The global cannabis industry is entering a pivotal reset. After several years of volatility, oversupply, and inconsistent regulatory progress, the sector is shifting toward disciplined, fundamentals-driven growth.

Legal cannabis sales reached roughly 52 billion dollars in 2024 and are projected to grow at more than 18% a year through 2028, supported by expanding adult-use markets, stronger consumer adoption, and the gradual conversion of the illicit market into regulated channels.

Although broad cannabis ETFs have struggled, the underlying equities are not behaving uniformly. A select group of cannabis stocks has expanded margins, strengthened cash generation, reinforced liquidity, and managed growth with careful capital allocation. These operators are laying the groundwork for durable business models as the industry approaches major catalysts, including U.S. federal reform, structured European medical access, and the continued shift toward higher-margin product categories.

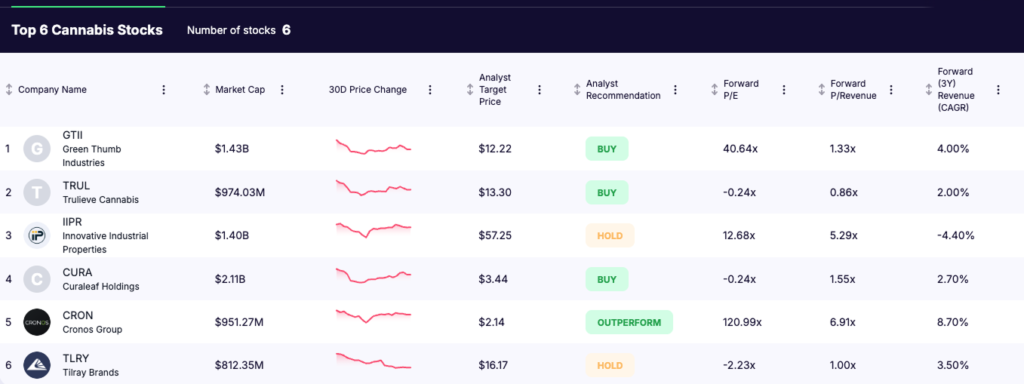

The cannabis stocks that stand out as the most important to watch are Green Thumb Industries, Trulieve Cannabis, Innovative Industrial Properties, Curaleaf Holdings, Cronos Group, and Tilray Brands. These six companies represent the core of the investable cannabis universe, each offering a different strategic exposure to cultivation, retail, real estate, consumer packaged goods, and international expansion. Their performance will shape the next phase of the cannabis market and define where long-term capital flows.

Key Takeaways

- The sector is shifting toward financial discipline, rewarding companies with stable gross margins, consistent operating cash flow, and well-managed balance sheets.

- A small group of public operators is leading the way, including Green Thumb, Trulieve, Curaleaf, Cronos, Tilray, and Innovative Industrial Properties, each with different catalysts, capital structures, and market exposures.

- The long-term upside remains tied to U.S. regulatory reform, which would lower financing costs, remove tax burdens, and open institutional capital channels, significantly altering valuations across the sector.

