Bill Ackman is a name that resonates across Wall Street. Known for bold bets, activist campaigns, and one of the sharpest minds in investing, Ackman has built a multibillion-dollar fortune. But how did he make his money and what lessons can everyday investors learn from his playbook?

In short: Bill Ackman built his fortune by founding Pershing Square Capital Management and generating outsized returns through bold, high-conviction bets, activist campaigns, and a legendary $2.6B hedge during the COVID crash. His edge? A disciplined blend of deep research, strategic risk-taking, and relentless conviction.

This article How Did Bill Ackman Make His Money breaks down the key milestones in his career, the investment principles behind his success, and how retail investors can apply similar thinking in their own portfolios.

Who Is Bill Ackman?

Bill Ackman is the founder and CEO of Pershing Square Capital Management, a hedge fund he launched in 2004 that now manages billions in assets. He is widely recognized for his activist investing approach, taking large strategic positions in companies to drive changes that unlock shareholder value.

As of 2026, Forbes estimates Ackman’s net worth at $9.3 billion. His path to that figure has not been smooth. It includes major wins, public missteps, and remarkable comebacks that have shaped his reputation as one of the most influential investors of his generation.

Key Milestones: How Bill Ackman Built His Wealth

1. Early Career: The Gotham Partners Era

Bill Ackman began his professional investing journey in 1992 by co-founding Gotham Partners, a small hedge fund, shortly after earning his MBA from Harvard Business School. The firm initially achieved strong returns, attracting attention for its bold and concentrated bets. However, by the early 2000s, Gotham became entangled in legal disputes and valuation controversies involving illiquid investments. The fund was ultimately wound down in 2003.

Key Insight for Investors: Early setbacks are not career-ending. The experience at Gotham instilled in Ackman a sharper understanding of transparency, concentration risk, and liquidity – principles that would become core to his future success.

2. The Launch of Pershing Square and Rise to Prominence

Ackman founded Pershing Square Capital Management in 2004 with $54 million in seed capital. The fund’s strategy emphasized concentrated, long-term positions in undervalued companies with potential for operational improvement, often driven by activist engagement.

Case Study No. 1: MBIA Short Thesis (2002–2008)

Ackman became widely known for his early and controversial short of MBIA (Municipal Bond Insurance Association), anticipating that the company’s exposure to mortgage-backed securities would trigger massive losses. His thesis was vindicated during the 2008 financial crisis, earning Pershing Square hundreds of millions of dollars. While the S&P 500 declined nearly 38% in 2008, Pershing Square produced positive returns, highlighting Ackman’s ability to profit in turbulent stock markets.

Lesson: Independent thinking, deep research, and the patience to withstand early criticism can yield extraordinary results.

3. The Herbalife Saga: A Public Blow

In 2012, Ackman took a $1 billion short position in Herbalife, alleging the company was operating as a pyramid scheme. The bet evolved into one of the most public and polarizing Wall Street battles, featuring high-profile opposition from investors such as Carl Icahn and Dan Loeb.

Despite years of advocacy, regulatory engagement, and public campaigns, the trade ended in a loss. Ackman exited the position in 2018 after a drawn-out and costly effort.

Performance Note: During this time, Pershing Square’s performance lagged hedge fund benchmarks like the HFRI Fund Weighted Composite Index, in part due to the Herbalife short and other high-profile missteps.

Lesson for Investors: Even the most rigorous thesis can go wrong. Risk management and adaptability are just as critical as conviction.

4. Canadian Pacific: A Textbook Activist Turnaround

In 2011, Ackman and Pershing Square took a sizable stake in Canadian Pacific Railway, arguing the company was underperforming relative to peers. After a contested proxy battle, Ackman successfully replaced the board and appointed Hunter Harrison as CEO.

Under new leadership, Canadian Pacific underwent a dramatic operational overhaul. Efficiency improved, margins expanded, and shareholder returns surged.

Performance Impact: The stock price more than quadrupled between 2011 and 2016, generating billions in profit for Pershing Square.

Investor Lesson: Activist investing can create massive value when paired with the right management and a clear operational roadmap.

5. The COVID-19 Hedge: A Historic Win

In early 2020, Ackman made one of the most profitable trades in hedge fund history. Sensing early signs of economic turmoil due to the COVID-19 pandemic, he spent $27 million on credit default swaps to hedge against a sharp market downturn.

The timing was impeccable. As global markets plunged, Pershing Square realized a $2.6 billion gain from the hedge within just one month.

ROI: Approximately 9,530%

Relative Benchmark: While many funds posted losses in Q1 2020, Pershing Square stood out with one of the best performances in the industry.

