Few names in American investing inspire as much debate or fascination as Bill Miller. For decades, Miller has been both celebrated as one of the sharpest minds on Wall Street and criticized for his bold, sometimes painful missteps. He is remembered most for one of the most remarkable streaks in fund management history: beating the S&P 500 for 15 consecutive years while running the Legg Mason Value Trust, a record that made him a legend in the industry and a rare household name in mutual funds. That achievement was more than just statistical luck. It reflected a deep commitment to value investing, disciplined research, and the courage to take concentrated bets when others were fearful. His reputation as a contrarian thinker, willing to buy companies that mainstream investors had abandoned, set him apart during an era when most managers closely tracked the index.

Miller’s approach has always been unconventional and unapologetically independent. He built his career on the belief that markets often overreact in the short term, creating opportunities for long-term investors who can stay patient. Whether it was doubling down on financial stocks in the depths of the dot-com crash, or holding Amazon when many doubted its future profitability, Miller consistently showed a willingness to challenge consensus and endure volatility for the sake of eventual reward.

His legacy, however, is not without blemishes. The financial crisis inflicted deep losses on his funds, investor redemptions eroded his asset base, and by 2016 he formally ended his 35-year career at Legg Mason. Still, Miller did not retire from investing. He transitioned to running his own firm, Miller Value Partners, where he could apply his philosophy on a smaller, more flexible scale. Nearly a decade later, his portfolio updates remain closely followed by market observers, offering rare insight into how a legendary investor continues to navigate an ever-changing financial landscape.

The Big Picture: From 4 Billion to 235 Million. The Real Story Behind the Shrinkage

The most striking storyline in recent years is not just which stocks Bill Miller owned, but the change in the size of his portfolio.

- In Q1 2021, Miller Value Partners reported nearly 4.3 billion dollars in assets under management.

- By Q3 2022, assets had dropped below 2 billion dollars, reflecting both performance declines and investor redemptions.

- In Q2 2023, reported assets plunged to just over 150 million dollars.

At first glance, the drop looked like the result of severe underperformance. The truth is more nuanced. The sharp reduction was largely due to a structural shift in Miller Value Partners.

In the spring of 2023, Miller Value Partners’ flagship Opportunity Equity strategy, which managed several billion dollars across mutual funds and separate accounts, was acquired by Patient Capital. Management of the fund transitioned to Samantha McLemore, who had co-managed Opportunity Equity with Bill Miller for years. She became the sole manager under the new ownership, while Miller stepped back from day-to-day involvement.

As a result, the billions in assets tied to Opportunity Equity no longer appeared under Bill Miller’s direct filings. What remained was the smaller collection of strategies managed within Miller Value Partners. This explains why reported assets shrank so dramatically between 2022 and 2023.

By 2025, Miller Value Partners had stabilized at roughly 200 to 250 million dollars. While a fraction of its former size, this leaner structure reflects a shift toward more focused investing.

Who Runs Miller Value Partners Today

Bill Miller officially retired from active portfolio management in 2022, marking the end of an era. Today, the firm is overseen by his son, Bill Miller IV, who serves as Chief Investment Officer. He has been with the firm for years and continues the family’s tradition of concentrated, research-driven value investing.

Meanwhile, Samantha McLemore, Miller’s long-time protégé, now runs the Opportunity Equity fund under Patient Capital. Together, Miller IV and McLemore represent the continuation of Miller’s philosophy for a new generation, applying the same contrarian discipline with a sharper focus on today’s market dynamics.

Bill Miller Investment Philosophy

Bill Miller’s investment philosophy has always been rooted in value investing, but he interprets it more flexibly than traditional value purists. While classic value investors like Benjamin Graham focused strictly on low price-to-book or low price-to-earnings stocks, Miller defined value more broadly as the gap between price and intrinsic worth, even if that meant investing in companies that looked like “growth” stocks at the time.

Core Principles of Miller’s Approach:

- Contrarian Thinking: Miller often bought what others were selling, believing that fear and pessimism create the best opportunities. His famous early position in Amazon, when many doubted its survival, is a prime example.