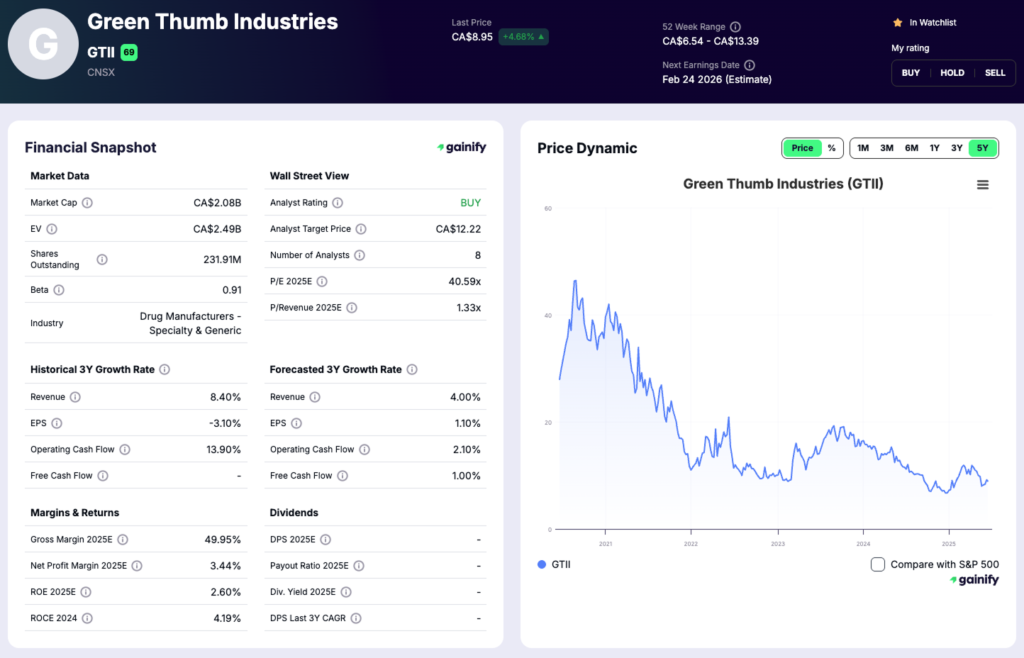

1. Green Thumb Industries (GTII)

Market Cap: $1.43B

Forward P/E: 40.6x

Analyst Rating: Buy

Forward 3Y Revenue Growth: ~4% CAGR

Green Thumb has emerged as one of the strongest operators in U.S. cannabis, supported by a disciplined multi-state footprint and a cultivation network that consistently delivers stable output and strong cost control. The company continues to post steady top-line performance, with quarterly revenue growing at roughly 5 percent year over year and gross margins holding near the mid-40 percent range. Retail productivity has improved as repeat purchasing has increased, and the company’s strongest brands maintain high sell-through across multiple product categories.

Operational execution remains a core strength. Green Thumb has generated more than 50 million dollars in operating cash flow in recent quarters, supported by better inventory rotation and disciplined capital expenditure. Liquidity remains solid, and the balance sheet is managed with conservative leverage relative to peers, which creates flexibility ahead of potential banking reform or uplisting availability.

Investment thesis: Green Thumb is positioned as one of the highest-quality operators in the sector. Consistent cash generation, strong brand performance, and a measured expansion strategy provide a durable foundation in both constrained medical markets and expanding adult-use markets. If U.S. federal policy improves access to capital or allows major exchange listings, Green Thumb has the operational profile and financial strength to benefit disproportionately.

Key risk: Pricing pressure remains an ongoing challenge in certain competitive states. If retail price compression accelerates faster than cost efficiencies, margin stability could face headwinds in the near term.

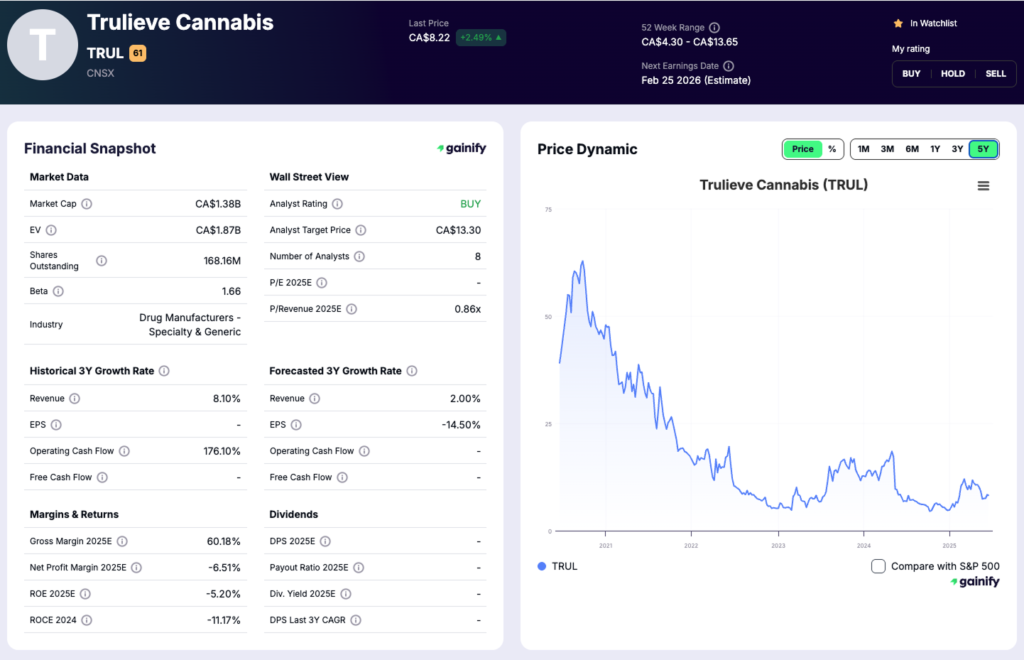

2. Trulieve Cannabis (TRUL)

Market Cap: $974M

Forward P/E: negative

Analyst Rating: Buy

Forward 3Y Revenue Growth: ~2% CAGR

Trulieve remains the dominant operator in Florida, supported by the largest retail network in the state and a cultivation infrastructure designed for consistent volume and low per-unit production costs. The company continues to hold one of the highest market shares in Florida’s medical program, driven by strong customer retention and a proven ability to move volume across more than 190 dispensaries. Recent filings show steady operating recovery, with retail throughput improving and cultivation yields rising as facility upgrades come online.

