How to monitor portfolio performance is about tracking the signals that tell you whether your investments are working as intended, where risk is building, and what is actually driving returns. Done well, portfolio monitoring is not about watching prices all day. It is about having enough clarity to make calm, informed decisions.

A practical approach comes down to four core elements:

- A portfolio dashboard to track total value, cash, and overall exposure

- Contribution analysis to identify which holdings drove returns

- Portfolio statistics to understand risk, valuation, and expectations

- A holdings table to manage position sizes with intent

Together, these views show more than performance alone. They reveal concentration, hidden risk, and whether your portfolio still matches your strategy.

The sections below outline this workflow step by step, reflecting how seasoned investors evaluate portfolio performance.

Key Takeaways

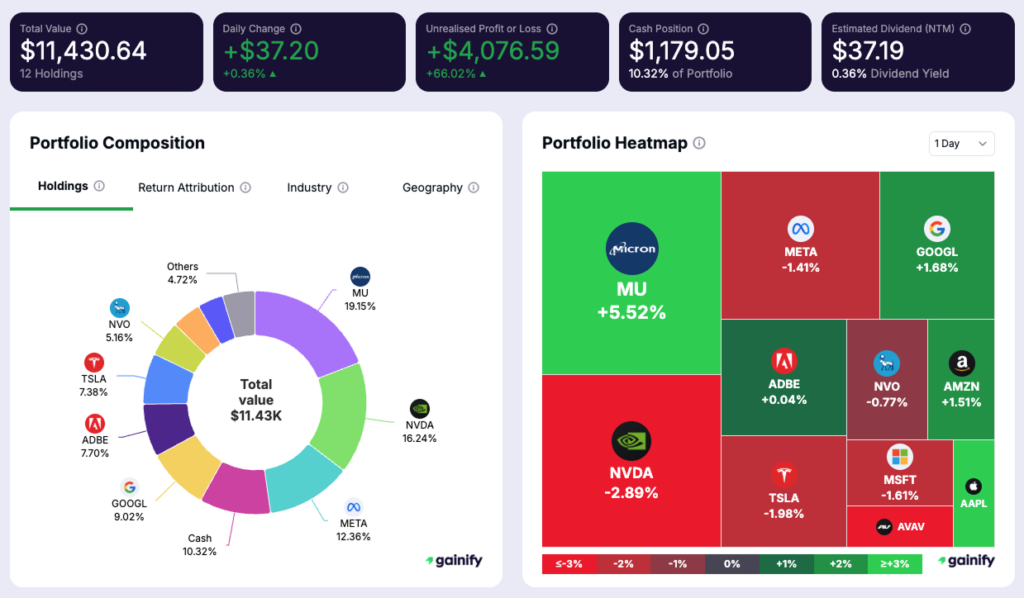

- Start at the portfolio level by reviewing total value, cash balance, unrealized P&L, and income to understand overall positioning.

- Use heatmaps and contribution analysis to see which holdings drive performance and where concentration is building.

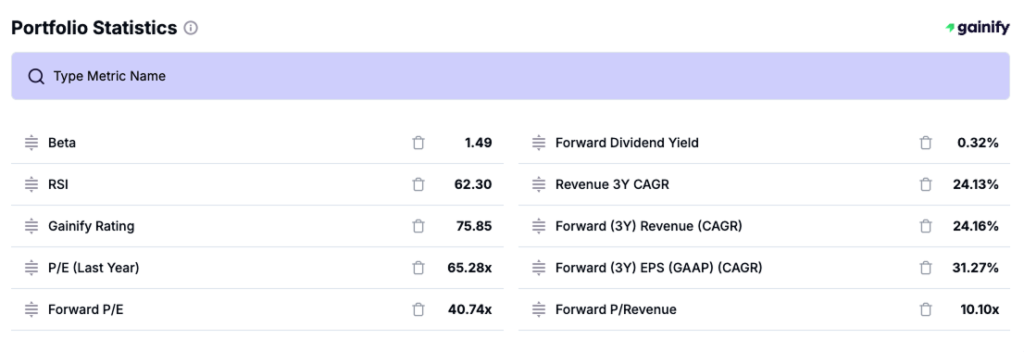

- Review portfolio-level risk and valuation metrics such as beta, valuation multiples, and growth expectations to understand how the portfolio may behave.

