The global gambling and betting industry is entering 2026 with more momentum and complexity than markets are pricing in. After a difficult 2025 defined by weak Las Vegas comps, mixed Macau trends and regulatory pressure on online betting, the sector faces a cleaner setup. Forward bookings in Las Vegas are improving, Macau’s mass gaming base continues to normalize, and Singapore’s acceleration is supporting Asia-facing operators. Digital platforms remain structurally profitable but must navigate higher taxes and regulatory scrutiny.

At the same time, the global market continues to expand. Industry revenue is projected to grow from about six hundred billion dollars in 2024 toward one trillion dollars by 2033. Digital penetration, mobile-first wagering, AR and VR gaming, and broader use of AI across personalization and risk management are driving the next wave of expansion.

Bloomberg Intelligence expects casino margins to stabilize in 2026 as operators leverage labor, procurement and marketing efficiencies. Online operators face tougher regulation but continue to benefit from improved structural hold rates. This creates a high-dispersion environment where leadership will matter more than beta.

The six largest publicly listed gambling stocks shape supply, pricing behavior and regulatory tone across the industry and are the names investors should watch closely going into 2026.

1. Las Vegas Sands (LVS)

Market Cap: $45.2 Billions

Forward P/E: 23.6x

Analyst Target Upside: -1.54%

Investment Thesis

Las Vegas Sands is the clearest large-cap play on Asia’s premium mass recovery. The company’s earnings base is driven almost entirely by Macau and Singapore, the two highest-margin gaming markets globally. LVS enters 2026 with a structurally advantaged footprint: the Londoner renovation is reshaping market share in Macau’s premium mass tier, while Marina Bay Sands continues to generate industry-leading profitability supported by its suite and retail expansion.

The company is emerging from its investment cycle with rising free cash flow and one of the strongest balance sheets in the sector. EBITDA in both Macau and Singapore is tracking firmly above pre-pandemic levels, supported by higher spend per visitor and tight cost control. LVS remains the operator with the highest leverage to Asia tourism normalization and long-duration mass gaming growth.

What to Watch Into 2026

- Trajectory of Macau premium mass recovery and the normalization of inbound tourism, particularly from non-Guangdong provinces

- Sustainability of Marina Bay Sands’ elevated margins and mass volumes as peak-season effects fade

- Growth in non-gaming segments such as retail, conventions and entertainment, which increasingly support margins

- Capital deployment across the next phase of MBS expansion and the pacing of large-scale development spending

Key Risks

- Exposure to Mainland China travel policy and visitation patterns

- Intensifying competition in Macau as Galaxy and Melco expand premium inventory

- Quarterly volatility in gaming hold rates despite higher table productivity

- Execution and return-on-investment risks linked to multi-year development projects

2. Flutter Entertainment (FLUT)

Market Cap: 37.0B

Forward P/E: 27.1x

Analyst Target Upside: 43.0%

Investment Thesis

Flutter is the global scale leader in online betting and gaming, with a portfolio that spans FanDuel in the U.S., Paddy Power and Betfair in Europe, and Sportsbet in Australia. The company enters 2026 with the strongest multi-market position in the industry, supported by proprietary technology, broad product depth, and a customer acquisition engine that continues to outpace peers.

FanDuel remains the crown jewel. It is the only operator consistently generating positive U.S. online sports-betting EBITDA, driven by disciplined promotions, superior pricing models, and a structurally higher parlay mix. Internationally, Flutter continues to benefit from its diversification: its ex-U.S. segment delivered solid revenue growth with stable margins, providing ballast against U.S. volatility. Q3 results highlighted the company’s ability to scale efficiently, with U.S. revenue accelerating more than 30 percent and group-wide EBITDA expanding despite ongoing investment.

Flutter’s balance sheet is improving as U.S. profitability ramps, and capital allocation discipline remains intact. The long-term thesis hinges on increasing U.S. market share, normalization of promotional intensity, and continued digital migration globally.

What to Watch in 2026

- U.S. share gains in online sports betting and iGaming

- Promotional intensity and customer lifetime value improvements

- Regulatory developments in key U.S. states and UK gambling reforms

Key Risks

- Higher U.S. state gaming taxes reducing unit economics

- Increasing regulatory scrutiny in the UK and Ireland

- Slower-than-expected profitability ramp in U.S. iGaming

3. Aristocrat Leisure (ALL)

Market Cap: 23.9B

Forward P/E: 23.7x

Analyst Target Upside: 25.6%

Investment Thesis

Aristocrat enters 2026 as the strongest content creator in global gaming. Its core machine business continues to outperform the market through premium games, recurring fee revenue, and expanding market share in North America. Digital gaming is scaling with improving margins, giving the company a second profit engine with long visibility. Across casino floors, Aristocrat’s penetration in premium leased games remains unmatched, and its software-driven models create more stable earnings than traditional hardware vendors.

