The need for immediate cash often presents investors with a challenging dilemma. On one hand, a sudden expense or a promising new opportunity demands liquidity. On the other, selling appreciated investments triggers capital gains taxes and removes assets from their long-term growth trajectory. This common crossroads can force difficult choices, potentially disrupting carefully constructed financial plans and hindering wealth accumulation.

Yet, a sophisticated financial strategy exists that can provide access to capital without liquidating your cherished portfolio: borrowing against stocks. This approach allows you to leverage the value of your existing investment securities, transforming them into a flexible source of funds. It offers a unique pathway to bridge financing gaps or seize timely opportunities, all while your underlying investments remain intact, continuing their potential for appreciation.

Financial experts observe that borrowing against stocks is a powerful tool, but one that demands profound understanding. It is a strategy employed by seasoned investors who recognize its dual nature: offering remarkable financial flexibility, yet simultaneously introducing significant risks that, if unmanaged, can lead to substantial losses or even forced asset sales.

This article will demystify the concept of borrowing against stocks. We will explore its fundamental mechanisms, illuminate its compelling advantages, and, crucially, dissect the inherent dangers that accompany this form of leverage. Prepare to gain a precise understanding of how this advanced strategy functions, enabling truly informed and responsible financial decisions for your investment portfolio.

What is Borrowing Against Stocks? Leveraging Your Portfolio

Borrowing against stocks means using your existing investment portfolio as collateral to secure a loan amount from a brokerage firm. Unlike a traditional bank loan that might require extensive paperwork and real estate-backed borrowing, these loans are secured directly by the marketable securities held within your investment account. This is a core component of securities-based lending.

The two primary vehicles for borrowing against stocks are margin loans and securities-backed lines of credit (SBLOCs).

Margin Loans (purpose driven): While flexible for short-term liquidity or trading, they are fundamentally linked to buying more securities. The proceeds can be used for non-investment purposes, but their regulatory framework (like the Federal Reserve Board Regulation) explicitly covers credit extended for the purpose of purchasing or carrying margin stock.

Securities-Backed Lines of Credit (SBLOCs) / Portfolio Lines of Credit (non-purpose): These are specifically designed for purposes outside of buying more securities. They are often used for:

- Bridge funding (e.g., buying a new home before selling the old one).

- College tuition payments.

- Real estate down payments.

- Large personal purchases (dream vacation, luxury items).

- Business financing.

- Paying taxes.

Here is a comparison highlighting their key distinctions:

Feature | Margin Loans | Securities-Backed Lines of Credit (SBLOCs) |

Primary Purpose | Primarily for buying additional investment securities (leveraged trading). | Non-investment purposes (e.g., personal expenses, business needs). |

Regulatory Basis | Governed by Federal Reserve Board Regulation T (for U.S. brokers). | Governed by Federal Reserve Board Regulation U (for U.S. banks/brokers lending for non-purpose loans). |

Account Integration | Integrated with your standard brokerage account for trading. | Often a separate line of credit facility, sometimes through an affiliated bank (e.g., Charles Schwab Bank). |

Access & Setup | Typically immediate access once margin requirements are met on a trading account. | Requires a separate application and underwriting review, often taking a few days to weeks for approval. |

Interest Rate Structure | Variable interest rate, usually the broker’s margin rate, fluctuating with market rates. | Variable interest rate, often SOFR-indexed with a spread; generally lower for larger amounts than margin. |

Loan Repayment | Flexible; typically interest-only payments allowed, principal due on demand or when the account falls below maintenance level. | Flexible; often interest-only payments allowed, principal repaid at borrower’s discretion or specified terms. |

Loan Type | Purpose loan (for securities purchase/carrying). | Non-purpose loan (funds used for anything else). |

This strategy fundamentally contrasts with selling assets. Instead of liquidating investment securities and incurring potential capital gains taxes or missing out on future growth, you temporarily access funds while your portfolio remains invested in the market. This aims to provide liquidity without breaking your long-term investment horizon, offering significant administrative simplicity.

The Appeal: Liquidity Without Selling

The foremost appeal of borrowing against stocks is its ability to provide immediate liquidity without requiring you to sell your valuable assets. This means you can maintain your long-term investment positions, continuing to benefit from potential market appreciation and dividend income, while simultaneously accessing cash for other needs. This flexibility is a significant advantage over outright liquidation.

