The drone industry has moved far beyond its early days when most people thought of drones only as toys or hobbyist gadgets. Today, drones are reshaping critical sectors of the economy and national defense. From aerial surveillance and military reconnaissance to package delivery, agriculture, filmmaking, and infrastructure inspection, drones are becoming essential tools that drive efficiency and innovation.

As adoption accelerates, drone stocks have caught the attention of investors who want exposure to one of the fastest-growing technologies of the decade. Whether through pure-play drone companies, suppliers of key components, diversified defense contractors, or upcoming IPO candidates like Anduril Industries and Skydio, investors now have multiple ways to participate in this trend.

Why Drone Stocks Matter in 2025

The global drone market is expanding rapidly, and the investment case for drones continues to strengthen.

- Explosive growth: Analysts expect the global drone industry to surpass $90 billion by 2030, with annual double-digit growth fueled by both civilian and military demand.

- Versatile use cases: Drones are no longer confined to defense or consumer use. They now perform crop spraying in agriculture, inspect oil rigs and power lines, monitor large construction projects, provide aerial cinematography, and even deliver medical supplies in rural areas.

- Technology convergence: Advances in AI, machine learning, and computer vision are turning drones into autonomous systems capable of operating without constant human control, opening entirely new markets.

- National security: Rising global tensions are driving governments to allocate significant budgets to unmanned aerial systems (UAS), giving defense-focused drone companies consistent demand.

For investors, these dynamics highlight why drone stocks are more than a niche bet and they represent exposure to a transformative technology that will touch many industries.

Categories of Drone Stocks

Drone investments can be grouped into four main categories, depending on the type of exposure and risk level.

1. Pure-Play Drone Companies

Pure-play drone makers are the most direct way to invest in this theme. These companies focus primarily on designing, producing, and selling unmanned aerial vehicles. While they offer strong upside if the sector continues to grow, they are also smaller and more volatile.

- AeroVironment (NASDAQ: AVAV) – U.S. defense contractor best known for its small UAVs and loitering munition, Switchblade. Strong defense contracts provide stability, and the company is also exploring commercial applications in areas like energy and infrastructure.

- Red Cat Holdings (NASDAQ: RCAT) – A micro-cap drone developer serving military, government, and commercial markets. Its Teal Drones subsidiary has received U.S. defense approvals, giving it a foothold in national security.

- DroneShield (ASX: DRO / OTC: DRSHF) – Specialist in counter-drone defense systems used by militaries and law enforcement. Growing demand for anti-drone solutions makes it one of the few public pure plays in this niche.

- Ondas Holdings (NASDAQ: ONDS) – Parent of American Robotics and Airobotics, focusing on autonomous industrial drone systems. Its technology targets inspections for railroads, oil & gas, and urban infrastructure.

- AIRO Group (NASDAQ: AIRO) – Diversified aerospace player with drone operations, training, and supporting technologies. Its broad exposure gives investors access to multiple parts of the drone ecosystem.

- EHang (NASDAQ: EH) – A Chinese pioneer in passenger drones and urban air mobility. Its autonomous aerial vehicles are being tested in multiple cities, though certification and adoption remain key hurdles.

- Joby Aviation (NYSE: JOBY) – A U.S. leader in electric VTOL air taxis, with applications in urban aerial mobility. Backed by major partners like Toyota and Uber, it is progressing toward FAA certification.

- Archer Aviation (NYSE: ACHR) – Competes in the eVTOL market, with strong airline partnerships and commercialization plans. Its collaboration with United Airlines gives it a clearer path to deployment.

2. Technology Enablers and Suppliers

Some of the most consistent performers in the drone value chain are component suppliers and technology enablers. These companies don’t build drones themselves but supply critical technologies like chips, sensors, cameras, and software.

