The global vaccine industry has entered a new phase of maturity following the extraordinary volatility of the COVID era. Emergency-driven demand, government stockpiling, and accelerated regulatory pathways are giving way to a more normalized but strategically important market defined by demographics, routine immunization expansion, and platform innovation.

Unlike the pandemic period, future vaccine growth will not be driven by one-off global events. Instead, it will be shaped by aging populations, increasing recognition of adult immunization, wider use of combination vaccines, and sustained demand in emerging markets for pediatric and endemic disease coverage. Respiratory syncytial virus, shingles, pneumococcal disease, influenza innovation, and HPV prevention are now the most commercially relevant segments.

From an investment perspective, this transition creates a sharp divide. Large pharmaceutical companies with established vaccine franchises are trading at discounted multiples despite generating steady cash flows. At the same time, smaller biotechnology firms with vaccine platforms are valued as distressed assets, even as their technologies remain strategically relevant.

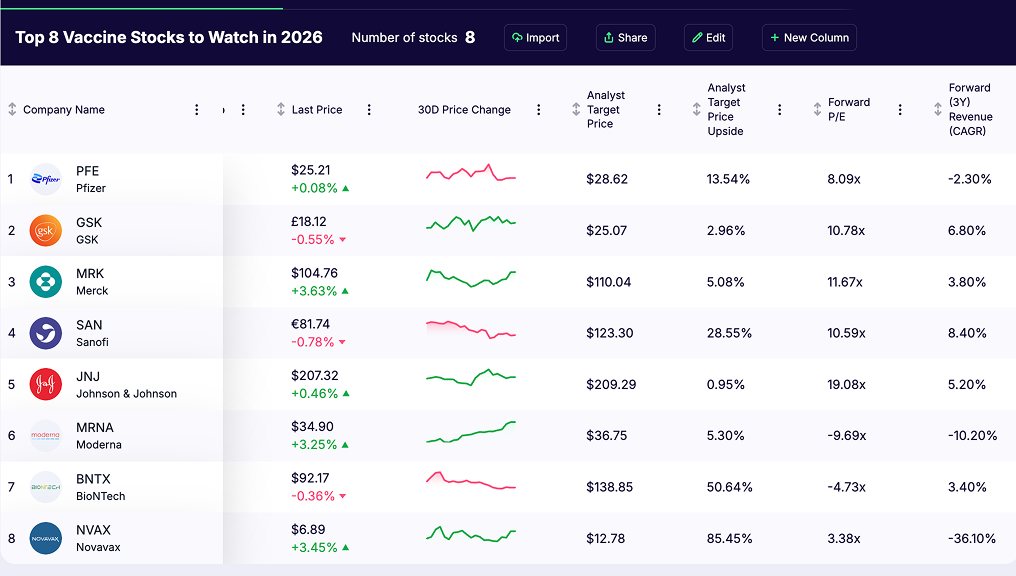

This article examines eight publicly traded vaccine stocks that matter heading into 2026. The focus is strictly on vaccine exposure rather than broader pharmaceutical portfolios. Each company is evaluated on three dimensions:

- Vaccine portfolio quality and relevance

- Financial positioning using selected market metrics

- Investment thesis and principal risks

Highlights

- Vaccine markets are shifting from pandemic-driven demand toward routine, recurring immunization cycles after a period of severe post-COVID normalization

- The sector experienced a sharp and prolonged valuation collapse as emergency revenues faded, followed by a modest and uneven recovery as baseline demand began to re-establish

- Adult vaccines for RSV, shingles, and pneumococcal disease are emerging as the primary structural growth drivers in the next phase of the market

- Large-cap vaccine leaders now trade at single-digit to low-teens forward earnings multiples, reflecting lingering skepticism rather than fundamental deterioration

- Vaccine-focused biotechs offer high convexity from depressed valuation levels, but remain exposed to execution risk, funding constraints, and regulatory uncertainty

