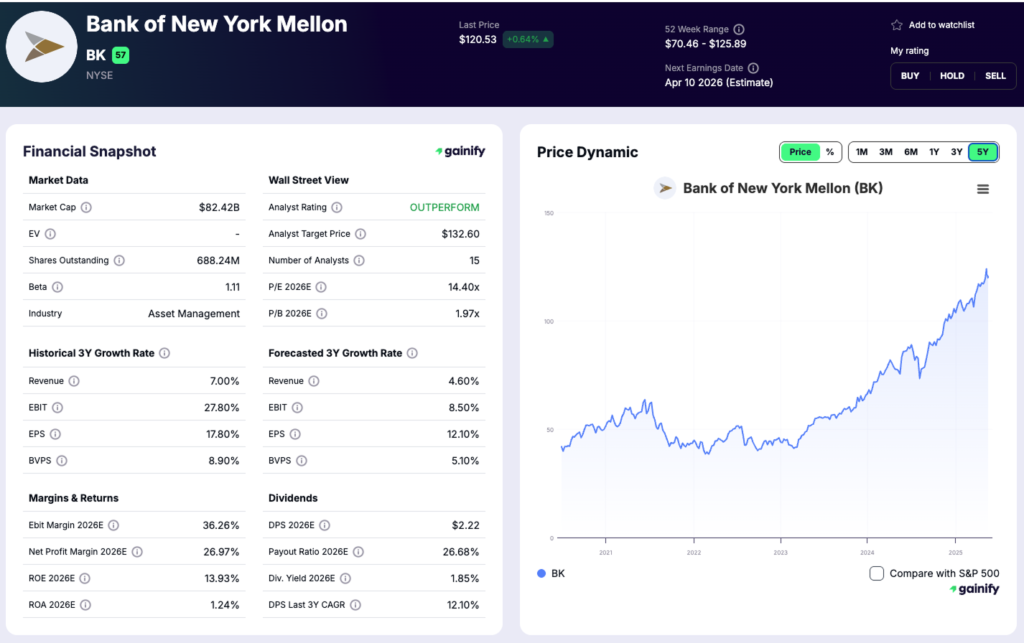

1. The Bank of New York Mellon Corporation (NYSE: BK)

Founded: 1784

Market Capitalization: $82 billion

The Bank of New York Mellon is widely regarded as the oldest stock in the United States still trading today. Founded by Alexander Hamilton, the nation’s first Secretary of the Treasury, the bank predates both the New York Stock Exchange and many foundational U.S. financial institutions.

Originally established as the Bank of New York, the company has survived more than two centuries of economic transformation by continually evolving its role within the financial system. Through mergers and restructuring, it transitioned away from traditional commercial banking into a global financial services firm specializing in asset servicing, custody, and investment management.

Today, BNY Mellon sits at the core of global capital markets, providing critical financial infrastructure for institutional investors, governments, and asset managers worldwide. Its scale, durability, and ability to adapt its business model as markets evolved toward technology-driven and fee-based services reinforce its position as the clearest example of the oldest stock in the U.S.

