In October 2025, lithium remains the critical metal at the heart of the global energy transition. Surging demand for electric vehicles (EVs), energy storage, and grid infrastructure has made lithium producers essential to the clean-technology supply chain.

According to Benchmark Mineral Intelligence, global lithium demand is projected to triple by 2030, while supply expansion continues to lag due to high capital costs and permitting delays. As a result, the lithium industry sits at the intersection of innovation, geopolitics, and resource scarcity.

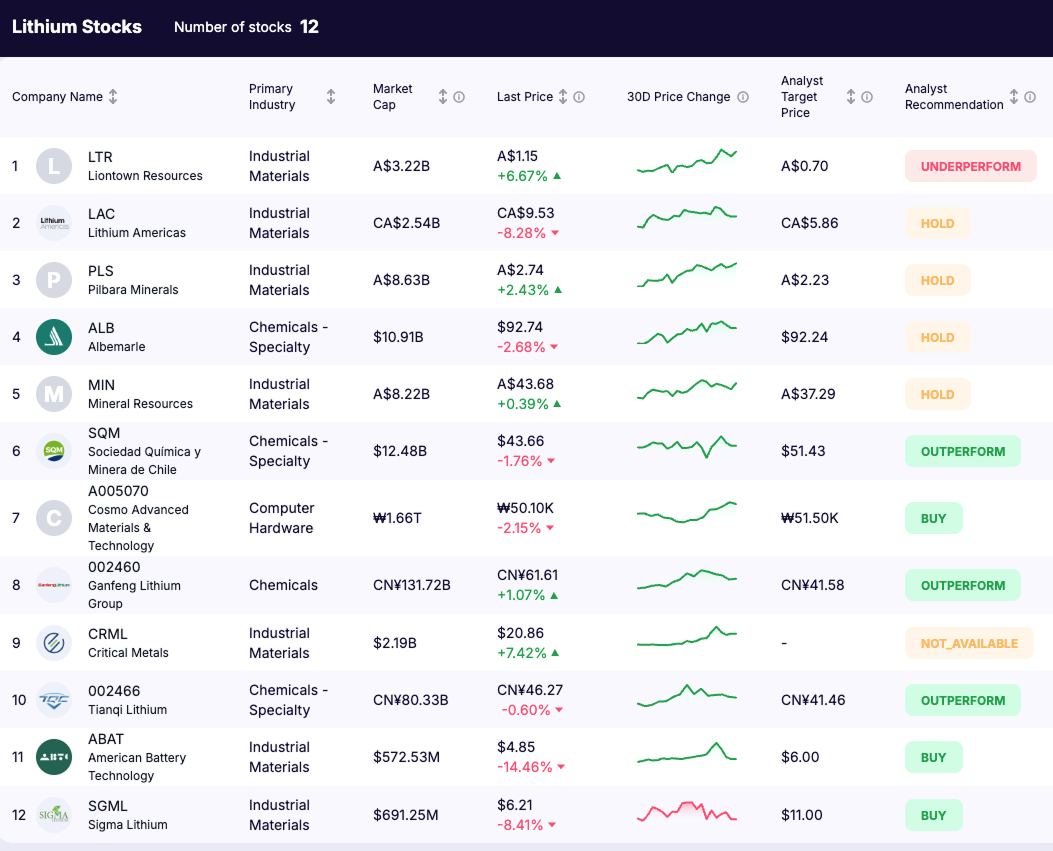

Below, we explore 12 leading lithium-related stocks, spanning miners, chemical refiners, and technology developers shaping the sector’s future.