1. Pfizer (NYSE: PFE)

- Share price: $25.21

- Market capitalization: $145 billion

- Forward P/E: 8.09x

- Analyst target upside: 13.54%

Vaccine portfolio overview

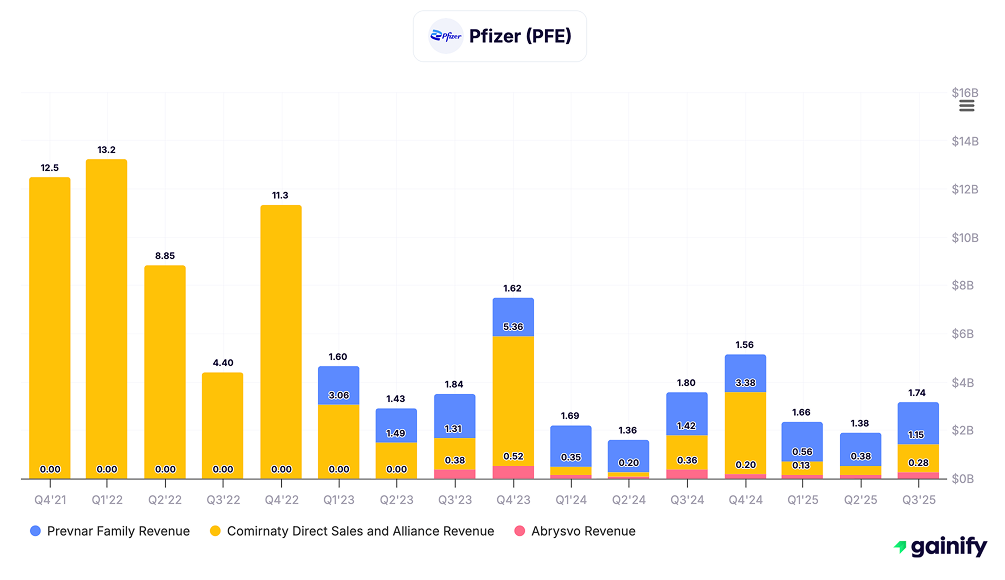

Pfizer operates one of the most successful vaccine franchises globally, anchored by Prevnar, its pneumococcal conjugate vaccine family. Pneumococcal disease remains a persistent public-health priority, supporting recurring demand across infant schedules, adult boosters, and aging populations. The franchise benefits from strong guideline support, physician familiarity, and durable reimbursement.

In addition to pneumococcal vaccines, Pfizer maintains exposure to seasonal COVID boosters and has entered the RSV vaccine market, expanding its adult immunization footprint. While pandemic-driven volumes have normalized, Pfizer’s vaccine portfolio remains structurally relevant rather than episodic.

Financial and revenue context

Vaccines remain one of Pfizer’s most stable revenue contributors following the post-COVID reset. Pneumococcal vaccines continue to generate multi-billion-dollar annual sales, providing predictable cash flow and margin support even as company-wide revenue adjusts.

Investment thesis

Pfizer’s vaccine business should be viewed as a defensive, cash-generating franchise, not a growth engine. Prevnar’s entrenched position and long lifecycle provide earnings durability that supports capital returns and pipeline investment. At a single-digit forward earnings multiple, the market appears to be discounting a steeper and longer-lasting decline than vaccine fundamentals justify.

Key risks

- Lower adult booster uptake for COVID and RSV could pressure near-term revenue

- Competitive pressure in RSV and next-generation pneumococcal vaccines

- Policy and pricing risk tied to U.S. reimbursement and government purchasing

- Sentiment risk, as COVID revenue declines may continue to dominate investor perception