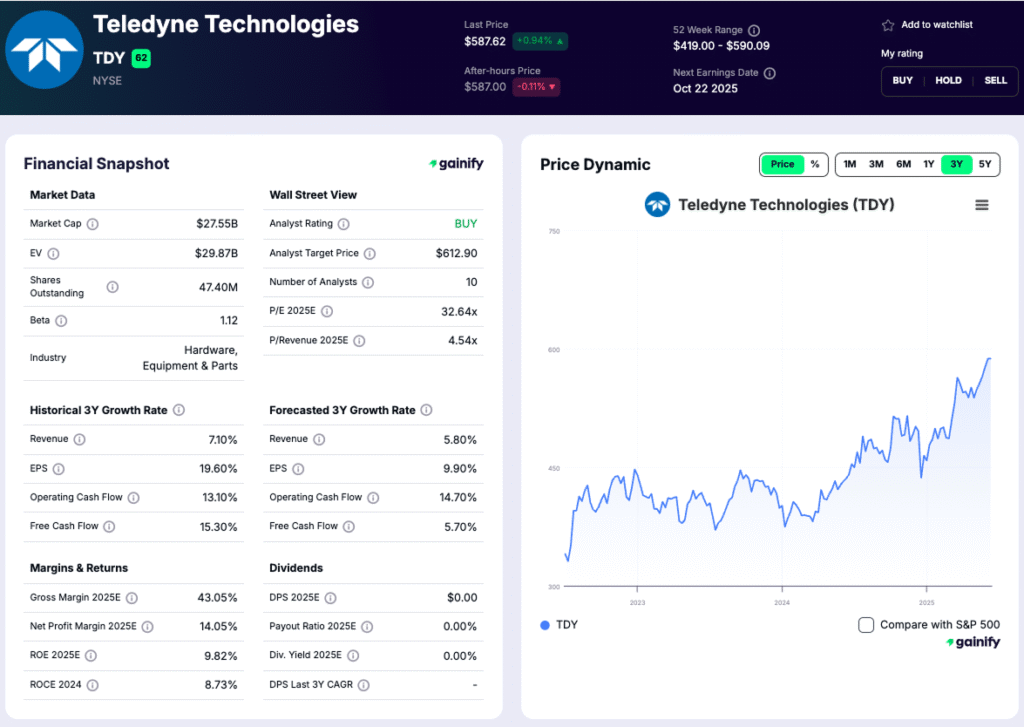

- Teledyne Technologies (NYSE: TDY) – Specializes in advanced imaging systems, sensors, and electronics used in drones for defense, industrial, and environmental applications.

