Augmented reality stocks are gaining renewed attention in 2026 as AR technology becomes a practical part of consumer devices, enterprise software, and industrial workflows. What was once a niche concept is now supported by real products, expanding developer ecosystems, and improving hardware.

For investors, identifying the right augmented reality stocks requires understanding where real exposure sits. While a small number of companies generate direct revenue from AR products, much of the opportunity lies with firms that supply the software platforms, chips, and infrastructure that make AR experiences possible at scale.

This guide highlights the 9 best augmented reality stocks to watch in 2026, explaining where each company fits within the AR ecosystem and what to monitor as adoption continues to develop.

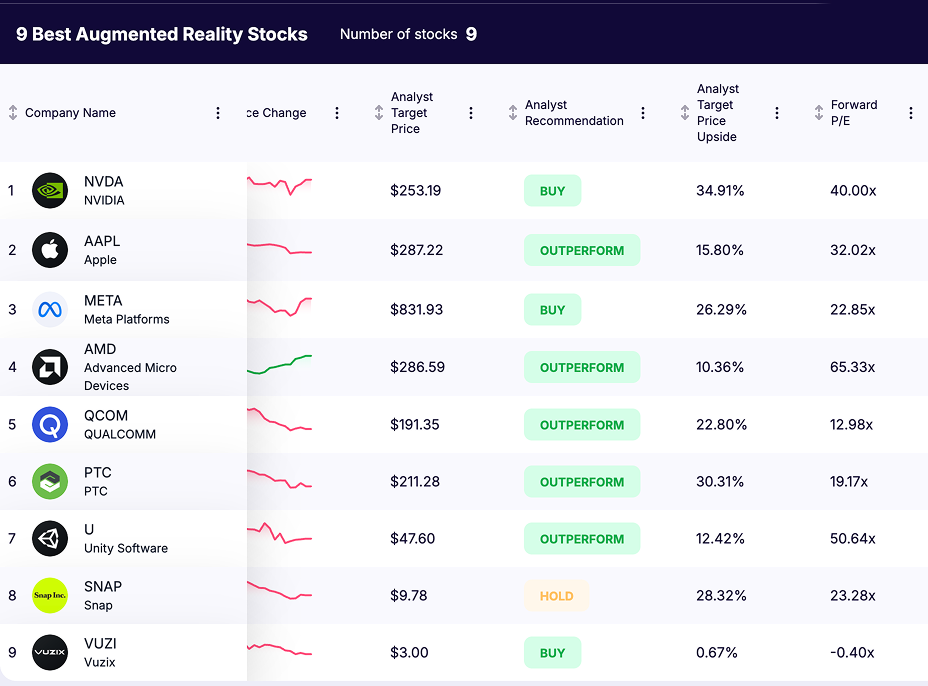

Quick Take: Best AR Stocks in 2026

- Best pure-play AR hardware: Vuzix (VUZI)

- Best consumer AR platform: Snap (SNAP)

- Best AR creation engine: Unity (U)

- Best AR ecosystem builder: Apple (AAPL)

- Best AR wearables ecosystem bet: Meta (META)

- Best AR compute backbone: NVIDIA (NVDA)

What qualifies as an augmented reality stock

An augmented reality stock generally falls into one of two categories.

Pure-play augmented reality companies generate a meaningful share of their revenue directly from AR software, platforms, or wearable devices. Their performance tends to move more closely with the pace of AR adoption, which can amplify both upside and volatility.

Augmented reality enablers provide the chips, software platforms, development tools, and computing infrastructure required to build and run AR experiences. These companies typically offer more diversified exposure, with AR serving as one growth driver among several.

9) NVIDIA (NASDAQ: NVDA)

Type: Enabler

AR role in 2026: NVIDIA provides the compute, simulation, and artificial intelligence infrastructure that sits upstream of augmented reality, particularly in enterprise and industrial use cases. Its platforms are used to create, simulate, and train the environments, physics, and AI systems that later surface inside AR applications.