Crucially, this approach allows for the deferral or even avoidance of future capital gains tax. Selling appreciated stock immediately triggers a tax event. By borrowing against the portfolio instead, you access funds without realizing a gain, postponing or even eliminating the tax liability if the portfolio loan is repaid before the assets are ultimately sold.

For example, imagine you hold a diversified portfolio of marketable securities including mutual funds and exchange-traded funds, valued at $600,000, with an original cost basis of $300,000, meaning it has $300,000 in untaxed capital gains. You need $180,000 for a significant home renovation. Instead of selling a portion of your stocks and potentially realizing a taxable gain (depending on the cost basis of the specific shares chosen for sale), you could obtain an SBLOC for $180,000 (representing a 30% LTV). Your stocks remain invested, potentially growing further, and you avoid the immediate tax payment, allowing for greater financial efficiency and continued market participation. This offers a flexible alternative to real estate-backed borrowing methods like home equity line of credit (HELOC) or cash-out refinancing, which often have longer underwriting review periods.

Furthermore, securities-backed loans often come with potentially lower interest rates compared to unsecured personal loans, credit union loans, or credit cards. As of July 2025, typical margin interest rates for smaller loans generally range from approximately 9% to 13%, while portfolio lines of credit for larger amounts can be notably lower, often ranging from 6.5% to 8.5%, typically tied to benchmark rates like SOFR, which is currently around 5.30%. The brokerage firm has the portfolio as collateral, which reduces its risk, allowing it to offer more favorable borrowing costs.

The Risks: Amplified Exposure and Maintenance Calls

While the allure of liquidity without selling is strong, borrowing against stocks carries significant and amplified risks that demand meticulous attention. The primary danger lies in the inherent leverage: your outstanding loan remains constant even as the market value of your securities fluctuates. If your investment account’s value drops, your actual equity in the account decreases at a much faster rate, creating a precarious position.

The most potent risk is the dreaded maintenance call. This occurs when the value of your collateral falls below a specific threshold set by the brokerage firm and regulatory bodies, known as the maintenance margin or margin requirements. Should this happen, the broker will demand additional funds or the sale of securities to bring the account back to the required maintenance level. This forces the investor to act quickly, often under duress.

For example, let’s take a clear scenario: You begin with a $200,000 portfolio and secure a $100,000 portfolio loan (50% LTV, meaning you have $100,000 of your own equity). Your broker sets a maintenance margin of 30% of the current portfolio value, a critical threshold your equity must always meet. If your $200,000 portfolio then drops to $140,000, your current equity becomes $40,000 (that is, the $140,000 portfolio value minus your $100,000 loan). At this new value, the required maintenance is $42,000 (30% of $140,000). Since your $40,000 equity is now below the $42,000 requirement, a maintenance call is immediately issued for $2,000.

Failure to meet a maintenance call promptly can lead to severe repercussions. The brokerage firm has the unequivocal right to sell any or all of your marketable securities in the account without your consent and without prior notice, to cover the shortfall. This forced liquidation often occurs during market downturns, locking in substantial losses at the worst possible time and potentially wiping out a significant portion of your portfolio value. Furthermore, the interest expense on your portfolio loan continues to accrue regardless of your portfolio’s performance. Should interest rates rise, your interest payments increase, further eroding your returns or adding to your financial burden.

When to Consider This Strategy

Borrowing against stocks is a refined financial tool best utilized for specific, well-defined purposes, rather than general consumption. It can be a highly effective solution for managing short-term liquidity needs, acting as a bridge funding solution for intrafamily loans or waiting for other asset sales. For instance, it can provide temporary cash while waiting for a bonus, a property sale to close, or another confirmed inflow of funds, without prematurely triggering tax events.

It is particularly attractive for sophisticated investors seeking to avoid immediate capital gains tax on highly appreciated assets. By borrowing, they defer the tax event, allowing the investment securities to continue growing while accessing necessary cash. This can be part of a broader tax planning strategy, coordinating with a tax professional or financial advisor to understand tax legislation and optimize U.S. taxation, including considerations for taxable income related to potential interest payments deductibility or tax on loan proceeds. This aligns with strategies like buy, borrow, die, which involves leveraging appreciated assets to avoid estate taxes.