Financial performance has strengthened as Trulieve progresses through its restructuring cycle. Operating expenses have moved lower, liquidity has improved through asset monetization, and the company has returned to generating positive operating cash flow, with recent figures trending above the 25 million dollar level. Capital discipline has allowed Trulieve to maintain a stable cost structure while preparing for a potential transition to adult-use sales.

Investment thesis: Trulieve is the highest-conviction way to gain exposure to Florida’s potential adult-use legalization. The company already controls the cultivation scale, distribution depth, and retail saturation required to scale rapidly once regulations shift. Its existing footprint gives it a structural advantage over new entrants and supports meaningful upside if Florida becomes an adult-use market.

Key risk: Trulieve’s heavy concentration in Florida creates a single-market dependency. Any regulatory delays, ballot setbacks, or changes to the medical program could materially affect near-term performance and investor sentiment.

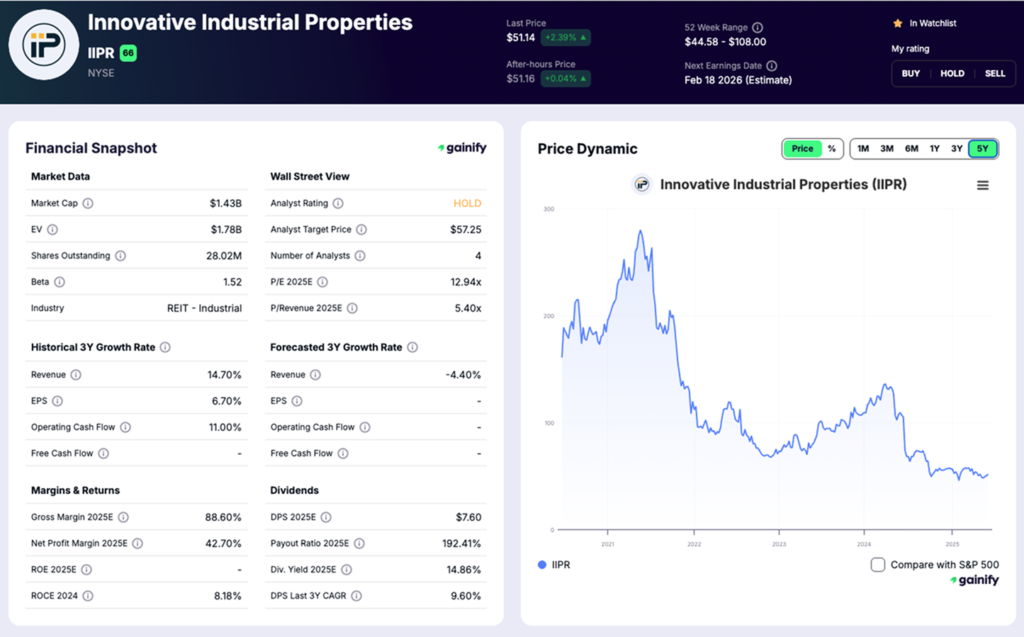

3. Innovative Industrial Properties (IIPR)

Market Cap: $1.40B

Forward P/E: 12.8x

Analyst Rating: Hold

Forward 3Y Revenue Growth: -4% CAGR

Innovative Industrial Properties serves as the primary real estate capital provider in the cannabis sector, financing operators through long-term triple-net leases that create highly predictable and long-duration rental income streams. The REIT owns more than 100 cultivation and processing facilities across key markets, and its weighted-average lease term remains above 15 years, supporting consistent cash flow visibility. These assets are mission-critical to tenants, which reinforces occupancy and renewal stability.

The current operating backdrop reflects the financial pressure many operators face. A small number of tenants have required lease restructuring, yet occupancy remains above 90 percent and rental collections continue to track near contractual levels. IIPR maintains a conservative balance sheet with modest leverage and strong liquidity, which gives the REIT resilience even as tenant credit quality varies. Dividend coverage remains supported by property-level performance and disciplined capital allocation.

