Wealth transfer is more than just an estate planning concept. For high-net-worth families, the transfer of wealth is not simply about who inherits financial assets. It is about managing a complex process that balances taxation, asset protection, family governance, philanthropic goals, and intergenerational harmony.

Over the next two decades, economists and financial advisors anticipate the great wealth transfer, the largest intergenerational transfer in history. An estimated 80 trillion dollars in household wealth will move from the baby boomer generation to Gen X, Millennials, and eventually Gen Z and Gen Alpha. This shift will reshape private markets, charitable contributions, investment trends, and even social stability, as younger generations inherit real estate, stock portfolios, retirement accounts, and family businesses.

At the personal level, wealth transfer planning is where financial tools, tax law, and family relationships intersect. It requires foresight and nuance, with careful attention to:

- Tax complexity. The U.S. tax code includes gift taxes, the federal estate tax, and capital gains tax rules. Without proper planning, these can dramatically reduce an estate’s value.

- Asset liquidity. Many families hold wealth in real estate, retirement accounts, or private equity, while heirs may need liquid assets to cover estate obligations or debts. Without liquidity planning, beneficiaries may be forced into home equity loans or quick asset sales.

- Generational wealth preservation. Studies show that much inherited wealth is lost within three generations. Passing wealth without financial education or governance structures undermines continuity.

- Family dynamics. Wealth transfer can reveal tensions. Clear communication, sometimes through family meetings, combined with legal considerations such as prenuptial agreements and powers of attorney, can prevent disputes.

Wealth transfer ensures that the vision and financial security you have built is not lost when it passes to future generations. For some families, that means using trusts and wills to create sustainable assets. For others, it involves charitable giving strategies that extend impact beyond family. For business owners, it requires an intergenerational continuity plan that secures retirement security, protects employees, and maintains stability.

In this article, we will explain what wealth transfer entails, why it matters for families and society, and the key strategies to manage it effectively. You will learn about tax optimization, trusts and wills, life insurance policies, charitable giving strategies, and business succession planning. We will also examine common challenges and provide a practical roadmap for starting your own wealth planning journey.

What Is Wealth Transfer?

Wealth transfer refers to the deliberate process of passing financial assets, property, and other forms of household wealth from one generation to another. While many people associate it with inheritances distributed through trusts and wills after death, the concept is broader. It can also occur during a person’s lifetime through gifting, charitable contributions, living trusts, private markets transfers, or annuity payments.

For the baby boomer generation, who hold a record share of U.S. wealth, planning for intergenerational transfer has become urgent. They will bequeath assets not only to children and grandchildren but also to charities, foundations, and institutions, with far-reaching economic effects. Gen Z and Gen Alpha will inherit wealth in very different conditions, shaped by income inequality, housing discrimination legacies, and evolving social or environmental factors.

Assets subject to transfer may include:

- Cash and savings accounts such as CDs and money markets.

- Real estate and property, including residential, vacation, and commercial holdings.

- Stocks, bonds, and investment portfolios, often with capital gains tax considerations and changing tax basis rules.

- Privately held businesses and equity stakes, often requiring investment advisory services for smooth transition.

- Retirement accounts such as IRAs, 401(k)s, and pensions, which involve specific beneficiary designations.

- Life insurance policies and death benefits, providing liquidity or inheritance equalization.

- Trust assets, from dynasty trusts to charitable remainder trusts, designed for long-term planning.

- Collectibles, art, jewelry, and sustainable assets, many of which carry cultural or philanthropic importance.

Wealth transfer is not just about distributing assets. It is about wealth planning, intergenerational wealth preservation, and structuring solutions that align with family values and goals. Having a trust in place, combined with tax and legal guidance, ensures heirs are protected.