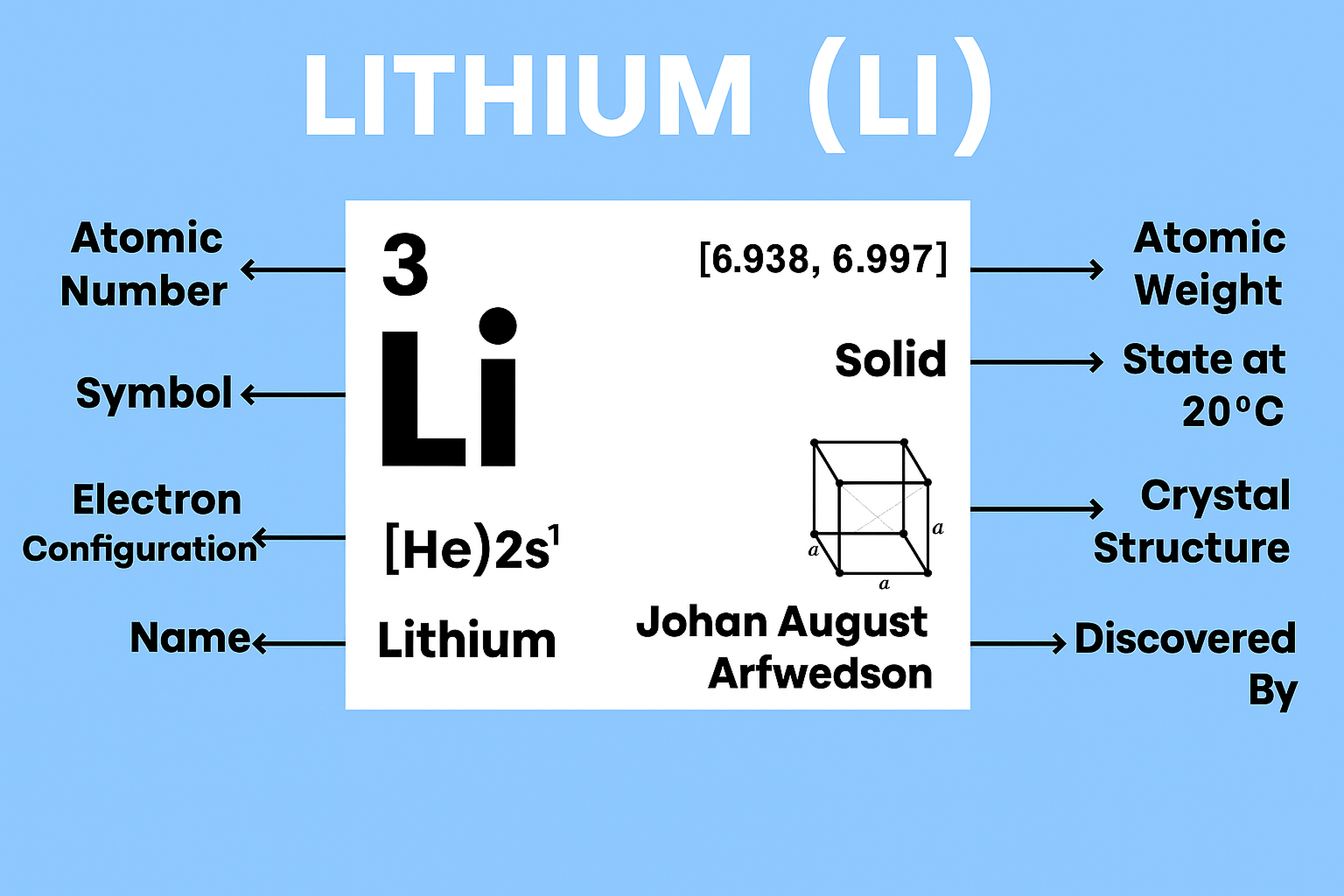

What Is Lithium and Why It Matters

Lithium is the lightest solid metal and the foundation of modern energy storage. Its combination of high voltage, low weight, and strong thermal stability makes it vital for the batteries driving the global shift to electrification.

Major Applications

1. Batteries (around 70%-80% of global demand)

Lithium-ion batteries power the clean-energy economy:

- Electric vehicles (EVs): Each EV battery contains about 8 to 10 kilograms of lithium, enough to store energy for hundreds of miles of driving.

- Grid storage: Large-scale battery installations balance renewable energy from solar and wind sources.

- Consumer electronics: Phones, laptops, and wearables rely on lithium for compact, high-capacity batteries.

2. Industrial Uses

Lithium improves the performance of advanced materials across sectors:

- Glass and ceramics: Increases durability and heat resistance.

- Greases: Withstands extreme heat in industrial and automotive machinery.

- Aerospace alloys: Reduces aircraft weight, improving efficiency.

- Pharmaceuticals: Used in mood-stabilizing medications.