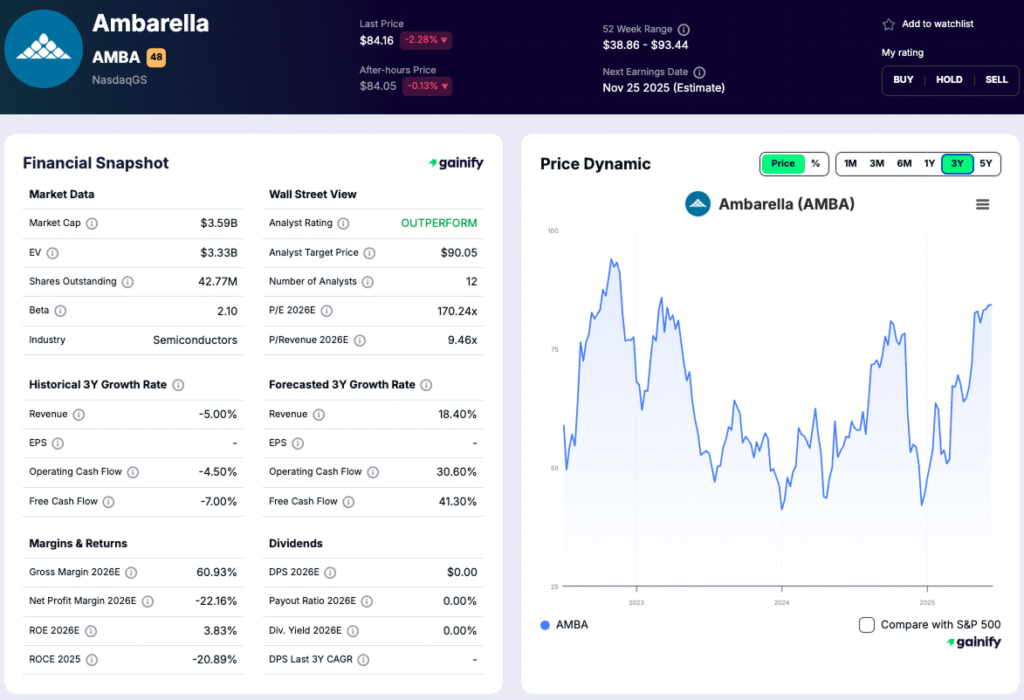

- Ambarella (NASDAQ: AMBA) – Provides computer vision and AI chips that power drone autonomy and high-resolution video capture, critical for both consumer and military drones.

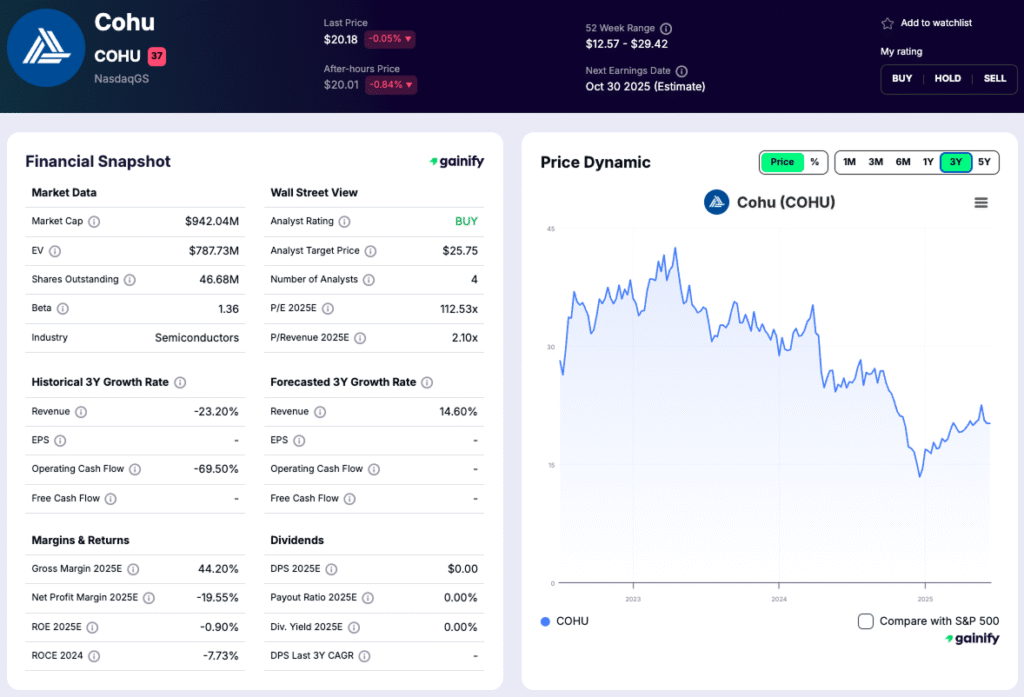

- Cohu (NASDAQ: COHU) – A leading semiconductor testing equipment provider that supports the chips used in AI-driven drones. By ensuring reliability and performance of advanced semiconductors, Cohu plays a behind-the-scenes but essential role in the drone ecosystem, while also gaining revenue from broader electronics and 5G markets.

3. Diversified Aerospace & Defense Giants

Large aerospace and defense firms give investors indirect exposure to drones while offering stability from broader operations.