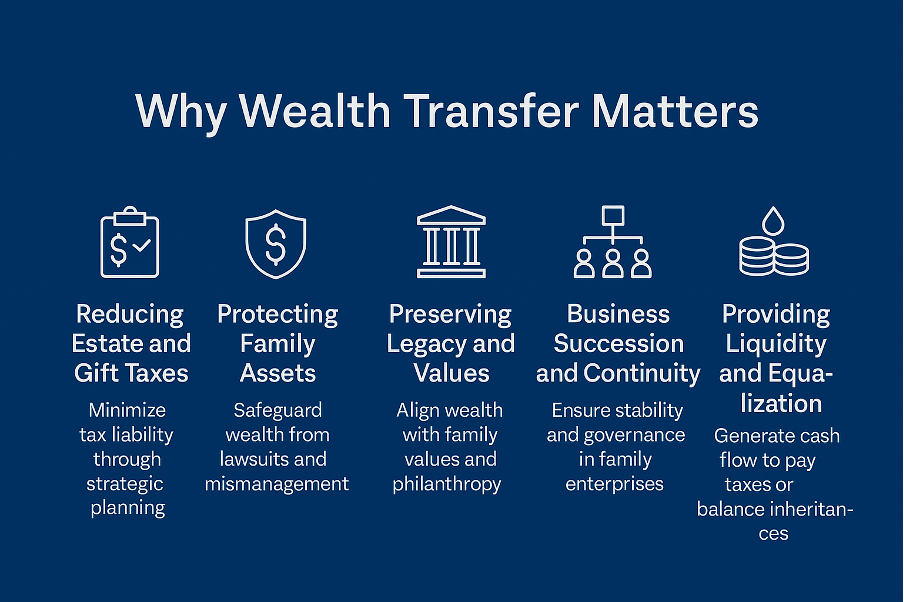

Why Wealth Transfer Matters

For families with significant wealth, failing to plan is planning to lose wealth. Without a structured wealth transfer strategy, heirs may face overwhelming tax liabilities, forced liquidation of assets, or disputes that permanently damage family relationships. Effective wealth transfer planning is not only about protecting assets, but also about preserving values, securing continuity, and ensuring that wealth supports future generations in the way it was intended.

1. Reducing Estate and Gift Taxes

In 2024, the federal estate tax exempts estates valued under $13.61 million per individual (or $27.22 million for married couples using portability). Amounts above this are subject to a progressive tax, with rates climbing as high as 40 percent. The estate and gift tax exemptions are unified, meaning that large gifts made during life reduce the exemption available at death.

To minimize this exposure, families often turn to strategies such as:

- Annual exclusion gifts, which allow transfers of up to $18,000 per recipient per year (2024) without using lifetime exemption.

- Irrevocable trusts, which remove appreciating assets from the taxable estate.

- Charitable giving strategies, such as donor-advised funds or charitable remainder trusts, which both reduce taxable estate size and support philanthropic goals.

In addition, planning around capital gains tax and step-up in basis rules is crucial. Proper timing ensures that heirs receive assets with a reset tax basis, reducing or eliminating capital gains when they sell. Coordinating lifetime gifts and transfers at death allows families to optimize both estate and income tax outcomes.

2. Protecting Family Assets

Wealth is vulnerable not only to taxes but also to lawsuits, creditors, and sometimes poor financial management by beneficiaries. Structures such as irrevocable trusts, family limited partnerships (FLPs), and durable powers of attorney help shield assets from external risks. These tools also establish professional oversight, ensuring that trust assets or business holdings are preserved and managed prudently. For high-net-worth families, asset protection is often as important as tax efficiency.

3. Preserving Legacy and Values

Wealth transfer is more than numbers on a balance sheet. It carries deep cultural, emotional, and personal significance. Families increasingly seek to align their wealth with their values, using tools such as:

- Charitable contributions and foundations to institutionalize giving.

- Donor-advised funds for flexible, tax-efficient philanthropy.

- Sustainable and impact investments, which integrate environmental and social factors into portfolio management.

By embedding values into wealth planning, families ensure that future generations not only inherit money but also a sense of purpose and responsibility. Investment advisory services can tailor portfolios to reflect both financial and social objectives, creating intergenerational wealth that aligns with legacy goals.

4. Business Succession and Continuity

For entrepreneurs and family business owners, wealth transfer is inseparable from succession planning. Without a plan, even thriving companies can face instability, disputes, or forced sales. Continuity requires coordinated action among owners, heirs, and advisors. This may involve:

- Buy-sell agreements to manage ownership transitions.

- Governance structures such as boards or family councils.

- Professional management succession, ensuring operational stability beyond the founder’s lifetime.

A well-designed intergenerational continuity plan protects both the family’s financial security and the livelihood of employees who depend on the business.

5. Providing Liquidity and Equalization

Many estates are asset-rich but cash-poor. Real estate, businesses, and private equity stakes may be valuable, but they cannot be easily divided among heirs. Without liquidity, families may be forced into fire sales to pay estate taxes or debts. Solutions include:

- Life insurance policies, which provide immediate, tax-free liquidity through the death benefit.

- Annuities and structured financial products, which create predictable cash flow.