3. Emerging Frontiers

Research is expanding lithium’s role in solid-state batteries, hydrogen storage, and nuclear fusion, where it could act as both a coolant and a tritium source.

Bottom line: Lithium is the metal of electrification, small in mass but enormous in impact. From cars to grids to smartphones, it powers the clean-energy systems that define the modern world.

Top Lithium Stocks to Watch in 2025

1. Liontown Resources (LTR.AX)

Market Cap: A$3.22B | Industry: Industrial Materials

What they do:

Liontown Resources is an Australian lithium miner developing the Kathleen Valley project, one of the world’s largest hard-rock lithium deposits.

Why it matters:

As global EV adoption accelerates, Kathleen Valley is poised to become a strategic lithium supplier to Tesla and LG Energy Solution, both key offtake partners. The project’s scale positions Liontown as a potential top-10 global lithium producer.

What to watch:

Ramp-up timelines at Kathleen Valley, cost control amid inflationary pressures, and potential expansion into downstream refining.

Key risk:

Project delays or cost overruns could limit near-term cash flow as prices remain volatile.

2. Lithium Americas (LAC.TO)

Market Cap: CA$2.54B | Industry: Industrial Materials

What they do:

Lithium Americas develops Thacker Pass in Nevada and Cauchari-Olaroz in Argentina, two of the most significant lithium projects in the Western Hemisphere.

Why it matters:

In October 2025, the U.S. Department of Energy acquired a 5% stake in Lithium Americas and an additional 5% in the Thacker Pass joint venture with General Motors, marking a historic public-private partnership. The move underscores Washington’s strategy to secure domestic lithium supply and reduce dependence on China.

What to watch:

Construction progress at Thacker Pass, U.S. federal incentives, and timing of first production expected in 2026.

Key risk:

Execution risk and environmental litigation could affect project timelines and cost structure.

3. Pilbara Minerals (PLS.AX)

Market Cap: A$8.63B | Industry: Industrial Materials

What they do:

Pilbara Minerals operates the Pilgangoora lithium-tantalum project in Western Australia, one of the world’s largest independent spodumene operations.

Why it matters:

Pilbara’s focus on vertical integration and battery-grade conversion gives it leverage in both upstream mining and downstream lithium hydroxide processing. In 2025, it expanded its joint venture with POSCO in South Korea to secure long-term offtake stability.

What to watch:

Conversion efficiency at the new POSCO plant and evolving spodumene prices.

Key risk:

Exposure to lithium spot price swings and reliance on export demand from Asia.

4. Albemarle (ALB)

Market Cap: $10.91B | Industry: Specialty Chemicals

What they do:

Albemarle is a global leader in lithium and bromine chemicals, with major production in Chile, Australia, and the U.S.

Why it matters:

The company remains one of the largest integrated lithium producers, supplying key battery manufacturers globally. In 2025, Albemarle announced its entry into direct lithium extraction (DLE) pilot programs aimed at improving recovery rates and sustainability.

What to watch:

Results from DLE pilots, cost management amid weaker lithium prices, and partnerships in solid-state battery supply chains.

Key risk:

Earnings volatility driven by fluctuating lithium carbonate prices.

5. Mineral Resources (MIN.AX)

Market Cap: A$8.22B | Industry: Industrial Materials

What they do:

Mineral Resources operates integrated mining, logistics, and lithium assets in Australia, including Wodgina and Mount Marion.

Why it matters:

MIN is both a miner and infrastructure operator, giving it margin stability even during price downturns. In 2025, it launched a new refining initiative to supply lithium hydroxide to battery manufacturers directly.

What to watch:

Output ramp-up from Wodgina Stage 2 and downstream revenue diversification.

Key risk:

High capital intensity and exposure to energy and labor cost inflation.

6. Sociedad Química y Minera de Chile (SQM)

Market Cap: $12.48B | Industry: Specialty Chemicals

What they do:

SQM is one of the largest global producers of lithium, potassium, and iodine, operating from Chile’s Salar de Atacama.

Why it matters:

SQM remains vital to global supply chains amid Chile’s evolving lithium policy. In 2025, it expanded its partnership with Codelco, aligning with the government’s new “public-private” lithium framework.