What to Watch in 2026

- Premium game mix: Continued share gains in premium leased cabinets, the highest-margin segment in land-based gaming.

- Digital margin expansion: The mobile gaming portfolio is stabilizing with better user acquisition economics and improving live-ops efficiency.

- Systems and recurring revenue: Growth in recurring fee-based product lines, which deepen customer lock-in and reduce earnings volatility.

Key Risks

- Casino capex cycles: Slower hardware refresh cycles at U.S. casinos could soften unit demand even if content remains strong.

- Digital hit dependency: Mobile growth still relies on sustaining a consistent pipeline of successful titles in a highly competitive space.

- Regulatory exposure: Any tightening of online gambling or in-app monetization rules could pressure digital earnings.

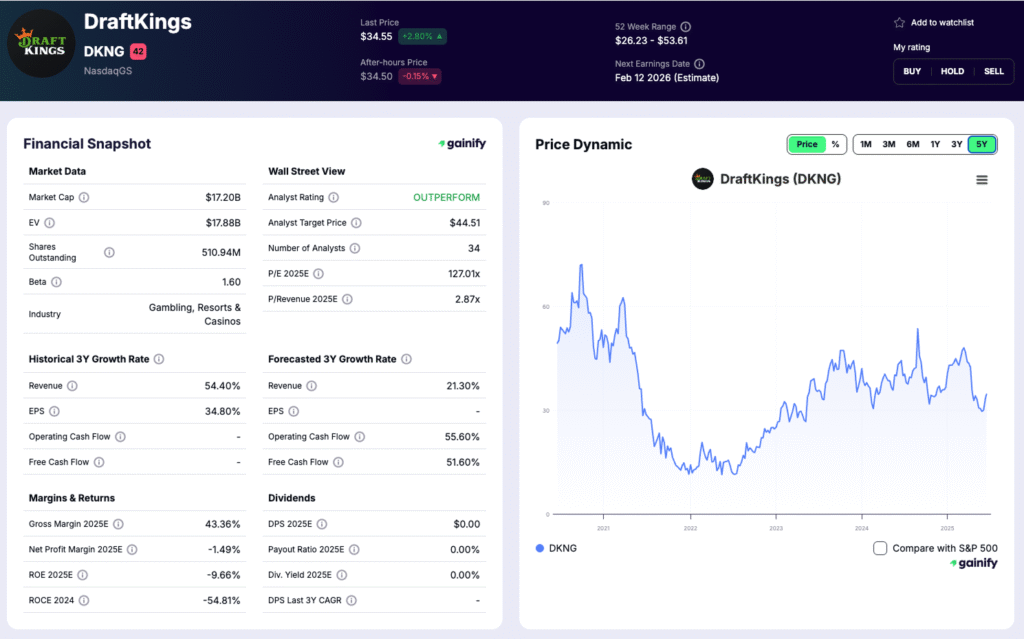

4. DraftKings (DKNG)

Market Cap: 17.2B

Forward P/E: 127.0x

Analyst Target Upside: 28.8%

Investment Thesis

DraftKings enters 2026 as the fastest-growing U.S. online betting and iGaming operator, with scale advantages now translating into material operating leverage. The company continues to compound revenue at a high rate while expanding gross margin through improved hold, better same-game parlay mix, and tighter promotional spending.

In its latest quarter, revenue grew more than twenty percent, gross margin expanded meaningfully, and adjusted EBITDA improved year-over-year despite ongoing state rollouts. Customer engagement remains strong, monthly unique payers increased at a double-digit rate, and average revenue per payer continues trending upward. As newer states mature and marketing intensity normalizes, DraftKings is moving toward consistent profitability with a clearer path to durable free cash flow.

The investment case centers on DraftKings’ widening product moat, increasingly efficient customer acquisition, and leading technology stack. The company is transitioning from a share-capture story to a margin-and-cash-flow story, which is the catalyst for rerating potential in 2026.

What to Watch in 2026

- Parlay mix shift: Higher same-game parlay adoption materially boosts gross margin and reduces volatility across major sports calendars.

- State-by-state maturity: New jurisdictions like North Carolina ramping, with older states entering the profitability phase of the cohort curve.