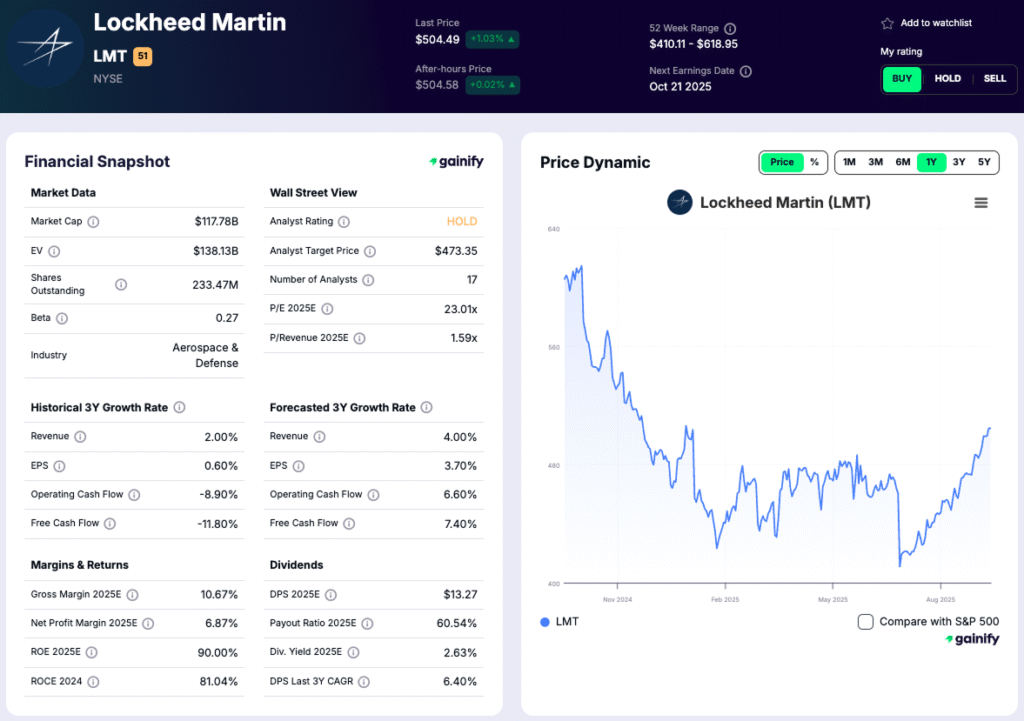

- Lockheed Martin (NYSE: LMT) – Produces drones such as the Indago and Stalker, while also being a global leader in defense systems. Drone sales are a growing but smaller piece of its diversified portfolio.