Why it matters in 2026: High-fidelity augmented reality increasingly depends on accurate 3D models, real-time physics, and AI-driven spatial understanding. NVIDIA’s strength lies in powering digital twins, synthetic data generation, and real-time rendering pipelines that feed AR workflows in manufacturing, robotics, logistics, and engineering. While NVIDIA does not deliver AR experiences directly, AR adoption increases demand for the kind of accelerated compute NVIDIA dominates.

What to watch:

- Expansion of enterprise digital twins into live AR field applications

- Increased use of AI-driven simulation to support AR training and maintenance

- Growth in real-time 3D and spatial computing workloads that require high-performance GPUs

Investor context:

Augmented reality is not a standalone revenue driver for NVIDIA, but it strengthens long-term demand for its core platforms. NVIDIA benefits if AR scales, without being dependent on AR adoption timing.

8) Apple (NASDAQ: AAPL)

Type: Enabler

AR role in 2026: Apple’s augmented reality strategy is built around spatial computing, with Vision Pro acting as the bridge product that hardens the software stack, developer habits, and interaction model ahead of lighter eyewear. Vision Pro has been on the market since February 2, 2024, and Apple positions it as a “spatial computer” rather than a traditional virtual reality headset. Apple still has no mass-market, lightweight AR glasses product available in 2026, but it has laid critical groundwork through visionOS, ARKit, custom silicon, and developer tooling.

Why it matters in 2026: Apple’s edge is platform control. It owns the operating system layer, the silicon roadmap, the developer frameworks, and global distribution. Vision Pro accelerates this by establishing the core interaction primitives and app architecture for spatial experiences, even if unit volumes remain limited. If Apple later introduces AR glasses, they are likely to inherit a mature ecosystem, familiar software patterns, and an existing developer base rather than starting from zero.

What to watch:

- Evidence that Apple is moving toward lighter eyewear through ecosystem signals like power-efficient sensing, on-device intelligence, and accessory support that fits all-day use

- Growth in spatial versions of mainstream apps, especially productivity, communication, and media

- Whether developers treat spatial interfaces as durable extensions of existing apps, with repeat use cases instead of one-off experiences

Investor context: Vision Pro is not expected to materially move Apple’s revenue in 2026. Its strategic value is ecosystem formation and platform control. If AR glasses become a mainstream interface later, Apple is positioned to capture outsized economics at the operating system and distribution layers.

7) Meta Platforms (NASDAQ: META)

Type: Enabler

AR role in 2026: Meta’s augmented reality strategy is centered on AR glasses as a primary consumer interface, supported by years of investment in hardware, software, and computer vision. By 2026, Meta has not yet launched fully standalone, all-day AR glasses at scale, but it has made meaningful progress through its Ray-Ban smart glasses line, which integrates cameras, audio, AI assistance, and early AR-style features without full visual overlays. These devices act as a stepping stone toward true AR glasses, while Meta continues developing displays, waveguides, and on-device intelligence internally.

Why it matters in 2026: Meta’s advantage lies in its focus on wearable-first AR, rather than desktop or professional spatial computing. The company is willing to iterate publicly, ship early, and absorb near-term losses to learn how consumers actually use AR-adjacent devices. Meta also controls a massive social graph and content ecosystem, which gives it a unique opportunity to make AR communication and social interaction habitual once visual AR becomes viable. Unlike Apple, Meta is explicitly optimizing for glasses as the primary endpoint.

What to watch:

- Progress toward AR glasses that add visual overlays while maintaining all-day comfort and battery life

- Expansion of AI-driven features on Ray-Ban smart glasses that reduce friction and increase daily usage

- Signals that social, messaging, or creator use cases are becoming central to Meta’s AR hardware roadmap

Investor context: Augmented reality remains a long-term bet for Meta rather than a near-term earnings driver. The company continues to fund AR development through Reality Labs at a loss, but this spending buys learning speed and optionality. If AR glasses become a mainstream consumer device, Meta is positioned to monetize through social platforms, advertising, and services layered on top of the hardware.