What to watch:

Policy clarity under Chile’s national lithium strategy and efficiency upgrades to reduce brine evaporation time.

Key risk:

Regulatory uncertainty and potential higher royalty burdens.

7. Cosmo Advanced Materials & Technology (A005070.KS)

Market Cap: ₩1.66T | Industry: Computer Hardware

What they do:

Cosmo develops cathode materials for lithium-ion batteries used in EVs and energy storage systems.

Why it matters:

The company benefits from South Korea’s drive to expand domestic battery materials production and has supply ties with LG Energy Solution and Samsung SDI.

What to watch:

Capacity expansion in cathode materials and progress on recycling technology.

Key risk:

Margin pressure from competition and raw material price volatility.

8. Ganfeng Lithium Group (002460.SZ)

Market Cap: CN¥131.72B | Industry: Chemicals

What they do:

Ganfeng Lithium is China’s largest lithium producer, with operations across extraction, refining, and recycling.

Why it matters:

As a vertically integrated player, Ganfeng controls the full value chain, from brine extraction in Argentina to solid-state battery research. In 2025, it accelerated investment in lithium recycling to strengthen supply resilience.

What to watch:

Progress in next-generation battery materials and export policy changes from China.

Key risk:

Government policy shifts and weaker export demand could pressure margins.

9. Critical Metals (CRML)

Market Cap: $2.19B | Industry: Industrial Materials

What they do:

Critical Metals is an emerging lithium exploration and development company focused on North American deposits.

Why it matters:

Its U.S.-based projects align with the Inflation Reduction Act’s critical minerals strategy, which incentivizes domestic battery-material production.

What to watch:

Drilling results and potential partnerships with U.S. battery manufacturers.

Key risk:

Early-stage development risk and limited near-term revenue.

10. Tianqi Lithium (002466.SZ)

Market Cap: CN¥80.33B | Industry: Specialty Chemicals

What they do:

Tianqi Lithium is a major lithium chemicals producer with a strong footprint in China and Australia.

Why it matters:

Tianqi holds a significant stake in Greenbushes, one of the richest lithium mines globally, and continues to expand refining capacity in China and Chile.

What to watch:

Operational efficiency, ESG performance, and evolving trade relations with Western markets.

Key risk:

Currency and geopolitical exposure given its global footprint.

11. American Battery Technology (ABAT)

Market Cap: $572.5M | Industry: Industrial Materials

What they do:

American Battery Technology specializes in battery recycling and lithium extraction technologies using closed-loop systems.

Why it matters:

The company provides an alternative source of lithium supply through recycling, aligning with U.S. goals for domestic resource circularity.

What to watch:

Scale-up of its Nevada recycling facility and progress toward commercial production.

Key risk:

Execution and financing challenges typical of early-stage technology firms.

12. Sigma Lithium (SGML)

Market Cap: $691.3M | Industry: Industrial Materials

What they do:

Sigma Lithium operates the Grota do Cirilo project in Brazil, one of the highest-grade hard-rock lithium mines in the Americas.

Why it matters:

The company’s low-carbon processing methods and renewable power integration make it a leader in sustainable lithium production. In 2025, Sigma expanded its green-hydroxide capacity to target North American automakers.

What to watch:

Plant expansion milestones and pricing trends for premium “green” lithium products.

Key risk:

Dependence on high-end buyers and volatility in premium hydroxide pricing.

Global Lithium Supply Overview

Lithium supply remains concentrated across a small group of countries that dominate both production and reserves.

According to the U.S. Geological Survey’s Mineral Commodity Summaries 2025 (USGS), published March 30, 2025, global mine output rose sharply in 2024, reflecting record demand from electric vehicles and energy storage systems.

While Australia, Chile, and China continue to lead, emerging producers such as Argentina, Zimbabwe, and Brazil are gaining traction.

The following table summarizes the latest USGS data on lithium mine production (2024) and remaining reserves, highlighting where the next phase of supply growth may come from.