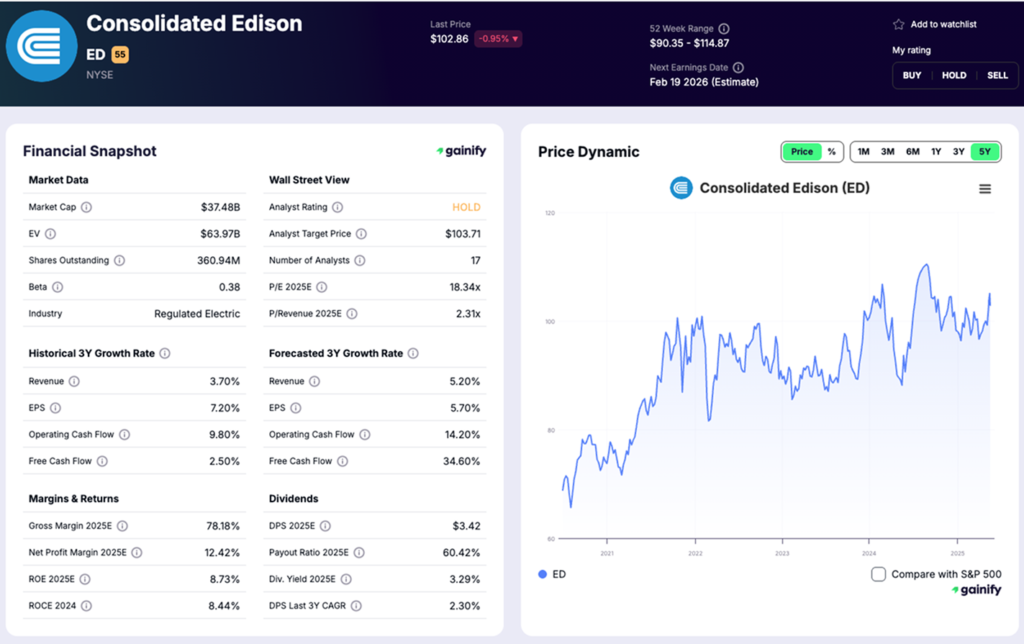

2. Consolidated Edison, Inc. (NYSE: ED)

Founded: 1823

Market Capitalization: $37 billion

Consolidated Edison is one of the longest-listed stocks on the New York Stock Exchange and among the oldest continuously traded public companies in the United States. The company began as the New York Gas Light Company before expanding into electricity, steam, and energy infrastructure serving New York City and surrounding areas.

Utilities have historically ranked among the most enduring public companies due to their regulated business models, essential services, and predictable demand. Con Edison exemplifies this durability, maintaining an uninterrupted public presence for nearly two centuries while adapting to changes in energy technology, regulation, and urban growth.

Today, Con Edison remains a cornerstone of the U.S. utility sector, with its longevity reflecting stability, regulatory integration, and the essential role of energy infrastructure, firmly securing its place among the oldest U.S. stocks still trading.

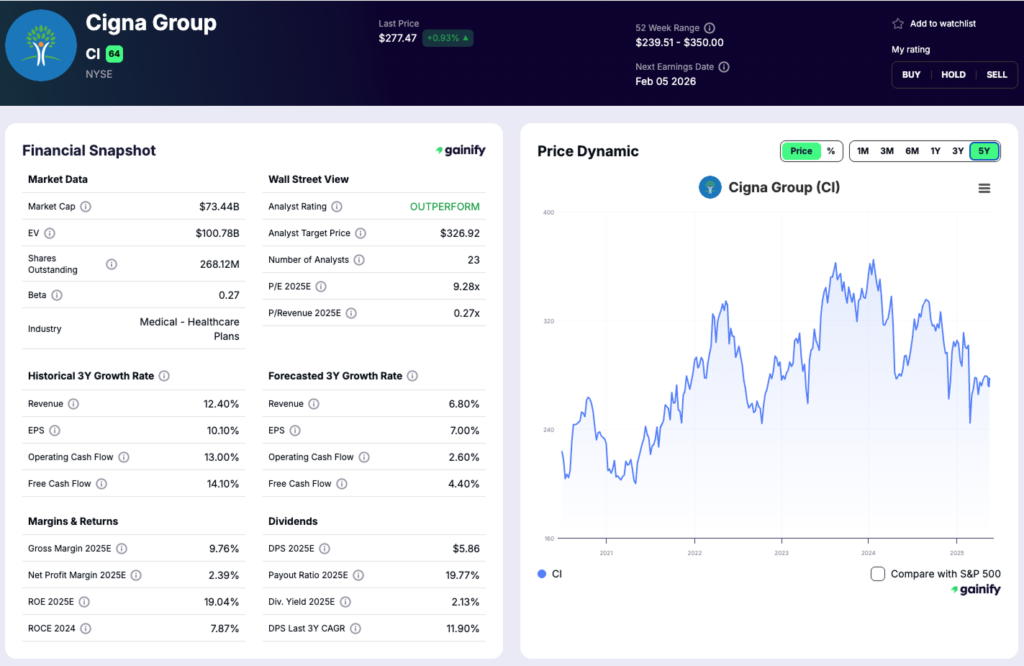

3. The Cigna Group (NYSE: CI)

Founded: 1792

Market Capitalization: $73 billion

The Cigna Group is one of the oldest publicly traded healthcare companies in the United States, with origins dating back to the late 18th century. The company traces its roots to early American insurance providers formed shortly after the founding of the nation, making it one of the earliest examples of organized risk management in the U.S. economy.