Investment thesis: IIPR provides investors with a differentiated way to access the cannabis industry through stable real estate cash flows rather than direct operating exposure. As the sector consolidates and weaker operators exit, tenant quality is likely to improve. Regulatory progress in the United States would also strengthen credit profiles across the portfolio and expand IIPR’s addressable market. The REIT’s long-term lease structure and conservative financing model create a durable income asset with upside tied to industry normalization.

Key risk: Tenant credit remains the central risk. If liquidity pressures deepen among operators, additional lease modifications or isolated defaults could affect rental income and dividend stability. Refinancing costs for tenants also influence long-term occupancy and lease performance.

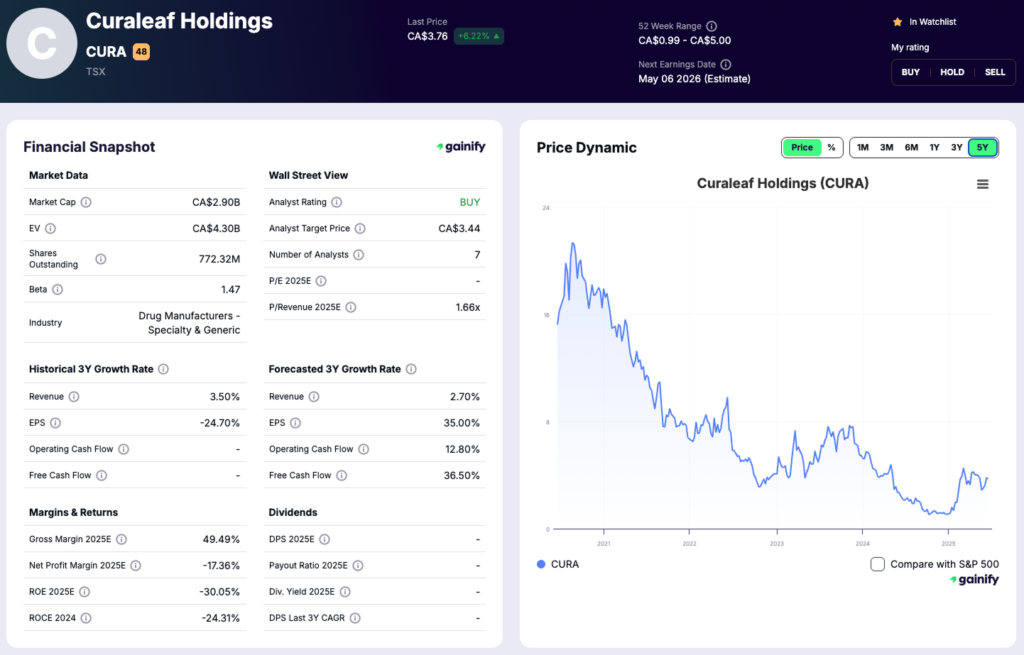

4. Curaleaf Holdings (CURA)

Market Cap: $2.1B

Forward P/E: negative

Analyst Rating: Buy

Forward 3Y Revenue Growth: ~2.7% CAGR

Curaleaf Holdings operates one of the broadest platforms in U.S. cannabis, with a retail and cultivation footprint that spans key adult-use states and an expanding presence in Europe. The company has positioned itself as the leading U.S. operator with meaningful international exposure, driven by early investments in Germany and other controlled-access markets. These investments target long-term medical reform and early commercial channels that could scale materially over the next decade.

Recent filings indicate steady performance across adult-use states, with revenue supported by stronger product mix economics and improving retail throughput. The company has moved aggressively to streamline operations, reducing overhead expenses and improving margin consistency. Curaleaf continues to expand its international portfolio, and early traction in Germany has been encouraging as patient counts rise and medical frameworks loosen. Across the platform, scale remains a competitive advantage, with more than 140 retail locations and annual revenue trending above 1.3 billion dollars.

Investment thesis: Curaleaf is uniquely positioned as a cross-border cannabis operator with exposure to both the maturing U.S. market and emerging European channels. Its scale, distribution reach, and diversified product portfolio provide multiple pathways for long-term growth. If U.S. policy reforms reduce financing constraints or improve capital-market access, Curaleaf has the platform breadth to scale rapidly. International expansion adds an additional strategic layer that few peers can match.

Key risk: The company carries elevated execution risk due to its wide geographic footprint. European regulatory progress can be uneven, and U.S. price pressure remains persistent in several states. Managing both international expansion and domestic competitive dynamics requires disciplined capital allocation and sustained cost control.