- Strategic use of loans and credit facilities, such as lines of credit secured by trust assets.

Liquidity planning also helps equalize inheritances. For example, one heir may receive the family business, while others receive equivalent distributions through insurance proceeds or investment portfolios.

6. Supporting Social and Economic Stability

The great wealth transfer will influence the broader economy in profound ways. The flow of trillions of dollars into the hands of younger generations will affect:

- Stock prices and private markets, as portfolios are restructured by heirs with different investment preferences.

- Real estate and home equity loans, as property wealth shifts hands.

- Philanthropy and charitable contributions, as younger generations apply their own values to giving.

- Macroeconomic policy and stimulus, as governments adapt to shifting household wealth and tax revenues.

Proper planning not only protects family wealth but also contributes to social stability. Poorly managed wealth transfers can exacerbate income inequality, while well-structured transfers can strengthen philanthropy, education, and economic opportunity.

Tax Optimization in Wealth Transfer

Taxes remain one of the most significant threats to intergenerational wealth transfer. Without proactive planning, families may lose millions of dollars unnecessarily to estate, gift, and capital gains taxes. High-net-worth families can protect and preserve wealth by carefully designing strategies that minimize exposure and maximize efficiency under the U.S. tax code.

Below are the most effective approaches for tax optimization:

Lifetime Gifting

The annual gift tax exclusion allows individuals to give up to $18,000 per recipient in 2024 without reducing their lifetime estate and gift tax exemption. For married couples, this doubles to $36,000 per recipient. Over time, this strategy allows gradual transfer of wealth to heirs, reducing the size of the taxable estate while instilling financial responsibility.

For larger transfers, families may use the lifetime gift tax exemption, which shares limits with the federal estate tax exemption ($13.61 million per individual in 2024). By making gifts of appreciating assets today, families remove future growth from the taxable estate, locking in lower tax exposure.

Step-Up in Basis

When assets are transferred at death, they typically receive a step-up in tax basis to fair market value. This adjustment eliminates unrealized capital gains and reduces the tax burden for heirs who later sell those assets. For example, if stock purchased for $1 million is worth $5 million at death, heirs inherit it with a $5 million basis, avoiding tax on $4 million of gains.

Coordinating lifetime gifting with basis planning is essential. In some cases, retaining highly appreciated assets until death ensures heirs benefit from the step-up, while gifting lower-basis assets during life can minimize tax leakage.

Trust Structuring

Irrevocable trusts play a central role in tax optimization. By transferring appreciating assets into a trust, families can effectively remove them from the taxable estate. Certain trust types offer specialized advantages:

- Grantor Retained Annuity Trusts (GRATs): Allow transfer of appreciating assets at little or no gift tax cost.

- Dynasty Trusts: Designed to last for multiple generations, avoiding estate tax at each generational level.

- Irrevocable Life Insurance Trusts (ILITs): Keep life insurance proceeds outside the taxable estate while providing tax-free liquidity to heirs.

Trusts also provide creditor protection, governance, and control over distributions, ensuring assets are preserved beyond just tax savings.

Charitable Giving Strategies

Philanthropy is both a legacy tool and a tax optimization strategy. Families may:

- Establish donor-advised funds, which provide immediate tax deductions while allowing flexibility in when and how donations are made.

- Create charitable remainder trusts (CRTs), which provide lifetime income to donors or heirs before the remainder passes to charity, generating both estate and income tax benefits.

- Build private family foundations, which institutionalize philanthropy across generations while offering ongoing tax deductions.

Charitable strategies reduce estate size, lower taxable income, and ensure long-term impact aligned with family values.

Life Insurance Planning

Properly structured life insurance policies are critical for liquidity and equalization. Policies held within an irrevocable life insurance trust (ILIT) remove the death benefit from the taxable estate, while still delivering tax-free funds to heirs. These proceeds can cover estate taxes, balance inheritances when some heirs receive illiquid assets, or provide immediate financial assistance during the transition period.

Retirement Account Strategies

Retirement accounts such as IRAs and 401(k)s come with special tax rules under the SECURE Act. Most non-spouse beneficiaries must withdraw inherited retirement funds within 10 years, accelerating taxation. Proper beneficiary designations, Roth conversions, and trust planning can help reduce the tax hit. For high-net-worth families, coordinating retirement assets with other estate strategies ensures tax burdens are balanced across heirs.