The strategy can also be considered for strategic, one-time large purchases, such as a real estate down payment or a significant business investment, especially if the investor expects the underlying portfolio to appreciate at a rate higher than the loan interest rate. It offers a rapid and convenient way to deploy capital without disrupting a meticulously built long-term investment portfolio. However, its utility is confined to those who possess a deep understanding of market mechanics and a robust risk tolerance. It is a tool for calculated financial maneuvers, not for routine expenses or impulsive spending, demanding a clear repayment strategy before any funds are drawn against the portfolio.

When to Exercise Extreme Caution

Despite its advantages, borrowing against stocks is a strategy that demands extreme caution and is explicitly unsuitable for many investors. It should never be viewed as a substitute for an adequate emergency fund or a stable income. Using it for speculative trades, such as launching a risky business or making highly leveraged investments, is a perilous misuse of this financial instrument.

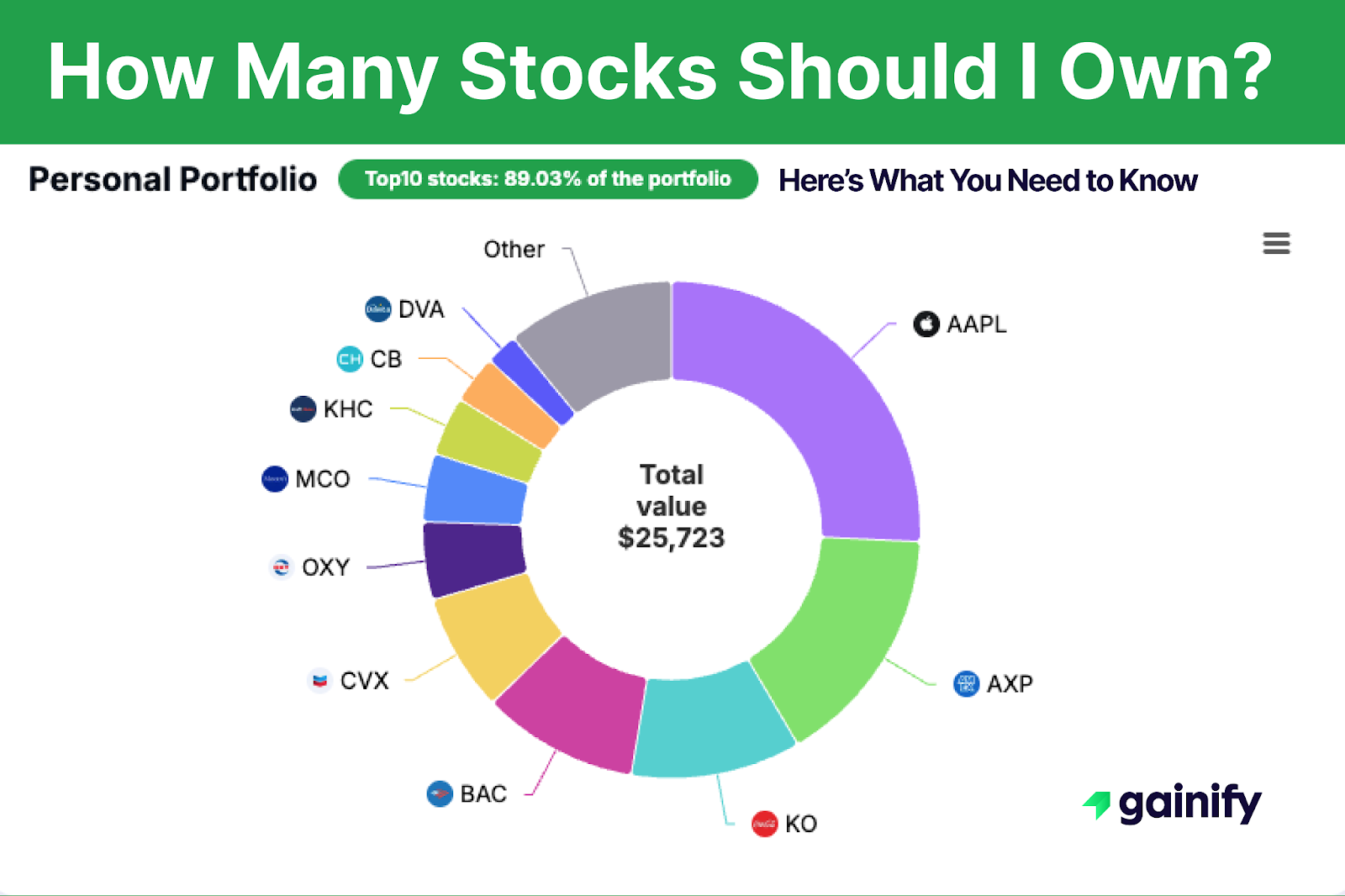

Avoid maxing out the loan amount. Maintaining a low Loan-to-Value (LTV) ratio provides a crucial buffer against market volatility and reduces the likelihood of a margin call. Financial experts generally advise against borrowing more than 20-30% of your collateral’s value for equity portfolios, even if the broker allows a higher amount, as higher leverage significantly increases market risk and makes the maintenance margin more precarious.

This strategy is ill-suited for funding long-term debt or expenses where there is no clear and reliable repayment plan. The variable interest rate can rise unexpectedly, increasing the burden, and a prolonged market downturn could trigger a margin call that you are unprepared to meet. Relying on future portfolio appreciation alone to repay the portfolio loan is a significant gamble, especially if it involves volatile assets. Investors should consider the tax base of their assets and compare it to cash-out refinancing which is typically more structured.

Furthermore, exercising caution is paramount if your portfolio is highly concentrated in a few volatile equity securities or a single asset class. Such portfolios are more susceptible to sharp declines, intensifying the risk of a maintenance call. Diversification of your collateral base is crucial to mitigating this intensified risk. The brokerage firm prioritizes the security of its margin loan, and its right to forced liquidation exists to protect its capital. Some securities-based lending offers interest rate swaps or interest rate collars to manage variable rate risk, but these add complexity.

FAQ: Borrowing Against Stocks

Q: What types of loans can I get using my stocks?