- Concentration over Diversification: Unlike managers who spread their bets thinly, Miller preferred holding fewer stocks in larger size, arguing that true conviction is what drives outperformance.

- Patience and Long-Term Horizon: Miller frequently endured years of volatility and underperformance, trusting that the market would eventually recognize a company’s true value.

- Value in All Forms: He rejected rigid definitions of value versus growth. To him, Amazon in the early 2000s was a value stock because its long-term potential was underappreciated, even if it looked expensive by conventional metrics.

- Adaptability: While grounded in discipline, Miller also believed in adapting to changing market realities. He combined traditional analysis with a willingness to embrace new sectors when they offered favorable risk-reward dynamics.

This philosophy explains why Miller could outperform for 15 consecutive years, but also why he sometimes faced painful downturns. By refusing to follow market consensus, he achieved spectacular highs and difficult lows, both of which remain central to his legacy.

Bill Miller’s Portfolio in Q2 2025

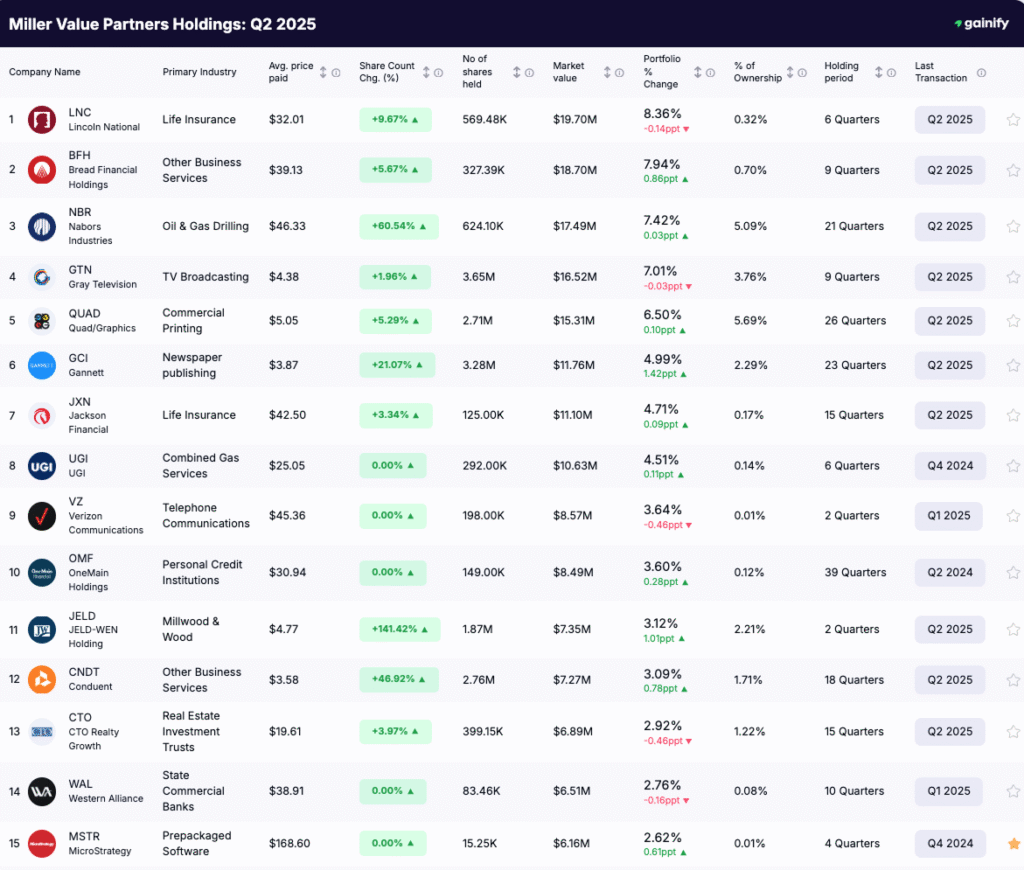

As of June 2025, Miller Value Partners reported 33 holdings, with the top 10 accounting for nearly 59 percent of total portfolio value. Miller’s firm continues to lean into industries that are unfashionable but undervalued, including life insurance, energy services, and traditional business operations.