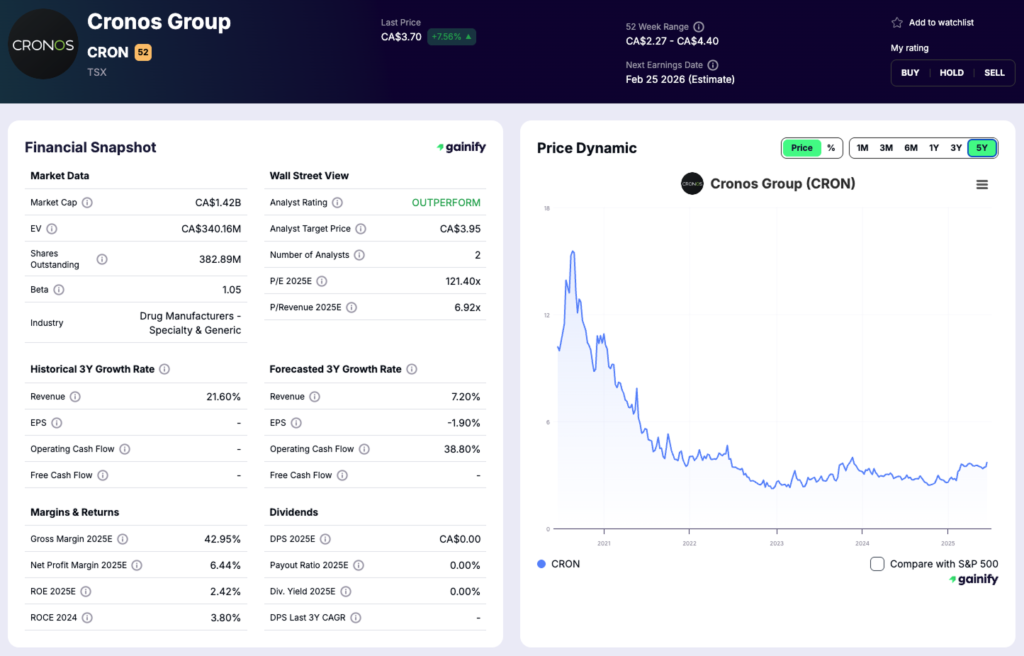

5. Cronos Group (CRON)

Market Cap: $951M

Forward P/E: NA

Analyst Rating: Outperform

Forward 3Y Revenue Growth: ~8.7% CAGR

Cronos Group operates a focused, research-driven platform centered on branded products, cannabinoid innovation, and disciplined capital allocation. The company maintains one of the strongest liquidity positions in the sector, with several hundred million dollars in cash and short-term investments. This balance sheet allows Cronos to operate with an asset-light model and pursue targeted international opportunities without taking on the operational or financial risk typical of larger vertically integrated operators.

Recent filings indicate stable revenue progression supported by improvements in product mix, particularly in premium flower and wellness-oriented categories. Operating discipline has been a clear priority, with total operating expenses declining meaningfully over the last twelve months as the company tightens its cost structure and prioritizes cash preservation. Revenue remains modest relative to larger U.S. operators, but the combination of controlled spending and strong liquidity has kept the company in a stable financial position. Gross margins have improved as the company refines its supply chain and consolidates production into higher-efficiency assets.

Investment thesis: Cronos is positioned as a defensive cannabis stock with asymmetric optionality. Its substantial cash reserves, conservative operating strategy, and focus on research-backed product development create strategic value that is uncommon in the sector. The company’s balance sheet gives it the flexibility to participate in international market openings, support selective investments, or act as a potential acquisition target once regulatory conditions improve. Cronos provides exposure to long-term global cannabis growth without the financial risk carried by multi-state operators.

Key risk: The primary risk is subdued revenue growth relative to peers operating in large U.S. markets. Without significant regulatory catalysts or acceleration in international demand, top-line growth may remain limited, which could weigh on valuation momentum.