A: You primarily access funds through margin loans or Securities-Backed Lines of Credit (SBLOCs), which are also known as portfolio lines of credit or securities-backed loans. Margin loans are typically revolving loans within your brokerage account, while SBLOCs are more formal lines of credit. Both use your investment portfolio as collateral.

Q: Is the interest paid on these loans tax-deductible?

A: Interest on margin loans or SBLOCs may be tax-deductible if the loan proceeds are used for investment purposes. However, specific rules apply, often involving tax legislation, and it’s essential to consult with a tax professional to understand the tax implications for your unique situation, as rules can change.

Q: What happens to my loan if the stock market crashes?

A: A stock market crash can trigger a margin call (or maintenance call). If the market value of your securities falls below the maintenance margin, your brokerage firm will demand additional funds. If you cannot provide them, the broker can force liquidation of your securities to cover the loan amount, potentially at significant losses.

Q: How much can I typically borrow against my stocks?

A: The loan amount you can borrow depends on your brokerage firm’s policies and regulatory rules. It’s usually expressed as a Loan-to-Value (LTV) ratio, often around 25% to 50% for common stocks in a diversified portfolio, but higher for less volatile investment securities like bonds. For example, a $100,000 diversified stock portfolio might allow a loan of $25,000 to $50,000, depending on the brokerage and asset type.

Q: Is my investment portfolio safe if I borrow against it?

A: While your assets remain invested, borrowing against stocks introduces significant risk. Your portfolio is used as collateral, meaning if you fail to meet a maintenance call, the brokerage firm can sell your securities. The risk is that a market downturn could lead to forced liquidation at unfavorable prices, resulting in substantial losses. It’s crucial to consult with an experienced financial advisor if considering these complex portfolio loan options.

Guiding Principles for Portfolio Leverage

Borrowing against stocks is a potent financial tool offering remarkable flexibility. It enables access to capital without immediately liquidating your investments, which can be advantageous for tax purposes and maintaining your market position.

- Understand that borrowing against stocks involves significant leverage, amplifying both potential gains and losses.

- Recognize that interest costs are ongoing and variable, impacting your effective returns.

- Be acutely aware of margin calls and the risk of forced liquidation during market downturns, potentially leading to substantial losses.

- Utilize this strategy only for well-defined, short-term liquidity needs, never as a substitute for an emergency fund or for speculative ventures.

- Maintain a conservative Loan-to-Value (LTV) ratio and possess a clear repayment plan to mitigate risk.