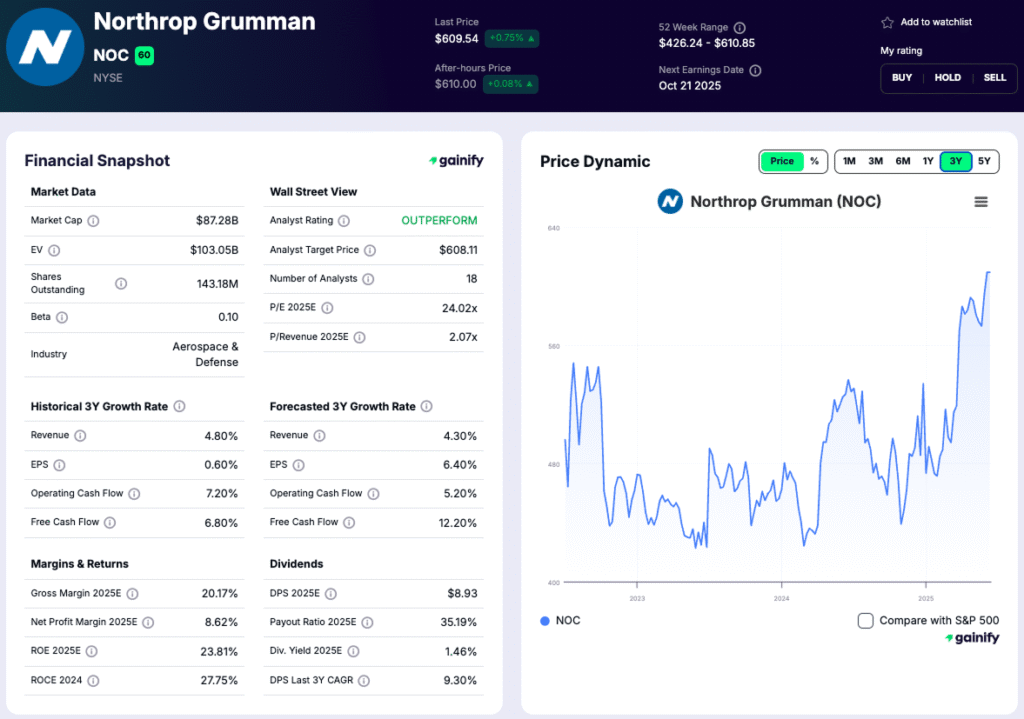

- Northrop Grumman (NYSE: NOC) – Builds the Global Hawk, one of the most advanced high-altitude, long-endurance surveillance drones. Its deep ties to the Pentagon make it a stable drone play.

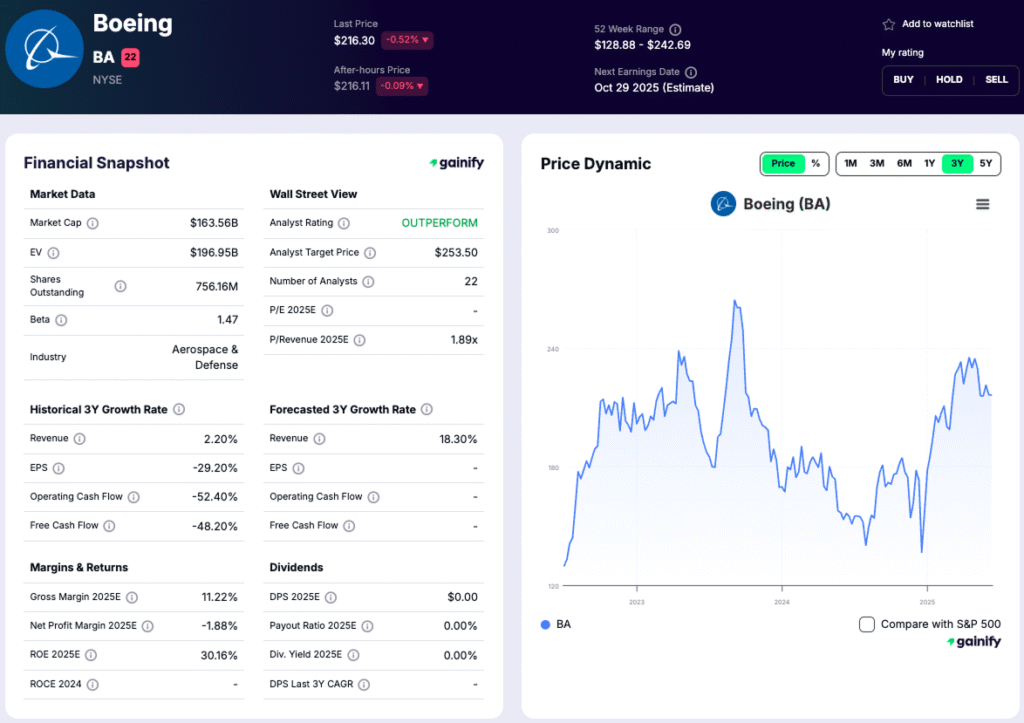

- Boeing (NYSE: BA) – Through its Insitu subsidiary, Boeing manufactures the ScanEagle and RQ-21 Blackjack drones, used extensively for surveillance and reconnaissance.

4. Emerging Private Drone Companies

Some of the most exciting drone innovation is happening in private startups, many of which could IPO in the near future.

- Anduril Industries – A defense-tech unicorn building autonomous defense systems and counter-drone technologies. Valued in the billions, it is a prime candidate for a future IPO.