- Monitor exposure breakdowns by sector, geography, and asset type to ensure diversification remains intentional and aligned with your strategy.

1. Monitor Portfolio Performance With a 60-Second Health Check

Effective portfolio performance monitoring always starts the same way: a quick, structured dashboard review. This step is not about tracking every move. It is about confirming that your portfolio is behaving as expected.

In under 60 seconds, you should be able to answer these five questions with confidence:

The five questions that matter

- Total value: What is my portfolio worth right now, and how does that compare to recent levels?

- Daily drivers: Which positions actually moved the portfolio today?

- Unrealized P&L: Where are gains and losses concentrated across holdings?

- Cash balance: How much cash do I hold, and what purpose does it serve?

- Income exposure: Am I receiving dividends, or is performance entirely price-driven?

If your dashboard cannot answer these questions quickly, it is not helping you monitor portfolio performance. It is creating friction.

Why this step matters

This 60-second check sets the baseline for everything else. It helps you spot emerging risks early, understand where returns are coming from, and approach deeper analysis with clarity instead of emotion. When portfolio performance monitoring starts here, the rest of the review becomes far more productive.

2. Monitor Portfolio Performance by Understanding What You Actually Own

After the initial health check, the next step in monitoring portfolio performance is understanding where your risk and returns truly come from. This is where composition, exposure, and attribution matter far more than short-term price moves.

At this stage, you are answering a different question: What am I really exposed to if markets move against me?

Start with portfolio composition

Begin by reviewing position weights. Look beyond the largest holding and focus on how quickly exposure adds up.

Ask yourself:

- How much of the portfolio sits in the top five holdings?

- Are smaller positions meaningful, or are they noise?

- Is cash intentional, or has it drifted higher over time?

This view helps you see concentration that is not obvious from total value alone. A portfolio with ten holdings can still behave like a three-stock bet.

Review sector exposure with intent

Sector exposure shows where your portfolio is economically sensitive.

Key questions to answer:

- Which sectors drive most of the portfolio’s volatility?

- Are defensive and cyclical exposures balanced for your risk tolerance?

- Has sector exposure changed due to price movement rather than decisions?

Strong portfolio performance often becomes unbalanced quietly. Sector reviews help catch that early.

Check geographic exposure

Geographic allocation matters more than many investors admit.

Look for:

- Dependence on a single country or region

- Hidden exposure through multinational companies

- Currency and macro risks that cluster in one area

Monitoring portfolio performance without geography is incomplete, especially in global markets where policy and growth diverge.

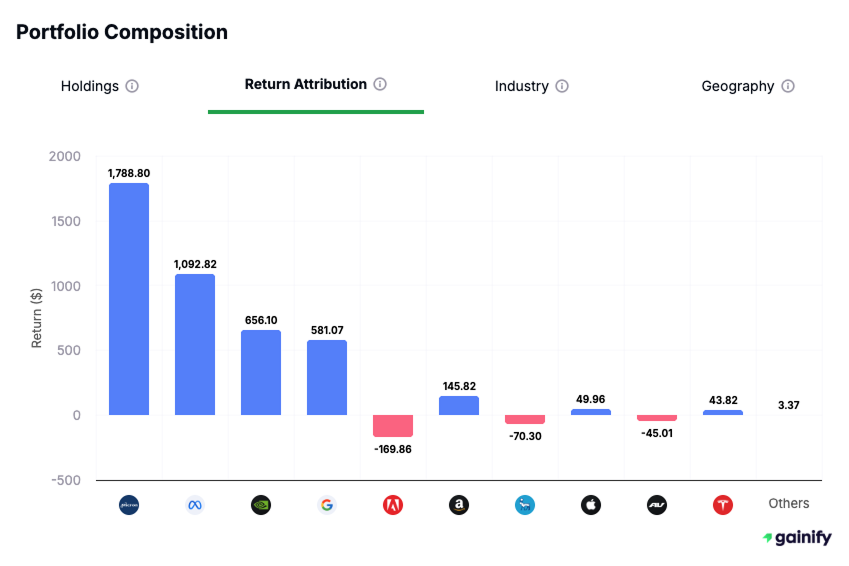

Use return attribution to separate signal from noise

Return attribution shows what actually generated returns, not what you think did.