2. GSK (NYSE: GSK)

Key market metrics

- Share price: $40.10

- Market capitalization: $83 billion

- Forward P/E: 10.78x

- Analyst target upside: 2.96%

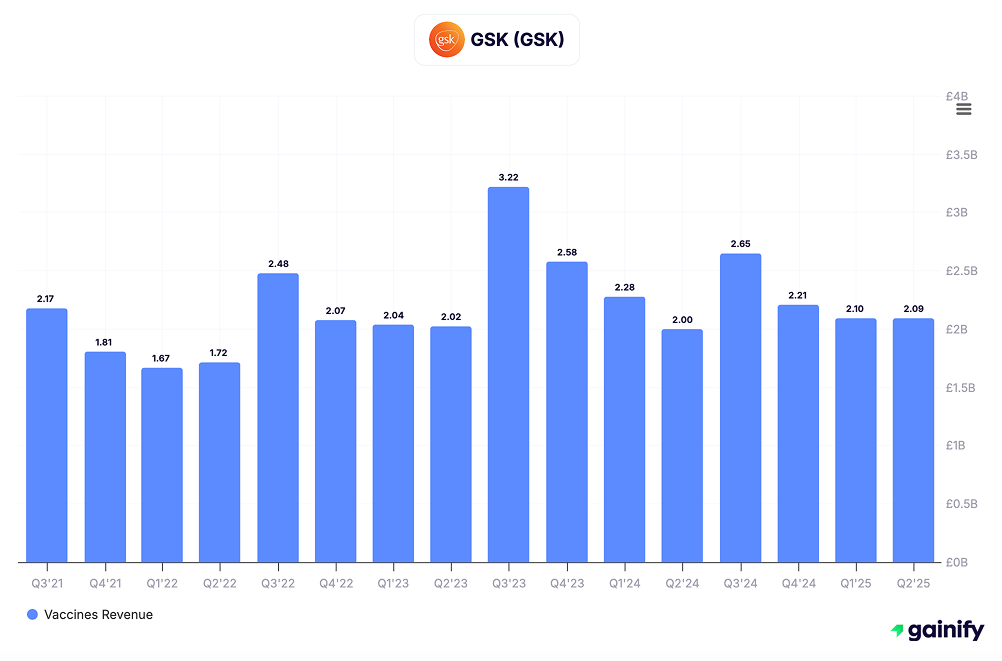

Vaccine portfolio overview

GSK operates the broadest and most diversified vaccine portfolio among large pharmaceutical companies. Its franchise spans Shingrix (shingles), meningitis vaccines, influenza, and Arexvy (RSV), with a strong emphasis on adult immunization. Shingrix remains the global standard of care for shingles prevention, supported by high efficacy, durable protection, and expanding international reimbursement.

GSK’s vaccine business benefits from deep integration into national immunization programs and a balanced geographic footprint. While influenza remains inherently seasonal, the portfolio is increasingly weighted toward higher-margin adult vaccines with longer product lifecycles.

Financial and revenue context

In Q3 2025, GSK’s vaccine segment generated £2.1 billion in revenue, with Shingrix alone contributing approximately £0.8 billion. While overall vaccine growth has moderated following the pandemic, adult vaccines and meningitis products continue to provide stable demand and strong international momentum.

Investment thesis

Vaccines represent a core strategic pillar at GSK rather than a supporting business. This focus underpins manufacturing scale, regulatory expertise, and disciplined capital allocation. At a low-teens forward earnings multiple, the stock reflects cautious expectations despite durable vaccine cash flows and long-term adult immunization tailwinds.

For investors, GSK offers exposure to vaccines with lower volatility and higher visibility than most pharmaceutical subsegments.