- iGaming penetration: Expansion and legalization momentum in high-value states where iGaming economics are significantly stronger than sports betting.

Key Risks

- Tax and regulatory creep: Rising state taxes and restrictions on bet types or promotions can pressure margins and customer lifetime value.

- Promotional intensity: If competitors over-spend during major sports seasons, acquisition costs could spike again.

- Seasonality and volatility: Earnings remain sensitive to outcomes during NFL and NBA peak periods, where small swings in hold can move adjusted EBITDA.

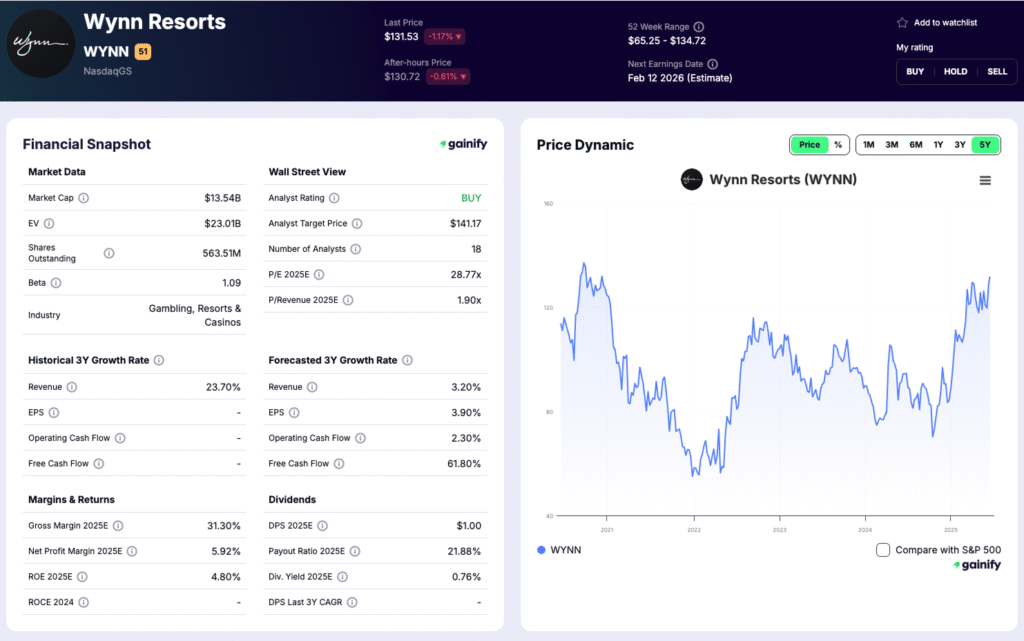

5. Wynn Resorts (WYNN)

Market Cap: 13.5B

Forward P/E: 29.1x

Analyst Target Upside: 7.3%

Investment Thesis

Wynn enters 2026 with its most balanced earnings profile in years. Macau is stabilizing at higher premium mass profitability, Las Vegas continues to benefit from strong ADRs and group demand, and the company’s operating discipline is showing up in cleaner margins across the portfolio.

The latest quarter demonstrated that Wynn’s core customer remains resilient. Wynn Palace and Wynn Macau delivered solid mass performance, supported by improved visitation and a healthier mix of premium play. Las Vegas posted strong results, with record non-gaming revenue and robust convention pacing. Boston Harbor remained steady, extending Wynn’s stable contribution from the U.S. region.

The strategic story is straightforward. Wynn has fewer levers than LVS or Galaxy but executes with precision at the highest end of the market. Its properties consistently rank among the most productive luxury assets globally. As travel flows normalize and mass gaming continues to lead recovery, the company enters 2026 with clear visibility and a cleaner cost base, positioning it for attractive incremental EBITDA conversion.

What to Watch in 2026

- Macau premium mass: Continued stabilization in premium mass, which drives most of Wynn’s incremental EBITDA.

- Las Vegas mix: Strength of ADRs, group bookings and non-gaming revenue as event calendars expand.

- Operating discipline: Execution on cost control as the company targets higher flow-through on revenue gains.

Key Risks

- Macau visitation risk: Slower recovery in Mainland China travel or policy-driven disruptions.

- Luxury demand sensitivity: Wynn’s model is more exposed to shifts in high-end discretionary spending.

- Competitive supply: New premium inventory in Macau and refreshed luxury offerings in Las Vegas.