This reveals:

- Which positions contributed meaningfully

- Which holdings consumed capital without reward

- Whether performance came from a few stocks or broad participation

This step prevents false confidence during strong markets and false pessimism during drawdowns.

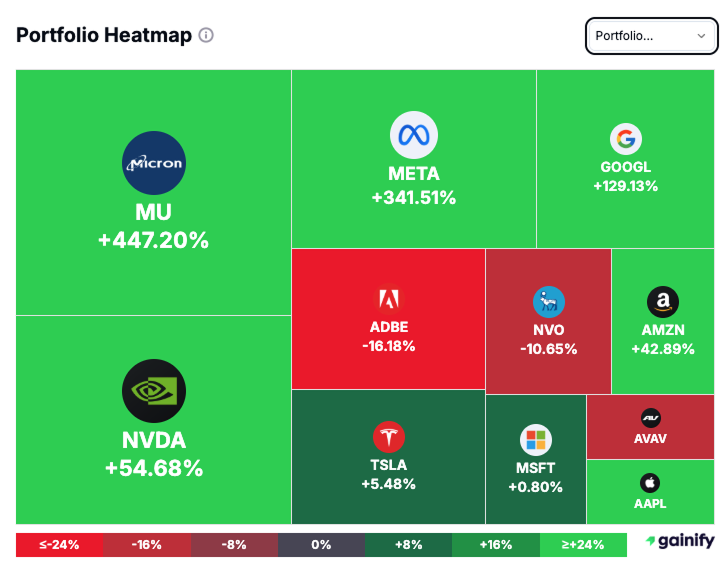

Read heatmaps as diagnostic tools

Heatmaps are not for entertainment. They are for pattern recognition.

Use them to:

- Spot which stocks dominate daily movement

- Identify clusters of weakness or strength

- Detect whether performance is stock-specific or thematic

If one or two names consistently drive portfolio swings, that is a risk signal worth addressing.

Why this step matters

This stage turns portfolio monitoring from passive observation into active understanding. Composition, sector exposure, geography, attribution, and heatmaps together create a clear picture of how your portfolio behaves under pressure. Without this step, performance numbers lack context and decisions become reactive instead of deliberate.

3. Monitor Portfolio Performance Through Portfolio-Level Exposure and Financial Metrics

Monitoring portfolio performance at the portfolio level means evaluating exposure, behavior, and outcomes, not individual stock stories. The objective is to determine whether the portfolio, as a system, is delivering results consistent with its mandate.

This review answers three core questions:

- How is capital exposed across the portfolio?

- How does the portfolio behave across market conditions?

- Are the returns being generated consistent with expectations?

Effective portfolio analysis begins by understanding return quality, risk behavior, valuation exposure, and growth delivery in aggregate.

Return quality: ROIC and ROC at the portfolio level

ROIC and ROC are foundational because they describe the economic engine of the portfolio. At the portfolio level, these stock metrics reflect the weighted efficiency of all underlying businesses in converting capital into profits and cash.

They are used to evaluate:

- Whether portfolio returns are supported by efficient capital deployment

- The sustainability of cash generation across holdings

- The portfolio’s capacity to compound value over time

When portfolio-level ROIC and ROC remain strong and stable, returns tend to be repeatable and less dependent on external conditions.

Risk behavior: market sensitivity and drawdown profile

Risk metrics describe how the portfolio behaves when markets move. Portfolio beta and volatility characteristics define sensitivity to broad market factors and the shape of drawdowns over time.

These metrics are reviewed to understand:

- Whether realized volatility aligns with intended exposure

- How drawdowns compare with historical experience

- Whether changes in risk stem from allocation decisions or exposure drift

Consistent risk behavior indicates that portfolio construction remains aligned with stated objectives.