Global Lithium Production and Reserves (USGS, 2025)

Country | 2024 Mine Production (metric tons, Li content) | Reserves (metric tons, Li content) | Share of Global Output (approx.) | Notes |

🇦🇺 Australia | 88,000 | 57,000,000 | ~37% | Dominant producer from hard-rock spodumene deposits in Western Australia. |

🇨🇱 Chile | 49,000 | 9,300,000 | ~21% | Brine extraction from Salar de Atacama; key producers SQM and Albemarle. |

🇨🇳 China | 41,000 | 3,000,000 | ~18% | Major refiner and battery manufacturer; growing domestic output. |

🇦🇷 Argentina | 18,000 | 4,000,000 | ~8% | Fastest-growing brine producer; expanding partnerships with global firms. |

🇿🇼 Zimbabwe | 22,000 | 480,000 | ~9% | Emerging African source with Chinese-backed investment. |

🇧🇷 Brazil | 10,000 | 390,000 | ~4% | Mix of hard-rock and brine projects; new investments underway. |

🇨🇦 Canada | 4,300 | 1,200,000 | ~2% | Early-stage growth in Quebec and Manitoba; rising exploration activity. |

🇺🇸 United States | Withheld | 1,800,000 | <1% | Limited current production; Thacker Pass project to boost future output. |

🌍 World Total | ≈240,000 | ≈30,000,000 | 100% | Concentrated supply base; top five countries control over 90% of production. |

Global Market Snapshot (October 2025)

Metric | Value |

Global lithium market size (2025E) | ~$25 billion |

Forecast market size (2030E) | ~$52 billion |

2025 lithium carbonate price (avg)** | ~$14,800/tonne |

Annual demand growth (2024–2030E)** | 13–15% CAGR |

Largest producers | China, Australia, Chile, Argentina |

Source: Benchmark Mineral Intelligence, IEA, BloombergNEF

Processing and Refining Landscape (2025)

Mining is only the first step in the lithium value chain.

The real value lies in refining, where raw lithium concentrate is converted into lithium carbonate and lithium hydroxide, the chemical forms used in battery manufacturing.

As of 2025, refining remains highly concentrated, with China dominating the midstream stage of global lithium supply.

🇨🇳 China: The Refining Powerhouse

According to Benchmark Mineral Intelligence (2025), China controls about 70 percent of global lithium refining capacity.

The country imports spodumene from Australia and South America and processes it into battery-grade chemicals that feed its large cell manufacturing industry, led by CATL and BYD.

This vertical integration gives China a structural advantage in cost control, efficiency, and supply chain security.

🇨🇱 Chile: Developing Domestic Refining

Chile, a major brine producer, is increasing its focus on downstream processing.

Under its National Lithium Strategy, partnerships between SQM, Albemarle, and the state-owned Codelco are building new refining facilities to process lithium carbonate and hydroxide domestically. This approach aims to capture more value within Chile and reduce reliance on foreign processing centers.

🇦🇺 Australia: Moving Beyond Exports

Australia, the world’s largest lithium miner, is now investing heavily in refining infrastructure.

Projects such as Tianqi Lithium’s Kwinana refinery and Albemarle’s Kemerton plant are expanding capacity to produce lithium hydroxide locally. Government support through the Critical Minerals Strategy is accelerating this shift toward a more integrated domestic supply chain.

🇺🇸 United States: Rebuilding the Value Chain

The U.S. Department of Energy’s 2025 investment in Lithium Americas and the Thacker Pass project marks a significant step in rebuilding domestic capacity.

Refining projects in Nevada, North Carolina, and Arkansas are in development, supported by funding under the Inflation Reduction Act. These initiatives aim to align lithium processing with the country’s growing electric vehicle and battery manufacturing sectors.

The Big Picture: Lithium’s Decade Ahead

Lithium sits at the heart of the clean-energy revolution. Demand for EV batteries, stationary storage, and grid balancing will nearly triple by 2030, yet new supply remains constrained by permitting, capital costs, and resource nationalism.

The DOE’s investment in Lithium Americas and Thacker Pass underscores how strategic lithium has become for U.S. energy independence. From giants like Albemarle and SQM to innovators such as Sigma Lithium and ABAT, the sector blends industrial scale with technological innovation.

For investors, the opportunity is clear, but so are the risks. Profitability depends on execution, cost discipline, and the ability to navigate commodity cycles. Lithium’s story is no longer about potential. In 2025, it has become the essential mineral powering the future of electrification.