6) Advanced Micro Devices (NASDAQ: AMD)

Type: Enabler

AR role in 2026: AMD’s exposure to augmented reality is indirect but relevant, centered on supplying high-performance CPUs and GPUs that support real-time 3D graphics, visualization, and immersive workloads. AMD does not develop AR platforms or devices, but its processors are used in PCs, workstations, and edge systems that create, render, and run AR content, particularly in enterprise and professional environments.

Why it matters in 2026: As augmented reality matures, demand increases for real-time rendering, spatial visualization, and AI-assisted graphics across design, engineering, and content creation workflows. AMD benefits when these workloads grow, even if AR adoption itself remains gradual. Its role is strongest in creator pipelines and enterprise systems rather than consumer wearables, where power efficiency and integration favor mobile-focused silicon providers.

What to watch:

- Adoption of AMD GPUs and accelerated processors in professional visualization and immersive content creation

- Growth in workstation and edge compute demand tied to 3D design, simulation, and spatial workflows

- Competitive positioning versus NVIDIA in graphics and AI workloads that increasingly support AR development

Investor context: Augmented reality is not a primary driver of AMD’s business in 2026. Instead, AR acts as an incremental tailwind to broader trends in graphics and compute. AMD offers optional exposure to AR adoption without reliance on AR-specific hardware or consumer uptake.

5) Qualcomm (NASDAQ: QCOM)

Type: Enabler

AR role in 2026: Qualcomm sits at the device silicon layer of augmented reality, supplying low-power system-on-chip platforms designed specifically for smart glasses and extended reality devices. By 2026, Qualcomm’s AR-focused processors are used primarily in lightweight glasses and developer hardware that emphasize always-on sensing, audio, and early visual AR capabilities rather than full immersive displays. Qualcomm’s strategy is centered on making AR wearable and practical, not visually maximal.

Why it matters in 2026: True AR glasses are constrained by power, heat, and battery life more than by software ambition. Qualcomm’s advantage is its ability to deliver integrated compute, connectivity, and AI inference within strict power budgets. As AR shifts toward glasses that are worn throughout the day, Qualcomm becomes one of the most critical suppliers in the stack. While it does not control the user experience, it enables the form factor to exist.

What to watch:

- Design wins in consumer and enterprise smart glasses that rely on Qualcomm AR platforms

- Continued improvements in power efficiency and thermal performance

- Growth in on-device artificial intelligence for vision, language, and contextual awareness within AR wearables

Investor context: Augmented reality is an enabling opportunity rather than a standalone growth driver for Qualcomm. If AR glasses scale, Qualcomm benefits through unit volume and platform adoption without bearing consumer product risk. Its exposure is leveraged to form factor success rather than content or ecosystem outcomes.

4) PTC (NASDAQ: PTC)

Type: Enabler

AR role in 2026: PTC’s role in augmented reality is focused on enterprise and industrial deployment, primarily through its Vuforia platform. By 2026, Vuforia is used in production environments for guided work instructions, equipment maintenance, training, and remote service. PTC’s AR strategy is tightly integrated with its broader industrial software portfolio, including product lifecycle management and digital thread solutions.

Why it matters in 2026: Industrial AR is one of the most durable segments of the augmented reality market because adoption is driven by measurable productivity gains rather than consumer behavior. Once AR workflows are embedded into manufacturing, service, or maintenance operations, they tend to persist due to switching costs and operational dependency. PTC benefits from this stickiness by positioning AR as part of a broader industrial software stack rather than a standalone tool.

What to watch:

- Expansion of AR deployments from pilot programs into standardized enterprise workflows

- Renewal rates and long-term contracts tied to Vuforia-enabled operations

- Deeper integration of AR into manufacturing execution, service management, and field operations

Investor context: Augmented reality is not a headline growth engine for PTC, but it strengthens customer retention and platform depth. PTC offers exposure to AR adoption where return on investment is quantifiable and less sensitive to consumer adoption cycles, making it one of the more predictable AR-related names in the public markets.

3) Unity Software (NYSE: U)

Type: Pure play

AR role in 2026: Unity remains one of the most widely used engines for building augmented reality experiences across mobile, enterprise, and industrial use cases. By 2026, Unity’s AR relevance is less about consumer experimentation and more about content creation, simulation, and visualization, particularly where real-time 3D and cross-platform deployment are required. Unity sits upstream in the AR stack, enabling developers to create and iterate on AR applications that are later deployed across devices and platforms.