Key risks

- Influenza season variability can pressure quarterly vaccine performance

- RSV competition may limit near-term share gains

- Pricing pressure in mature adult vaccine markets

- Foreign exchange exposure due to substantial non-U.S. revenue

- Currency exposure due to global sales mix

3. Merck & Co. (NYSE: MRK)

- Share price: $104.76

- Market capitalization: $265 billion

- Forward P/E: 11.67x

- Analyst target upside: 8.10%

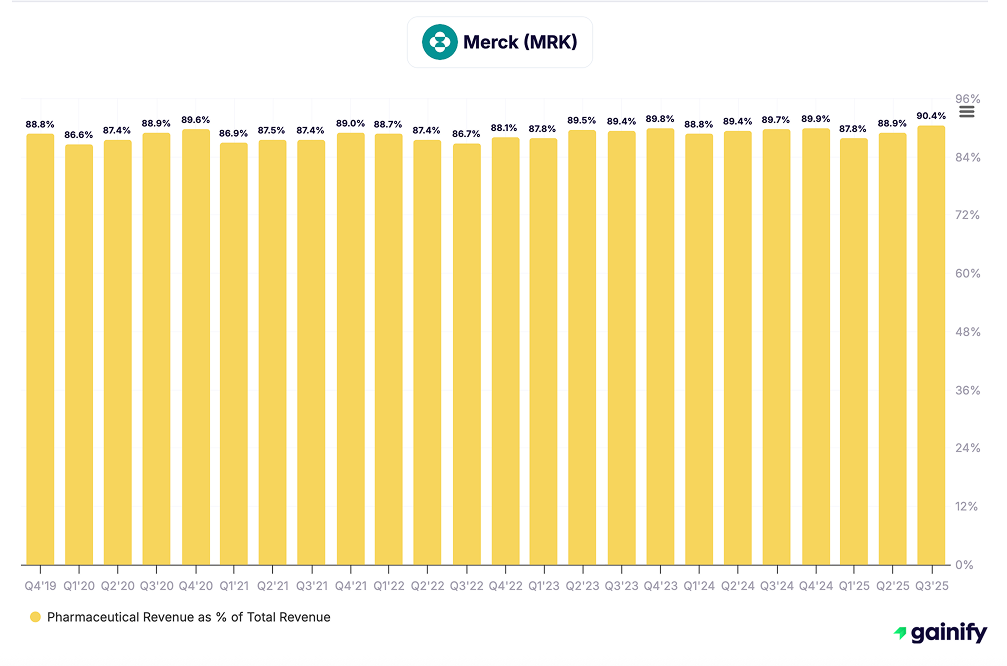

Vaccine portfolio overview

Merck is one of the world’s most important vaccine producers, with its franchise centered on Gardasil, the leading vaccine for prevention of human papillomavirus. Gardasil is embedded in adolescent immunization schedules across developed markets and continues to expand internationally, supported by strong clinical data, long duration of protection, and public-health endorsement.

Beyond HPV, Merck markets MMR and varicella vaccines, which provide stable baseline demand through routine childhood immunization programs. While less visible than its oncology portfolio, vaccines remain a strategically important and highly profitable segment within Merck’s business mix.

Financial and revenue context

Gardasil remains one of the highest-grossing vaccines globally, generating multi-billion-dollar annual revenue and industry-leading margins. While short-term sales can be affected by country-level ordering patterns, long-term demand is supported by rising vaccination penetration outside the U.S. and Europe.

Investment thesis

Merck’s vaccine business offers durable growth with exceptional predictability. Gardasil’s long patent life, limited competitive alternatives, and expanding international reach provide a steady revenue stream that offsets volatility in other therapeutic areas. At a low-teens forward earnings multiple, Merck’s valuation reflects modest growth expectations despite the structural strength of its vaccine franchise.

For investors, vaccines enhance Merck’s earnings quality and visibility rather than driving speculative upside.

Key risks

- Revenue concentration risk due to reliance on Gardasil

- China demand volatility, driven by procurement timing and policy decisions

- Public health policy shifts affecting adolescent vaccination programs

- Currency and pricing pressure in international markets

4. Sanofi (ENXTPA: SAN)

- Share price: €81.74

- Market capitalization: €105 billion

- Forward P/E: 10.59x

- Analyst target upside: 28.55%

Vaccine portfolio overview

Sanofi is one of the world’s most important vaccine suppliers, with a portfolio deeply embedded in global childhood, travel, and endemic disease immunization programs. Its vaccines cover polio, pertussis, influenza, meningitis, and other routine pediatric indications, giving Sanofi a central role in public-sector procurement worldwide.

In addition, Sanofi has expanded into RSV prevention through Beyfortus, which targets infants and young children. This product broadens Sanofi’s exposure beyond traditional pediatric schedules while maintaining alignment with government-funded immunization frameworks.

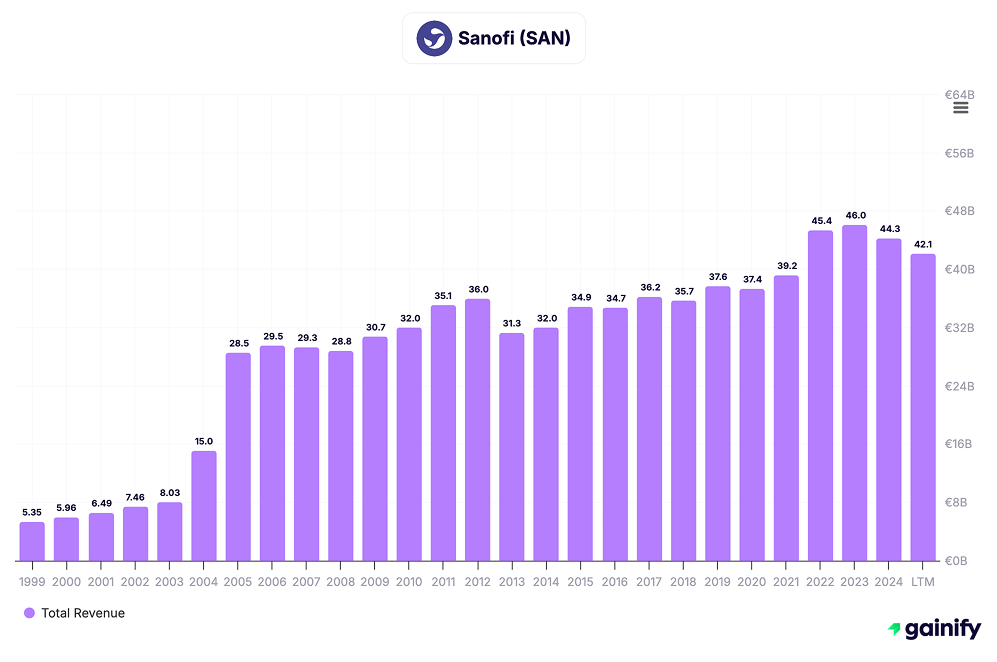

Financial and revenue context

Sanofi’s vaccine division generates multi-billion-euro annual revenue, with demand largely driven by long-term supply contracts and national immunization calendars. While influenza sales can fluctuate year to year, the broader vaccine portfolio provides stability through diversified disease exposure and geographic reach.