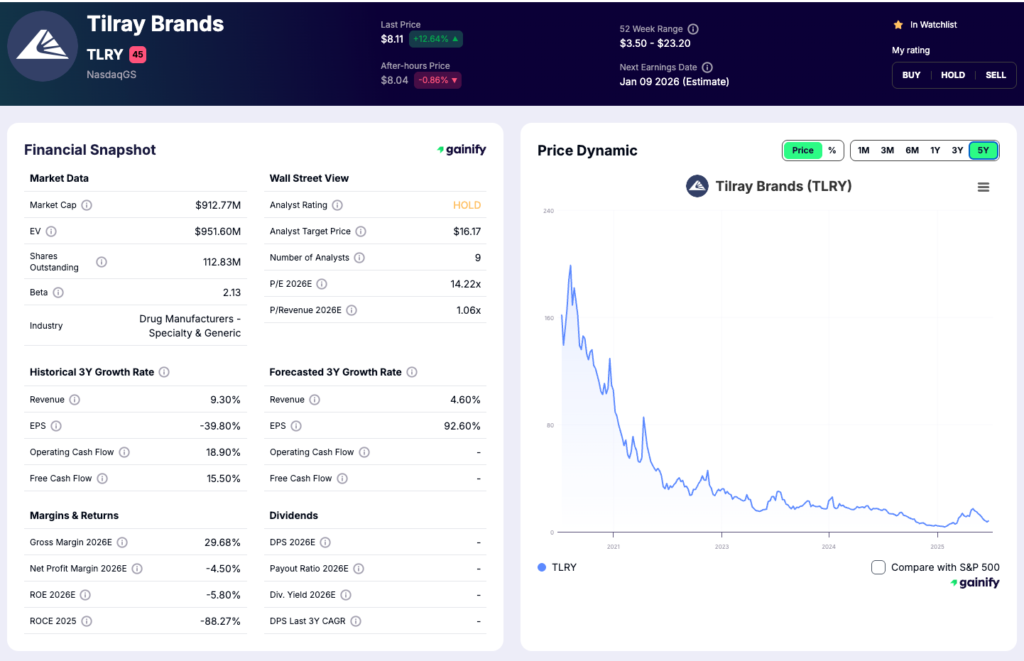

6. Tilray Brands (TLRY)

Market Cap: $812M

Forward P/E: negative

Analyst Rating: Hold

Forward 3Y Revenue Growth: ~3.5% CAGR

Tilray Brands has evolved into a diversified consumer goods platform with exposure to cannabis, beverages, and wellness categories. The company’s strategy has shifted toward acquiring and integrating beverage assets that provide steadier cash flow and broader distribution reach. These acquisitions have meaningfully diversified revenue, with the beverage portfolio now contributing a substantial portion of total sales. Cannabis revenue remains pressured by competitive pricing, but the company’s scale and distribution capabilities continue to support market presence in Canada and select international markets.

Recent disclosures reflect a deliberate transition toward higher-volume beverage categories, supported by more than 20 acquired or developed brands. Annual revenue has stabilized near the 700 million dollar level, and the company continues to streamline operations to improve margin consistency. Tilray’s distribution infrastructure provides a strategic foothold if cannabis beverages gain regulatory support in the United States or Europe, where the company already has established commercial channels. The business model aims to combine consumer packaged goods stability with long-term cannabis optionality.

Investment thesis: Tilray offers a diversified approach to cannabis investing by pairing CPG assets with global cannabis operations. This model reduces revenue volatility and provides multiple vectors for growth across alcohol, wellness, and cannabis categories. If cannabis beverages become a regulated commercial category, Tilray is well positioned to scale quickly through its existing distribution network. The company’s strategy targets long-term brand consolidation and multi-category leadership rather than pure cultivation-driven growth.

Key risk: Integration complexity remains elevated. The company must manage a broad set of beverage, wellness, and cannabis assets while facing ongoing price compression in core cannabis markets. Margin recovery depends on balancing growth investments with continued cost discipline across all business segments.

Industry Outlook for 2025 and Beyond

The cannabis sector is entering a more rational phase shaped by disciplined cost control, consolidation, improving cash generation, and a shift away from unprofitable expansion. Key long-term drivers remain intact. Adult-use legalization in the United States represents the most significant catalyst, with the potential to double the legal user base to more than 40 million. International markets, particularly in Europe, are progressing slowly but steadily, with medical access and controlled retail environments emerging.

Product diversification continues. Flower is projected to decline from 32 percent to 28 percent of total category share by 2028 as consumers adopt edibles, infused beverages, vapes, and wellness products. This shift supports margin expansion over time for operators with strong brand portfolios and advanced manufacturing capabilities.

Despite valuation compression across the sector, the fundamentals support a constructive long-term view. Companies with strong balance sheets, efficient cultivation, diversified revenue channels, and a disciplined approach to capital allocation are positioned to outperform as the regulatory environment becomes more favorable.