- Skydio – One of the fastest-growing U.S. drone startups, focused on autonomous drones for defense, law enforcement, and industrial inspections. Seen as a strong rival to DJI.

- Shield AI – Develops AI-driven drones for military operations, focusing on contested environments where autonomy is critical.

- DJI – The world leader in consumer drones, based in China. Despite its dominance, geopolitical restrictions make investment access more complex.

Strengths vs. Risks of Drone Stocks

Strengths | Details | Risks | Details |

1. High Growth Potential | Global drone market expected to grow at sustained double-digit rates. Driven by defense/security and commercial adoption. Recurring revenues from software, data services, training, and maintenance. Multi-year defense contracts provide visibility. | 1. Regulatory Hurdles | Adoption depends on airspace approvals (e.g., BVLOS, urban delivery). Fragmented global rules raise compliance costs. Privacy, security, and sovereignty concerns slow adoption. |

2. Broad Industry Applications | Use cases span defense, logistics, agriculture, energy, construction, mining, real estate, media, insurance, and emergency response. | 2. Geopolitical Risks | Defense contracts vulnerable to policy shifts, sanctions, and alliances. Export restrictions and nationalism may limit sales. Supply chain disruption risks for chips, batteries, and composites. |

3. Innovation & Autonomy | AI, machine vision, and autonomy enable BVLOS operations and obstacle avoidance. Modular payloads expand missions (LiDAR, infrared, comms, electronic warfare). Advances in batteries, hybrids, and hydrogen fuel cells boost endurance. Growth in UTM and 5G/6G connectivity will enable urban operations. | 3. Intense Competition | DJI dominates commercial drones, pressuring rivals’ margins. Crowded field of startups and incumbents drives price wars. Consumer/prosumer drones risk commoditization with limited differentiation. |

4. Government Spending | Rising global defense budgets sustain long-term demand. Governments deploy drones for surveillance, reconnaissance, combat, and border security. Multi-year procurement and local-content policies support suppliers. Defense demand stabilizes volatility from commercial markets. | 4. Stock Volatility | Smaller pure plays see sharp valuation swings tied to contracts and policy news. Many firms are cash-burning with dilution risks. Sentiment highly sensitive to regulation, budgets, and product announcements. |

How to Invest in Drone Stocks

Investors can gain exposure in several ways, depending on their risk tolerance and strategy:

- Direct stock picking (Pure plays) – Choose companies primarily focused on drones and eVTOLs for higher-risk, higher-upside exposure. Examples include AeroVironment (AVAV), Red Cat (RCAT), DroneShield (DRO/DRSHF), Ondas (ONDS), AIRO Group (AIRO), EHang (EH), Joby Aviation (JOBY), and Archer Aviation (ACHR).

- Diversified defense giants – Opt for large primes with drone divisions for safer, more stable exposure. Examples include Lockheed Martin (LMT), Northrop Grumman (NOC), Boeing (BA), and Kratos Defense (KTOS).

- Technology suppliers – Consider companies providing the chips, sensors, and electronics that power drones. Examples include Teledyne (TDY), Ambarella (AMBA), and Cohu (COHU).

- ETFs – Broader aerospace and defense ETFs often include drone exposure, allowing investors to spread risk across multiple companies while still participating in the sector’s growth.

Key Takeaways

➡️ Drone stocks represent a unique mix of high growth, innovation, and defense-driven stability.

➡️ Investors can choose between pure plays for direct exposure, suppliers for steady growth, or defense primes for balanced risk.

➡️ Risks include regulation, competition, and geopolitical pressures, but long-term demand for drones is expected to expand significantly.

➡️ A blended strategy, combining safe bets like defense giants with select high-growth pure plays, may provide the best balance.

Bottom Line: Drone technology is revolutionizing how industries and militaries operate. For investors, drone stocks provide exposure to one of the most promising growth themes of the decade. From established defense players to innovative startups like Anduril and Skydio, this is a sector worth watching closely.