Over more than two centuries, Cigna evolved from traditional insurance operations into a global healthcare services organization, with a focus on health benefits, pharmacy services, and employer-sponsored plans. Its longevity reflects the enduring demand for healthcare coverage, as well as the company’s ability to adapt to shifting regulatory frameworks, healthcare delivery models, and cost structures.

Today, Cigna remains a major player in the U.S. healthcare system. Its continued public presence underscores how companies operating in essential services can achieve long-term survival through scale, diversification, and regulatory integration, securing its place among the oldest U.S. stocks still trading today.

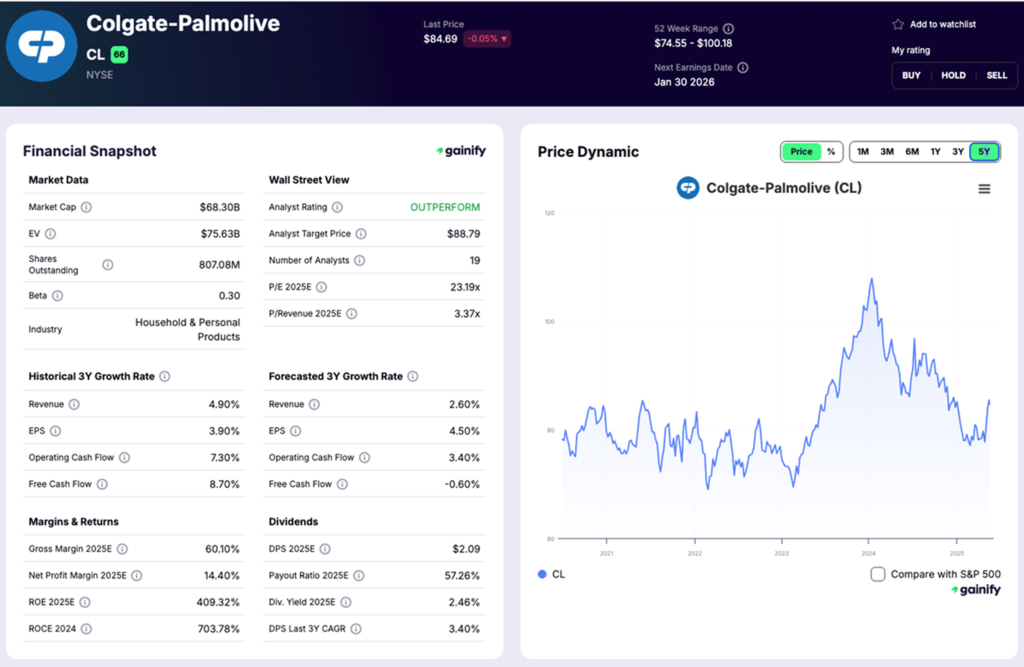

4. Colgate-Palmolive Company (NYSE: CL)

Founded: 1806

Market Capitalization: ~$68 billion

Colgate-Palmolive is one of the oldest consumer staples stocks in the United States, with a history that spans more than two centuries. The company began as a small soap and candle business in New York City before expanding into personal care, oral hygiene, and household products that are now sold globally.

Over time, Colgate-Palmolive built a portfolio of everyday brands that benefit from consistent demand regardless of economic conditions. Its longevity reflects the durability of consumer staples businesses, as well as the company’s ability to adapt its product mix, manufacturing processes, and global distribution strategy as consumer preferences and markets evolved.

Today, Colgate-Palmolive remains a major player in the household and personal products sector. Its continued public presence underscores how companies tied to essential, repeat-purchase goods can achieve long-term survival, securing its place among the oldest U.S. stocks still trading today.