Why it matters in 2026: If augmented reality adoption expands, the demand for tools that simplify AR development grows alongside it. Unity benefits from being familiar, flexible, and deeply embedded in developer workflows. Its engine lowers the barrier to building AR experiences, making it a natural choice for training, digital twins, simulations, and enterprise XR applications. As AR shifts from novelty to utility, Unity’s relevance depends on whether it remains a default creation environment rather than a specialized tool.

What to watch:

- Developer sentiment and retention following recent platform and pricing changes

- Growth in enterprise and industrial XR use cases such as training, simulation, and digital twins

- Evidence that Unity is becoming a standardized tool for non-gaming AR workflows

Investor context: Unity offers some of the most direct exposure to AR content creation among public companies, but that exposure comes with higher execution risk. Its upside is closely tied to developer adoption and AR workload growth, while its downside reflects competition, platform commoditization, and pricing sensitivity. For investors, Unity represents a leveraged bet on AR creation rather than AR hardware adoption.

2) Snap (NYSE: SNAP)

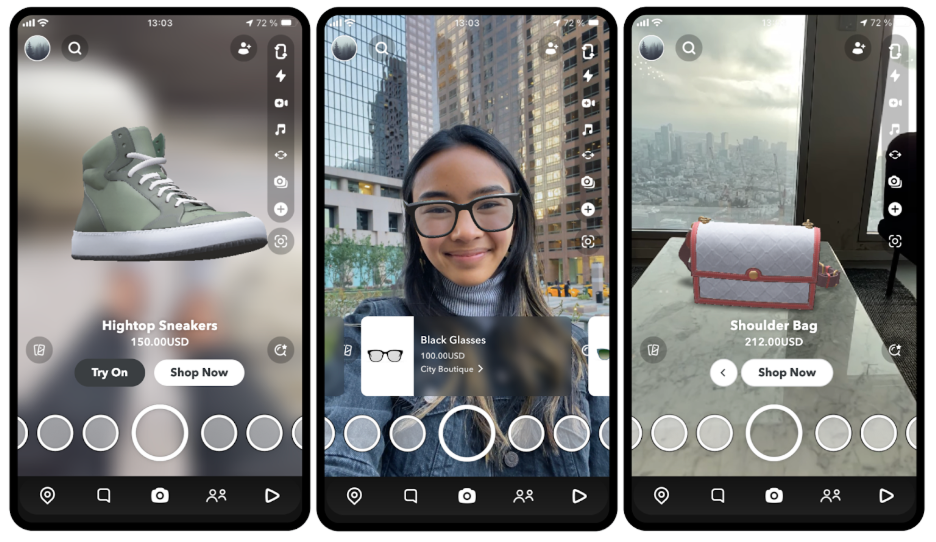

AR role in 2026: Snap is one of the few public companies where augmented reality is already embedded in daily consumer behavior. By 2026, Snap’s AR strategy centers on extending its camera-first platform into wearable AR, with the planned launch of lightweight immersive Specs acting as a natural evolution of its long-standing AR lenses and creation tools. Snap’s advantage lies in pairing AR hardware ambitions with an existing audience that already uses AR as part of communication and self-expression.

Why it matters in 2026: Snap starts from distribution, not hardware. Hundreds of millions of users already engage with AR lenses through the Snapchat app, giving Snap a rare opportunity to migrate AR usage from phones to wearables without needing to invent new behaviors. If Specs successfully connect Snap’s AR content ecosystem to a wearable form factor, Snap becomes one of the few companies combining consumer reach, AR software capability, and hardware intent in a single platform.

What to watch:

- Progress and reception of the Specs launch, particularly around comfort, battery life, and daily usability

- Growth of the AR developer and creator ecosystem building for wearable formats

- Early signals around monetization, including advertising, commerce, and sponsored AR experiences tied to usage

Investor context: Snap offers some of the most direct exposure to consumer augmented reality, but with higher execution risk. Hardware introduces new complexity, and monetization beyond mobile advertising remains unproven. For investors, Snap represents a high-upside AR bet where success depends on translating strong AR engagement into a sustainable wearable platform.