Retail Takeaway: Hedging strategies, even in simple forms like inverse ETFs or protective options, can provide meaningful downside protection during periods of extreme market stress.

Core Investment Principles That Made Ackman Wealthy

Bill Ackman’s rise to billionaire investor status wasn’t the result of luck or market timing. His track record is rooted in a clear, repeatable framework built on deep conviction, operational insight, and intelligent risk-taking. These principles can be adapted by investors at any level to improve their investment strategy.

A. High-Conviction, Concentrated Bets

Ackman doesn’t spread his capital across dozens of ideas. He runs a concentrated portfolio of 8 to 12 high-conviction positions, each backed by rigorous research and a clear investment thesis. This allows for focus, agility, and meaningful impact on performance.

Example: Long-term holdings like Chipotle, Restaurant Brands International, and Lowe’s delivered exceptional returns, not by accident but by design.

Retail Insight: Diversification is a tool for uncertainty. Conviction comes from understanding. Most investors would benefit more from mastering five businesses than monitoring fifty tickers.

B. Value Creation Through Activism

Ackman’s edge isn’t just stock picking; it’s value unlocking. He takes an active role in shaping outcomes, whether through operational restructuring, capital allocation changes, or board-level influence.

Example: The turnaround at Canadian Pacific Railway, where new leadership and operational efficiency led to a fourfold stock price increase, was driven directly by Pershing Square’s activist involvement.

Industry Data: Activist hedge funds outperformed the MSCI World Index in 7 of the last 10 years (Preqin), highlighting how this approach consistently generates alpha.

Retail Insight: While retail investors can’t initiate proxy battles, they can monitor 13D filings and follow proven activist investors through holdings-based ETFs or direct co-investments.

C. Discipline in Risk and Exit Strategy

Ackman’s most successful trades weren’t just about entry points. They were defined by exit discipline and risk control. He hedged brilliantly during the COVID-19 crash, turning $27 million into $2.6 billion. Just as importantly, he exited misfires like Netflix and Herbalife decisively when the thesis broke down.

Retail Insight: A great investment thesis is only as strong as your willingness to reassess it. Always define your downside, and don’t let conviction turn into stubbornness.

Bottom Line:

Ackman’s success is rooted in clarity, not complexity. Focused bets, shareholder-level thinking, and disciplined risk management form a timeless blueprint. It’s one that investors at any scale can learn from, adapt, and apply.

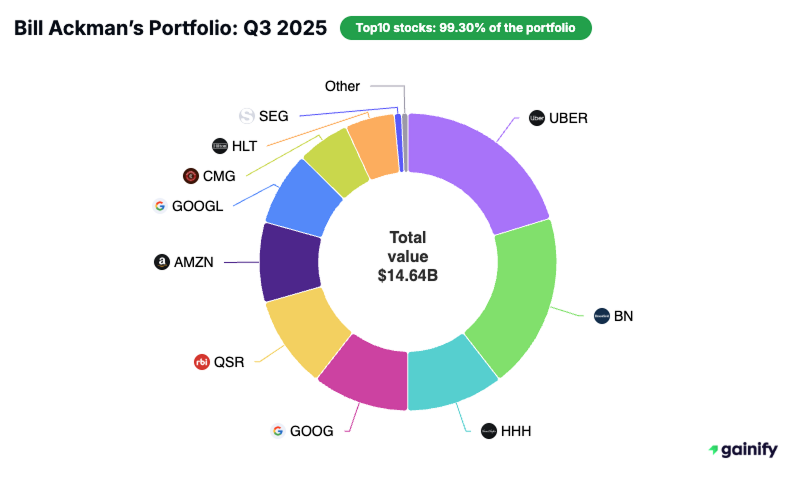

A Look Inside Bill Ackman’s Portfolio: Pershing Square Q3 2025 Holdings

As of the third quarter of 2025, Pershing Square manages approximately $13.77 billion in public equity assets across just 11 positions, reflecting Ackman’s commitment to quality over quantity. The portfolio spans a mix of consumer-facing brands, real estate, and technology, with several positions held for more than 30 quarters, showcasing long-term conviction.