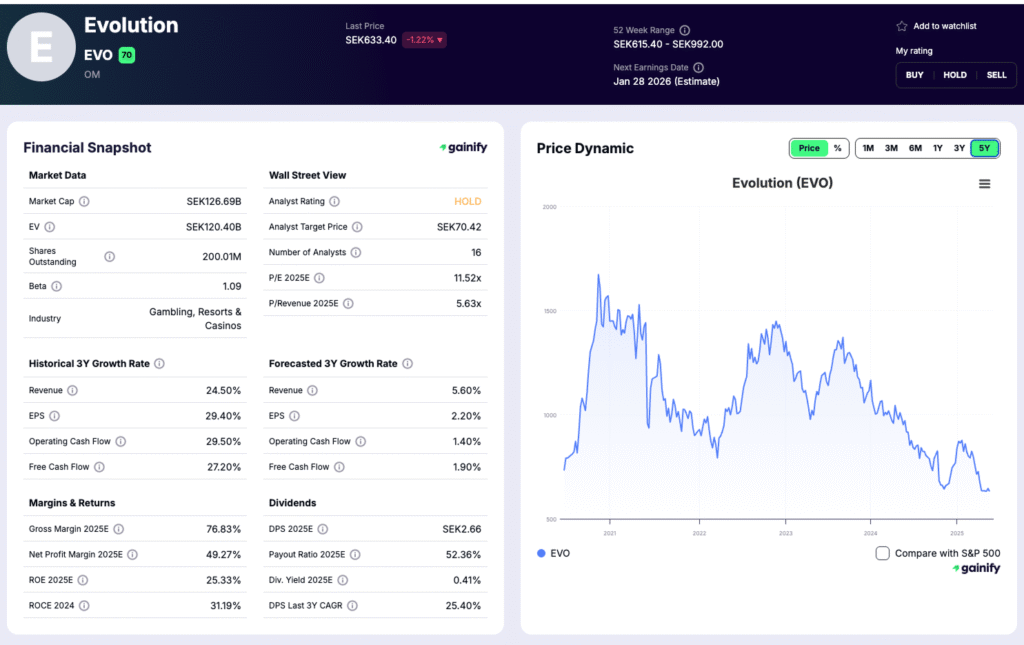

6. Evolution (EVO)

Market Cap: 13.5B

Forward P/E: 11.4x

Analyst Target Upside: 12.9%

Investment Thesis

Evolution remains the dominant global supplier of live casino gaming, with a business model that is structurally different from operators and significantly more resilient. The company sells streaming tables, game formats and digital infrastructure on a recurring-fee basis, giving it predictable growth and high incremental margins.

EVO enters 2026 with three major advantages. First, its live casino content still commands premium pricing, and operators depend on it to differentiate user experience. Second, the company continues to expand studios across North America, Europe and APAC, increasing capacity and reducing regional latency. Third, digital penetration of casino gaming continues to rise globally, and Evolution captures this shift almost dollar-for-dollar due to its recurring revenue mechanics.

Recent performance has been steady. Top-line growth remained solid, EBITDA margins held at levels most gaming companies cannot approach, and new games continue scaling successfully across operators. While regulatory reviews have created noise, Evolution’s fundamentals remain anchored by unmatched distribution, reliable margins and strong cash generation.

What to Watch in 2026

- North America rollout: Expansion of live casino studios and deeper penetration of regulated U.S. states.

- New game adoption: Performance of game-show formats and RNG hybrids, which drive higher-margin digital growth.

- Operator wallet share: Evolution’s ability to increase revenue per operator as live casino takes a larger share of iGaming spend.

Key Risks

- Regulatory scrutiny: Increased oversight in key jurisdictions, particularly around compliance and content controls.

- Competition in live gaming: Larger operators may attempt to internalize studio capabilities.

- Currency exposure: EVO reports in euros but earns revenue in numerous currencies, which can affect reported growth.

Conclusion: A Sector Defined by Divergence in 2026

The gambling industry enters 2026 with cleaner comps, more balanced regional demand and stable casino margins. The sector’s long-term trajectory is supported by digital adoption, higher structural hold rates and rapid innovation across software and platforms. At the same time, operators face rising taxation, tighter regulation and ongoing policy uncertainty in major jurisdictions.

The six largest publicly listed names stand at the center of these dynamics. They shape global pricing, influence regulatory outcomes and anchor the industry’s supply chain. Their ability to control costs, scale technology, expand internationally and navigate regulation will determine who captures the next phase of growth.

For investors, 2026 is not a sector-wide call. It is a selection year. The dispersion between strong operators and weak ones will be wide, and the companies above remain the most important to track as the industry enters a new cycle shaped by technology, regulation and global demand.