The Role of Advisors

Optimizing taxes in wealth transfer is not a do-it-yourself process. The rules are complex and evolve frequently with changes to the tax code. Families should work closely with:

- A financial advisor, to coordinate investment portfolios, liquidity, and legacy goals.

- A tax and legal advisor, to ensure compliance with estate, gift, and income tax rules.

- An estate planning attorney, to draft and update trusts, wills, and powers of attorney.

Together, this team ensures wealth is transferred not only efficiently, but also in alignment with family legacy and intergenerational preservation.

Common Challenges in Wealth Transfer and How to Address Them

Wealth transfer is one of the most complex aspects of financial planning. Without careful preparation, families may lose wealth to taxes, disputes, or poor management. Below are the most common pitfalls and the solutions that help avoid them.

Disputes Among Heirs

The Problem: Ambiguous wills, conflicting instructions, or inconsistent beneficiary designations often spark legal battles among heirs. These disputes can drain financial assets and damage family relationships permanently.

The Solution: Draft precise legal documents, hold family meetings to communicate intentions, and consider mediation or family governance structures to ensure clarity and alignment.

Heavy Tax Burdens

The Problem: Estate, gift, and capital gains taxes can significantly erode an estate’s value. Without tax optimization, heirs may inherit more liabilities than assets.

The Solution: Use lifetime gifting, irrevocable trusts, charitable giving strategies, and careful capital gains planning to minimize tax exposure while complying with the U.S. tax code.

Liquidity Shortfalls

The Problem: Families with estates tied up in real estate, private markets, or closely held businesses may lack the liquidity to cover estate taxes or debts, forcing heirs to sell valuable assets at unfavorable prices.

The Solution: Incorporate life insurance policies, annuities, or credit facilities secured by trust assets to provide immediate liquidity and avoid fire sales.

Outdated Estate Plans

The Problem: Tax laws, markets, and family circumstances change. Outdated wills or trusts may no longer reflect current needs, leaving heirs unprotected or exposed to unnecessary risk.

The Solution: Review and update estate planning documents regularly, especially after major life events such as marriages, divorces, or business sales.

Erosion of Generational Wealth

The Problem: Studies show that most fortunes are gone within three generations due to lack of financial literacy, poor investment decisions, or absence of governance.

The Solution: Educate heirs, create intergenerational continuity plans, and involve younger family members in investment and philanthropic decisions early on.

A Roadmap to Begin Wealth Transfer Planning

Getting started with wealth transfer can feel overwhelming. Breaking the process into structured steps makes it manageable and ensures nothing critical is overlooked.

Step 1: Take Inventory of All Assets

List everything – financial assets, real estate, private equity, retirement accounts, life insurance policies, and collectibles. This provides a complete picture of household wealth and identifies potential liquidity issues.

Step 2: Define Your Legacy Objectives

Clarify what you want your wealth to achieve. Is the goal generational wealth preservation, retirement security, charitable contributions, or equalizing inheritances? Defining objectives ensures your plan reflects your values as well as your assets.

Step 3: Build a Professional Advisory Team

Work with a financial advisor, estate attorney, and tax and legal advisor. This team will coordinate strategies for investment portfolios, tax optimization, and legal documentation.

Step 4: Draft and Update Key Documents

Ensure that trusts, wills, powers of attorney, and beneficiary designations are legally valid and up to date. These documents prevent disputes, establish authority, and provide guidance in case of incapacity.

Step 5: Prepare and Educate Heirs

Introduce heirs to governance structures, provide financial training, and involve them in family meetings. Building financial literacy helps preserve intergenerational wealth and reduces the risk of mismanagement.

Step 6: Review and Adjust Over Time

Wealth transfer planning is a dynamic process. Revisit your plan regularly, especially when tax laws change or major life events occur. Continuous updates keep your strategy effective and relevant.

Final Thoughts

Wealth transfer is not just a financial transaction. It is the culmination of a lifetime of effort, values, and planning. With trillions set to change hands in the great wealth transfer, high-net-worth families must embrace comprehensive wealth planning that combines tax optimization, asset protection, and intergenerational governance.

By integrating trusts and wills, life insurance policies, charitable giving strategies, and investment advisory services, families can protect against estate tax burdens, preserve intergenerational wealth, and ensure continuity. The most successful families view wealth transfer not as a one-time event but as an ongoing process that requires education, communication, and professional support.

👉 Pro Insight: A well-designed intergenerational continuity plan, supported by financial tools and tax strategies, ensures that wealth is not only transferred, but preserved and grown for future generations.