1) Vuzix (NASDAQ: VUZI)

Type: Pure play

AR role in 2026: Vuzix is one of the few publicly traded companies focused almost entirely on augmented reality smart glasses and optical systems. By 2026, its strategy centers on enterprise and industrial use cases, with products designed for hands-free workflows, remote assistance, and guided operations. The lightweight, prescription-ready optical reference design unveiled at CES 2026 highlights Vuzix’s emphasis on improving comfort, usability, and form factor rather than chasing consumer scale prematurely.

Why it matters in 2026: Vuzix offers direct exposure to AR hardware adoption, particularly in enterprise environments where return on investment can be measured. Its expertise in waveguides, optics, and display systems positions it as both a device maker and a component-level specialist. As companies look to deploy AR glasses in logistics, healthcare, manufacturing, and field service, Vuzix stands out as a focused supplier without broader platform distractions.

What to watch:

- Expansion of commercial deployments beyond pilot programs

- Partnerships with enterprise customers, integrators, or platform providers

- Progress on reducing cost and improving comfort to enable wider adoption

Investor context: Vuzix represents a concentrated bet on augmented reality hardware. That focus creates meaningful upside if enterprise smart glasses adoption accelerates, but it also brings higher volatility and execution risk. For investors, Vuzix is best viewed as a high-conviction pure-play AR exposure rather than a diversified technology holding.

Key Risks When Investing in Augmented Reality Stocks

A. Consumer adoption may take longer than markets expect. Lightweight AR glasses still face constraints around comfort, battery life, price, and social acceptance. If adoption progresses gradually, pure-play AR hardware companies can see prolonged periods of weak demand and higher financial strain.

B. AR value often appears indirectly, not as reported revenue. Many of the biggest AR beneficiaries do not break out “AR revenue.” Instead, gains show up through higher demand for semiconductors, graphics processing, cloud infrastructure, or enterprise software. This can delay recognition by the market and make progress harder to measure.

C. Developer ecosystems determine winners and losers. AR hardware without sustained developer engagement rarely succeeds. Platforms that fail to attract creators, tools, and repeat-use applications tend to stall, regardless of technical capability. Software depth often matters more than hardware specifications.

D. Enterprise AR depends on provable returns. Industrial AR adoption is steadier than consumer AR, but budgets remain tied to measurable productivity gains. Deployments scale only when they clearly reduce costs, improve safety, or increase efficiency.

What to Watch in Augmented Reality Through 2026

Looking ahead through 2026, progress in augmented reality is likely to be incremental rather than dramatic. The biggest advances tend to come from improvements in usability, such as lighter devices, better battery life, and software that fits naturally into existing workflows, rather than from headline-grabbing launches. Adoption builds when AR tools feel useful and reliable in everyday settings, not when they are impressive in short demos.

From an investment perspective, value often accrues to the platform and infrastructure layers. Companies that control operating systems, developer tools, or core silicon tend to shape how AR evolves and where economics ultimately settle. These positions benefit even when end-user adoption moves slowly, because they sit closest to the long-term control points of the ecosystem.

At the same time, risk varies significantly across the AR stack. Pure-play AR companies can offer meaningful upside if adoption accelerates, but they are more exposed to timing and execution risk. Enablers typically compound more quietly, with AR acting as one growth driver among several. In 2026, the more durable AR investment cases are built around understanding where value accumulates over time, rather than trying to call the exact moment AR becomes mainstream.

FAQ: Augmented Reality Stocks in 2026

What are the best pure-play augmented reality stocks?

Vuzix, Snap, and Unity are the most direct AR exposure in this list.

What are the best AR enabler stocks?

Apple, Meta, Qualcomm, NVIDIA, PTC, and AMD offer AR exposure through platforms, silicon, compute, and enterprise software.

Which AR stock is most tied to smart glasses?

Qualcomm and Meta are central to smart glasses momentum. Snap is the key consumer wildcard with Specs planned for 2026.