Investment thesis

Sanofi’s vaccine business offers high revenue visibility and low cyclicality, supported by government-backed purchasing and essential public-health demand. Although margins are typically lower than specialty adult vaccines, volume stability and contract-based sales reduce earnings volatility. At a low-teens earnings multiple and with meaningful analyst upside, the stock reflects conservative expectations despite structurally defensive vaccine fundamentals.

For investors, Sanofi provides vaccine exposure with public-sector durability rather than innovation-driven risk.

Key risks

- Public procurement pricing pressure, particularly in Europe and emerging markets

- Influenza season variability, which can affect year-to-year comparisons

- Execution risk in scaling RSV prevention globally

- Manufacturing complexity across a large, multi-product vaccine portfolio

5. Johnson & Johnson (NYSE: JNJ)

- Share price: $207.32

- Market capitalization: $505 billion

- Forward P/E: 19.08x

- Analyst target upside: 0.95%

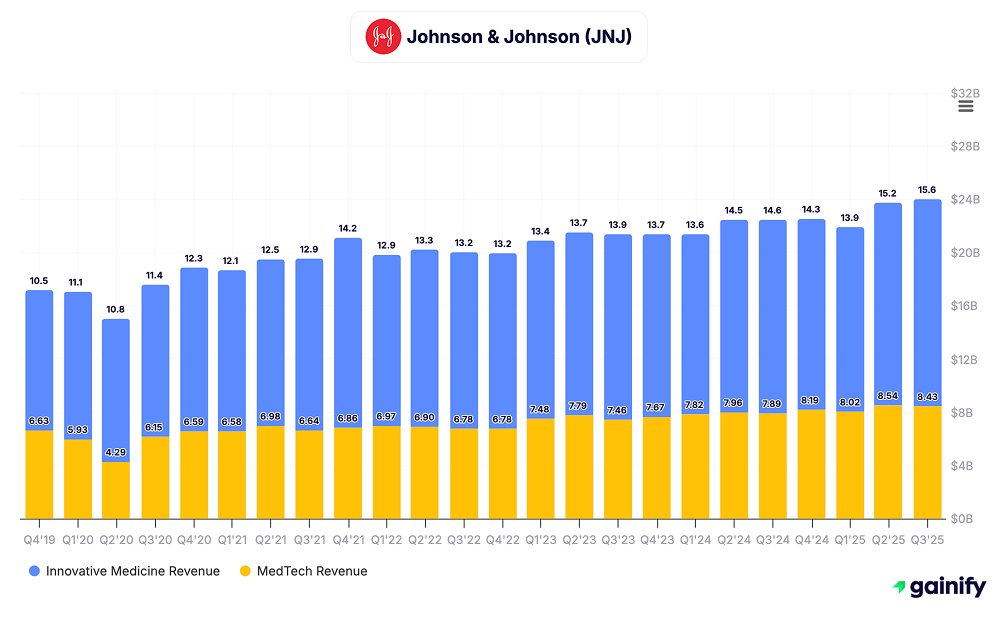

Vaccine portfolio overview

Johnson & Johnson maintains a selective but strategically important vaccine presence through its Janssen division. Its most notable vaccine contribution has been in Ebola prevention, where JNJ plays a critical role in global outbreak preparedness and stockpiling. Unlike peers, JNJ does not operate a broad, commercially driven vaccine franchise.

Vaccines at JNJ are positioned primarily as public-health and strategic assets rather than growth engines. The company leverages its scale, scientific capabilities, and government relationships to participate in high-impact infectious disease programs when commercial incentives alone would be insufficient.

Financial and revenue context

Vaccines represent a small portion of Johnson & Johnson’s total revenue, with demand largely tied to government contracts and international health organizations. While this limits revenue growth potential, it also reduces exposure to seasonal volatility and competitive market dynamics seen in consumer-facing vaccines.