Below is a detailed look at Pershing Square Holding’s holdings, including exposure amounts and each company’s weight within the portfolio:

Below is a detailed look at Pershing Square Holding’s top 10 holdings, including exposure amounts and each company’s weight within the portfolio:

All Equity Holdings of Pershing Square Holding – Q3 2025

- Uber Technologies (NYSE: UBER)

Exposure: $2.97 billion

Portfolio Weight: 20.25%

Holding Period: 3 quarters - Brookfield Corp (NYSE: BN)

Exposure: $2.81 billion

Portfolio Weight: 19.21%

Holding Period: 6 quarters - Howard Hughes Holdings (NYSE: HHH)

Exposure: $1.55 billion

Portfolio Weight: 10.58%

Holding Period: 9 quarters - Alphabet Inc. – Class C (NASDAQ: GOOG)

Exposure: $1.54 billion

Portfolio Weight: 10.52%

Holding Period: 11 quarters - Restaurant Brands International (NYSE: QSR)

Exposure: $1.47 billion

Portfolio Weight: 10.04%

Holding Period: 44 quarters - Amazon.com (NASDAQ: AMZN)

Exposure: $1.28 billion

Portfolio Weight: 8.73%

Holding Period: 2 quarter - Alphabet Inc. – Class A (NASDAQ: GOOGL)

Exposure: $1.18 billion

Portfolio Weight: 8.04%

Holding Period: 11 quarters - Chipotle Mexican Grill (NYSE: CMG)

Exposure: $844.2 million

Portfolio Weight: 5.77%

Holding Period: 37 quarters - Hilton Worldwide Holdings (NYSE: HLT)

Exposure: $786.25 million

Portfolio Weight: 5.37%

Holding Period: 28 quarters - Seaport Entertainment Group (NYSE: SEG)

Exposure: $115.15 million

Portfolio Weight: 0.79%

Holding Period: 5 quarters - Hertz Global Holdings (NASDAQ: HTZ)

Exposure: $103.64 million

Portfolio Weight: 0.71%

Holding Period: 4 quarters

Ackman’s portfolio continues to reflect a strong preference for durable business models, operational leverage, and opportunities to influence value creation through active engagement. His top positions in Uber, Brookfield, and Howard Hughes Holdings highlight both conviction in long-term structural growth and a willingness to double down on large, scalable platforms.

How Did Bill Ackman Make His Money?

Bill Ackman made his money by building Pershing Square Capital Management into one of the most focused and successful hedge funds of its generation. Since founding the firm in 2004, Ackman has generated extraordinary personal wealth through a disciplined approach centered on deep research, concentrated bets, and long-term value creation.

His fortune was forged through key investment moves executed within the Pershing Square framework. These include the early and profitable short of MBIA ahead of the 2008 financial crisis, the activist-driven turnaround of Canadian Pacific Railway, and one of the most successful stock market hedges of all time during the onset of COVID-19, where a $27 million position produced a $2.6 billion gain.

Rather than spreading capital across dozens of ideas, Ackman concentrated Pershing Square’s portfolio in a small number of high-conviction positions. He invested in companies he understood, pushed for operational improvement, and stayed committed through volatility. The strategy required not only insight, but resilience and a willingness to adapt when the facts changed.

Frequently Asked Questions

1. How did Bill Ackman make his fortune?

Bill Ackman built his fortune primarily through Pershing Square Capital Management, the hedge fund he founded in 2004. He made high-conviction, long-term investments in a small number of companies, often applying activist strategies to unlock value. His wealth was generated through standout trades such as the MBIA short, the Canadian Pacific turnaround, and a $2.6 billion profit during the COVID-19 stock market crash.

2. What is Bill Ackman’s net worth in 2026?

As of 2026, Bill Ackman’s estimated net worth is $9.3 billion, according to Forbes. His wealth stems from both management fees and capital appreciation earned through Pershing Square’s performance over two decades.

3. What is Pershing Square Capital Management’s investment style?

Pershing Square follows a high-conviction, concentrated equity investment strategy. The fund typically holds 8 to 12 positions at a time, focusing on fundamentally strong, undervalued companies with potential for operational improvement. The strategy blends deep fundamental research, long-term holding periods, and shareholder engagement to drive value creation. To see how this plays out in practice, check out our full Bill Ackman portfolio breakdown.

4. What are some of Bill Ackman’s most successful investments?

Notable successes include the activist-led turnaround of Canadian Pacific Railway, long-term holdings in Chipotle Mexican Grill and Restaurant Brands International, and a famous hedge in early 2020 that turned $27 million into $2.6 billion as markets reacted to COVID-19.

5. Has Bill Ackman made any major investing mistakes?

Yes. One of his most publicized losses was a five-year short position in Herbalife, where he bet $1 billion that the company was a pyramid scheme. Despite a lengthy campaign, the trade ended in a significant loss. Ackman has acknowledged the mistake and used it as a learning moment in risk management and exit discipline.