Valuation exposure: expectations embedded in the portfolio

Portfolio-level valuation metrics summarize the expectations embedded across holdings. Forward P/E, EV-based multiples, and free cash flow yield describe how much future performance is required to justify current pricing.

They help assess:

- The degree of expectation embedded in portfolio value

- Sensitivity to changes in rates, growth, and margins

- The balance between valuation support and fundamental delivery

Valuation exposure shapes the range and durability of future returns.

Growth delivery: execution of portfolio assumptions

Growth metrics make portfolio assumptions explicit. Revenue and earnings growth at the portfolio level show whether the underlying businesses are delivering at the pace required to support long-term outcomes.

These metrics are used to:

- Track progress against required growth levels

- Identify areas where execution risk is rising

- Confirm whether the portfolio thesis remains intact

Reliable growth delivery supports alignment between expectations and realized results.

4. Manage Portfolio Positions Using the Holdings Table

The holdings table is where portfolio monitoring becomes concrete. This is the view that connects analysis to responsibility. It shows how much capital is allocated to each idea and how those allocations shape outcomes. At this stage, the goal is not interpretation. It is evaluation.

What to review for each position

Portfolio weight: Position size is the primary driver of portfolio outcomes. A strong idea held at a small weight has limited impact. A weak idea held at a large weight dominates risk. Every position size should be intentional and defensible.

Unrealized profit and loss: Unrealized P&L highlights exposure and concentration. Large gains often indicate where risk has accumulated quietly. Large losses signal where assumptions may need review. This metric is used to understand risk distribution, not to judge past decisions.

Average cost: Average price provides historical context. It explains how the position was built and how it evolved. It should not influence future decisions. Portfolio outcomes depend on current exposure and future expectations, not entry points.

Ratings and external inputs: Analyst views and ratings can inform review. They do not substitute for independent judgment. A position should stand on its own rationale and evidence.

Apply a simple position review test

For each top holding, the review should be quick and disciplined. In one minute, answer:

- Would I allocate this much capital to this position today?

- If overall portfolio risk had to be reduced by 20 percent, would this position be a candidate?

- What specific data point or development would invalidate the thesis?

The third question matters most. A position without a clear invalidation criterion lacks a defined framework for review.

Why this step matters

The holdings table turns portfolio monitoring into governance. It forces clarity on exposure, accountability for risk, and discipline around capital allocation. When reviewed consistently, it prevents drift and ensures that position sizes reflect conviction, evidence, and expectations ra.

Build a Portfolio Monitoring Routine That Reduces Mistakes

Effective portfolio monitoring does not require constant attention. It requires consistency. A simple, repeatable routine helps you stay informed without reacting to noise and keeps decisions tied to evidence rather than emotion.

A practical monitoring schedule

Weekly review (10 minutes)

The weekly check is a lightweight status update.

- Review the portfolio dashboard

- Scan the heatmap to identify what drove performance

- Write one sentence summarizing the main driver of results

This keeps you oriented without pulling you into short-term decision-making.

Monthly review (30 minutes)

The monthly review focuses on structure and exposure.

- Review return contribution by position

- Check position weights and concentration

- Reassess the cash balance and its role in the portfolio

This step ensures that performance and risk remain aligned with expectations.

Quarterly review (60 minutes)

The quarterly review is where judgment matters most.

- Revisit the thesis for the largest holdings

- Rebalance positions that have drifted beyond predefined limits

- Decide which behaviors or positions no longer deserve attention

Document these decisions. Written reasoning creates accountability and improves future judgment.

Conclusion

Monitoring portfolio performance is a process of evaluation. The goal is to understand how the portfolio behaves, how returns are generated, and whether outcomes remain consistent with intent.

A structured routine, combined with portfolio-level metrics and position-level accountability, helps you stay disciplined through different market environments. It reduces unforced errors and helps you invest with confidence, limits reactionary decisions, and keeps capital aligned with long-term objectives.

When portfolio monitoring is done well, it does not increase activity. It improves clarity.