Investment thesis

Johnson & Johnson’s vaccine business should be viewed as a stability and credibility enhancer, not a valuation driver. For investors, vaccine exposure at JNJ adds diversification and optional upside without materially increasing risk. The premium valuation reflects strength across pharmaceuticals and medical devices rather than vaccines alone.

As a result, JNJ is best suited for investors seeking defensive healthcare exposure, not targeted vaccine-driven returns.

Key risks

- Limited scale and scope of the vaccine portfolio relative to peers

- Low strategic priority, which may constrain future investment

- Dependence on government demand, particularly for outbreak-related vaccines

- Minimal contribution to earnings growth, limiting upside from vaccines

6. Moderna (NASDAQ: MRNA)

- Share price: $34.90

- Market capitalization: $13 billion

- Forward P/E: negative

- Analyst target upside: 37.60%

Vaccine portfolio overview

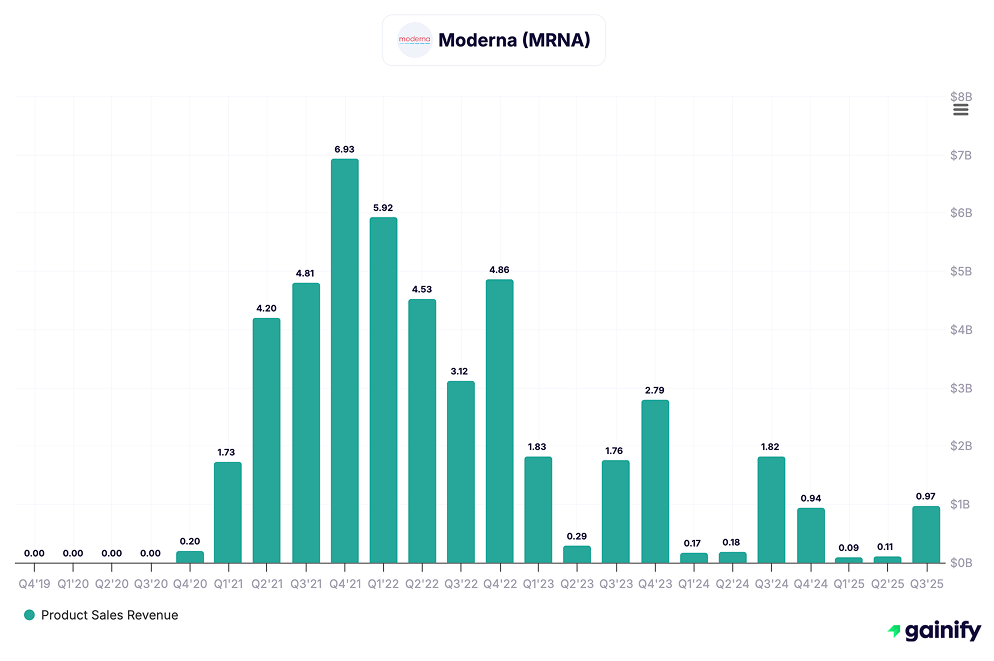

Moderna is repositioning its business away from pandemic-driven demand toward a portfolio of seasonal and combination vaccines built on its mRNA platform. Core programs include influenza, RSV, and a combined flu and COVID vaccine, all aimed at proving that mRNA technology can support routine, recurring immunization markets.

Unlike traditional vaccine manufacturers, Moderna’s value proposition lies in platform scalability and rapid strain adaptation, which could offer advantages in seasonal respiratory vaccines. However, this remains contingent on regulatory approvals and competitive differentiation versus established protein-based alternatives.

Financial and revenue context

Following the collapse in COVID vaccine demand, Moderna’s revenue base has contracted sharply. In 2025, the company reported approximately $1.0 billion in quarterly revenue, supported by residual COVID sales and early commercial contributions from newer products. Cash and investments of roughly $6.6 billion provide near-term financial runway.

Investment thesis

Moderna represents a high-convexity recovery play within vaccines. At current valuation levels, the market prices in limited long-term vaccine success. If Moderna secures regulatory approval and meaningful uptake for even one major non-COVID vaccine, revenue expectations and investor sentiment could reset materially.

For investors, Moderna offers asymmetric upside balanced against prolonged execution risk.