Key Industry Allocations

- Life Insurance: 13.1%

- Other Business Services: 11.0%

- Oil and Gas Drilling: 7.4%

- TV Broadcasting: 7.0%

- Commercial Printing: 6.5%

This sector mix highlights the firm’s refusal to chase hype in areas like artificial intelligence or mega-cap technology. Instead, it seeks value where others see risk.

Top 10 Holdings in Bill Miller’s Portfolio (Q2 2025)

As of June 2025, the top 10 holdings make up nearly 59 percent of Miller Value Partners’ reported portfolio. The table below shows the companies, their tickers, portfolio weights, estimated market values, and average holding periods. This concentration highlights Miller’s conviction-driven style, preferring a smaller number of large positions over broad diversification.

Company | Ticker | Portfolio Weight | Market Value (USD) | Holding Period (Quarters) |

Lincoln National | LNC | 8.4% | $19.7M | 12 |

Bread Financial | BFH | 7.9% | $18.6M | 9 |

Nabors Industries | NBR | 7.4% | $17.5M | 7 |

Nexstar Media Group | NXST | 7.0% | $16.5M | 14 |

Quad Graphics | QUAD | 6.5% | $15.3M | 11 |

DXC Technology | DXC | 5.9% | $13.9M | 13 |

Desktop Metal | DM | 5.2% | $12.2M | 6 |

Nabors Energy Transition | NETI | 5.1% | $12.0M | 5 |

Diebold Nixdorf | DBD | 3.7% | $8.7M | 8 |

JELD-WEN | JELD | 3.1% | $7.3M | 10 |

Portfolio Moves in Q2 2025

Bill Miller Value Partners made several notable adjustments in Q2 2025, including new buys, aggressive increases in select holdings, reductions, and a full exit from one long-standing position.

New Buys

- Easterly Government Properties (DEA) – Initiated a $3.2M position in this REIT, which leases office space to U.S. federal agencies. The purchase provides stable, government-backed income and adds a defensive balance to the portfolio.

Biggest Increases

- Nabors Industries (NBR) – Added roughly $7M in new capital, raising the total position to $17.5M. Shares were bought at an average price of $29.76, reflecting conviction in oil and gas drilling despite energy market volatility.

- JELD-WEN (JELD) – Increased by about $4.2M, more than doubling the stake to $7.3M. The building products manufacturer was accumulated during sector weakness.

- Conduent (CNDT) – Added approximately $2.2M, bringing the total holding to $7.3M. This signals continued belief in the company’s turnaround story.

Reductions

- Tutor Perini (TPC) – Reduced by $6.1M, leaving only a small remaining stake.

- United Natural Foods (UNFI) – Cut by $3.4M, trimming overall exposure to consumer staples.

- TechnipFMC (FTI) – A modest reduction of about $0.5M, keeping the position intact but smaller.

Sold-Out Positions

- AT&T (T) – Fully exited, freeing up about $3.2M. Once a hallmark dividend stock in Miller’s portfolios, the capital was redirected toward higher-conviction opportunities.

Conclusion: The Evolution of Bill Miller

The Bill Miller portfolio in Q2 2025 reflects the story of an investor who built a legendary track record, endured setbacks, and passed the torch to a new generation. The dramatic drop in reported assets during 2023 was not simply a collapse of performance, but the result of a transfer of the Opportunity Equity strategy to Patient Capital under Samantha McLemore. Today, Miller Value Partners, led by Bill Miller IV, carries forward the family name with a leaner but still conviction-driven portfolio.

The holdings reveal the same contrarian discipline that defined Bill Miller’s career: heavy concentration, a focus on undervalued industries, and patience with misunderstood companies. While his days of running multi-billion-dollar funds are over, the firm remains a case study in how value investing adapts to changing market landscapes.

For students of investing, the lesson is clear. The scale of assets may change, but the principles of disciplined research, patience, and conviction can endure across generations.