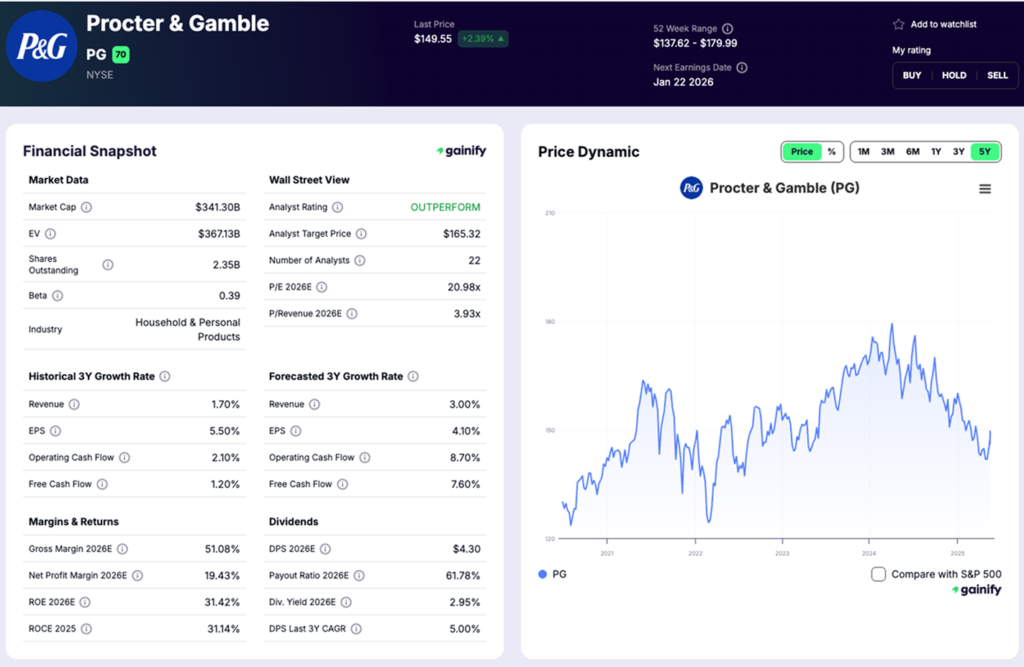

5. Procter & Gamble Co. (NYSE: PG)

Founded: 1837

Market Capitalization: ~$340 billion

Procter & Gamble is one of the longest-surviving consumer staples stocks in the United States and among the most influential publicly traded companies in modern market history. Founded in the 19th century, P&G has remained publicly traded for well over a century while building a global portfolio of household, personal care, and health brands.

The company’s longevity reflects the enduring demand for everyday consumer products, as well as disciplined brand management, scale, and global distribution. Over time, Procter & Gamble has repeatedly refined its business model, divesting non-core assets and focusing on category-leading brands to maintain relevance across changing consumer preferences and economic cycles.

Today, Procter & Gamble stands as one of the largest and most stable companies in the U.S. equity market. Its sustained public presence underscores how consumer staples businesses, when paired with strong brands and operational discipline, can achieve exceptional durability, cementing PG’s place among the oldest U.S. stocks still trading today.

Why Have These U.S. Stocks Survived So Long?

Despite operating in different industries, the oldest U.S. stocks share a common set of structural advantages that have allowed them to endure across centuries of economic and market change.

- Essential products and services: These companies operate in sectors such as banking, utilities, healthcare, and consumer goods, where demand persists regardless of economic cycles.

- Capacity to evolve: Each business has repeatedly adapted its model, transitioning across technologies, regulations, and consumer behavior rather than remaining static.

- Institutional scale: Large, systemically important operations have provided resilience, market influence, and the ability to absorb shocks that would overwhelm smaller competitors.

- Access to public capital: Continuous access to equity markets enabled restructuring, reinvestment, and strategic realignment during periods of stress.

Longevity in U.S. public markets is not driven by innovation alone. It is primarily the result of institutional endurance, strategic flexibility, and sustained relevance within the broader economy.

Is the Oldest Stock in the U.S. a Good Investment?

The oldest stock in the U.S. is not automatically a superior investment simply because of its age. Longevity signals resilience, but it does not guarantee outsized returns. Companies that have survived for centuries typically exhibit a different risk-return profile than younger, faster-growing firms.

In general, these stocks tend to offer:

- Moderate growth rather than rapid expansion, reflecting mature business models

- Stability over volatility, with more predictable cash flows across market cycles

- Exposure to established industries such as financial services, utilities, healthcare, and consumer staples

Their primary appeal lies in durability, dividends, and long-term resilience, rather than aggressive growth or disruptive innovation. For investors seeking capital preservation, income, and exposure to businesses that have endured multiple economic regimes, the oldest U.S. stocks can play a complementary role within a diversified portfolio.

The Bottom Line on the Oldest Stock in the U.S.

The oldest stocks in the United States provide a rare perspective on corporate survival across centuries of economic change. Companies like The Bank of New York Mellon, Consolidated Edison, Cigna, Colgate-Palmolive, and Procter & Gamble endured by adapting repeatedly rather than resisting change.

For investors, the lesson of the oldest stock in the U.S. is clear: longevity is not about permanence, but about evolution.