Key risks

- Continued operating losses as non-COVID vaccines scale

- Regulatory and timing risk across multiple late-stage programs

- Competitive pressure from established vaccine manufacturers

- Commercial adoption risk, particularly in crowded respiratory markets

7. BioNTech (NASDAQ: BNTX)

- Share price: $92.17

- Market capitalization: $22 billion

- Forward P/E: negative

- Analyst target upside: 50.64%

Vaccine portfolio overview

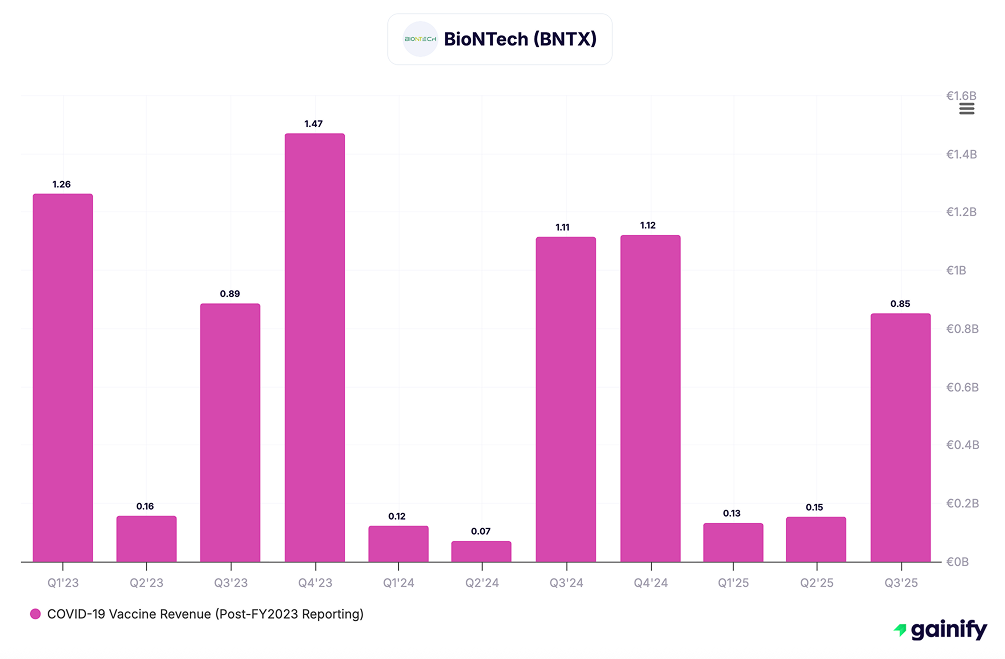

BioNTech’s vaccine business is anchored by its role in the development and commercialization of mRNA COVID vaccines, which provided the company with substantial financial resources and manufacturing scale. While COVID demand has declined, the company continues to leverage its mRNA expertise to advance next-generation infectious disease vaccines, including updated respiratory programs.

Unlike peers focused on near-term commercial optimization, BioNTech is using its vaccine platform to support long-cycle innovation, where infectious disease programs serve as both revenue sources and technology validation for broader platform development.

Financial and revenue context

As COVID-related revenue normalizes, BioNTech’s top line has contracted materially from peak levels. However, the company retains a strong balance sheet with multi-billion-dollar cash reserves, allowing continued investment in vaccine and platform development without near-term financing pressure.

Investment thesis

BioNTech represents a platform-driven vaccine investment rather than a traditional commercial vaccine story. At current valuation levels, the market appears to discount the potential for meaningful non-COVID vaccine revenue. If BioNTech successfully translates its mRNA capabilities into routine infectious disease vaccines, long-term value creation could extend beyond current expectations.

For investors, the vaccine business provides downside protection through cash reserves while preserving optional upside from future approvals.

Key risks

- Continued erosion of COVID vaccine revenue

- Long development timelines for next-generation vaccines

- Regulatory and clinical execution risk

- Uncertainty around commercial adoption outside pandemic settings

8. Novavax (NASDAQ: NVAX)

- Share price: $6.89

- Market capitalization: $900 million

- Forward P/E: 3.38x

- Analyst target upside: 85.45%

Vaccine portfolio overview

Novavax is a vaccine-focused biotechnology company built around protein-based vaccine technology enhanced by its proprietary Matrix-M adjuvant. Unlike mRNA platforms, Novavax’s approach relies on more traditional vaccine design, which can offer advantages in stability, storage, and tolerability. The company’s lead commercial product is its COVID vaccine, with ongoing development of influenza and combination vaccines.

Novavax’s platform has attracted partnerships and regulatory interest, positioning the company as an alternative supplier in markets seeking non-mRNA options. However, commercial scale remains limited relative to large pharmaceutical competitors.

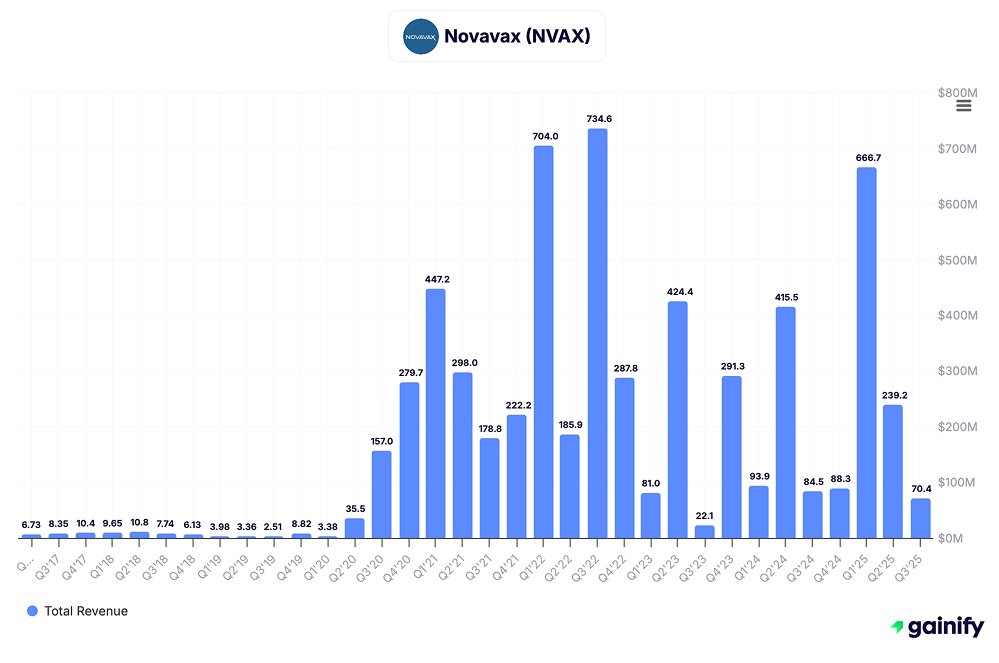

Financial and revenue context

Novavax’s revenue base has contracted significantly following the post-pandemic demand reset. Recent results reflect hundreds of millions of dollars in annual revenue, primarily from COVID-related supply and licensing arrangements. Liquidity remains a key focus, with financial performance highly sensitive to partner execution and contract timing.

Investment thesis

Novavax represents a high-risk, asymmetric vaccine investment. At a deeply discounted valuation, the stock embeds pessimistic assumptions about long-term viability. If management stabilizes operations and successfully advances flu or combination vaccines, equity upside could be substantial. However, outcomes remain binary.

For investors, Novavax offers optionality rather than durability.

Key risks

- Balance-sheet pressure and ongoing funding requirements

- Limited commercial infrastructure compared with peers

- Dependence on partners for manufacturing and distribution

- Binary clinical and regulatory outcomes for pipeline vaccines

Conclusion

The vaccine sector has moved decisively out of its pandemic-driven phase and into a period defined by normalization, repricing, and selective opportunity. The sharp collapse in valuations following the COVID revenue peak has reset expectations across the industry. While the recovery to date has been modest, it reflects a growing recognition that vaccines remain an essential, recurring component of global healthcare systems rather than a transient windfall.

Large-cap vaccine leaders such as Pfizer, GSK, Merck, Sanofi, and Johnson & Johnson offer durable cash flows, embedded demand, and downside protection, often at valuations that already discount conservative growth assumptions. Their vaccine businesses benefit from guideline inclusion, government procurement, and demographic tailwinds tied to aging populations and expanded adult immunization.

At the same time, Moderna, BioNTech, and Novavax represent a different opportunity set. These companies have absorbed the full force of post-pandemic normalization and now trade at levels that reflect skepticism around execution and long-term commercial relevance. For investors willing to accept higher risk, successful expansion into flu, RSV, or combination vaccines could drive meaningful valuation re-rating, though outcomes remain uncertain.

Ultimately, vaccine investing in 2026 is less about anticipating the next global health emergency and more about identifying which franchises can compound steadily and which platforms can reinvent themselves. The opportunity lies not in scale alone, but in durability, discipline, and the ability to translate scientific capability into sustainable demand.